This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

El Salvador’s Upgraded to Caa1 by Moody’s

May 24, 2024

El Salvador and its senior unsecured debt were upgraded by two notches to Caa1 by Moody’s. This comes on back of the material decrease in credit risks for the sovereign, given lower likelihood of liquidity stress episodes. El Salvador carried out a debt liability management exercise last month which has significantly reduced external debt amortization till 2027. In addition, the government has also eased liquidity pressures by extending the maturity profile of its domestic debt along with debt reprofiling operations. According to Moody’s the repayment risks for El Savador’s 5.875% bond due January 2025 has reduced significantly given a small amount of principal outstanding. El Salvador was last upgraded to B- by S&P in November last year.

Go back to Latest bond Market News

Related Posts:

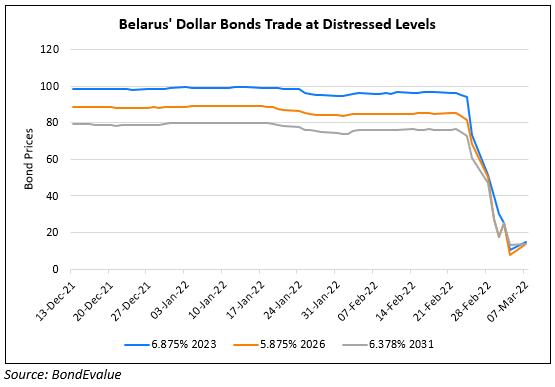

Belarus Downgraded to CCC by S&P

March 7, 2022

Turkey Downgraded to B from B+ by Fitch

July 12, 2022

Ghana Downgraded to CCC+/C by S&P

August 8, 2022