This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

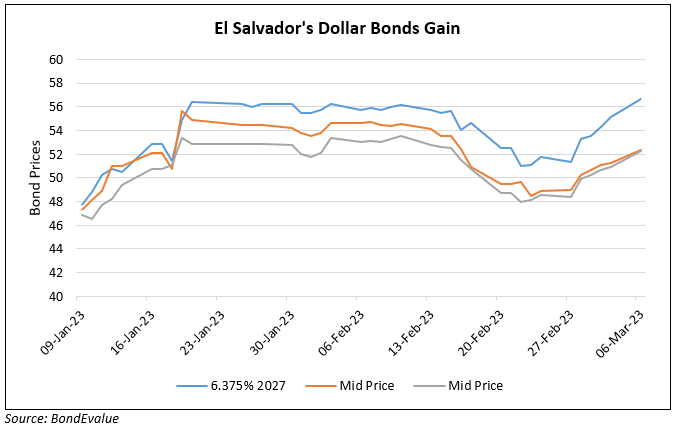

El Salvador’s Dollar Bonds Jump Higher by 1.5-2 Points

July 3, 2024

Dollar bonds of El Salvador were up over 1.5-2 points across the curve. The nation’s central bank reported an 8% growth in FDI to $176.3mn for Q1 2024. The central bank president said that the inflows were mainly on account of reinvestment of profits and capital contributions. The manufacturing industry was the primary beneficiary, receiving $154.1mn after a year of contraction, followed by the commerce sector that saw investments of $119.1mn. Overall, Spanish investors contributed the most with $97.2mn, (55.1% of total FDI), followed by US investors who contributed over $69.04mn (39.1%), and Mexican investors with $42.8mn (24.3%). As per Bloomberg, El Salvador saw the least FDI inflows in 2023 among Central American countries. The nation was upgraded to by Caa1 by Moody’s in May, citing material decrease in credit risks. It had even conducted tender offers for its 2025s, 2027s and 2029s and prior to that, priced a 6Y dollar bond at 12% in mid-April.

Its 9.25% 2030s were up 2.1 points to 90.3, yielding 11.97%.

For more details, click here

Go back to Latest bond Market News

Related Posts: