This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

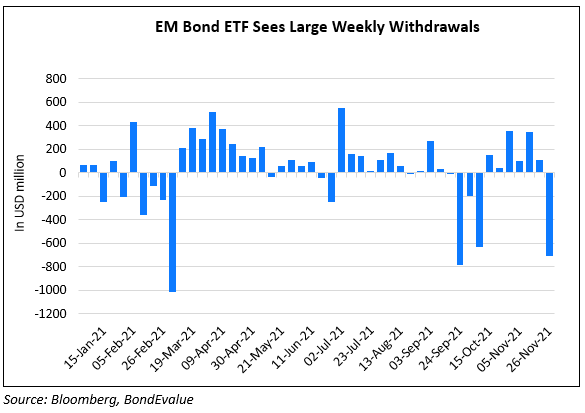

EMB ETF Sees Largest Outflows in Two Months

November 30, 2021

The iShares JP Morgan USD Emerging Markets Bond ETF saw $709.5mn in outflows in the week ended November 26, the biggest withdrawal in two months. The withdrawals coincided with a 2.6% drop in the ETF, the worst week since March 2020. Bloomberg notes that most of the withdrawals came on Tuesday, a day after Fed Chair Jerome Powell was reappointed for a second term. Powell being reappointed is considered hawkish, expecting a quicker pace of monetary tightening. The other chunk of withdrawals came on Friday after the Omicron variant worries spooked markets. Citigroup strategists note, “We can’t see a positive environment for EM, as many EM countries will be last in line for vaccine that might be produced to counteract”.

For the full story, click here

Go back to Latest bond Market News

Related Posts: