This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

El Salvador Upgraded to B- by Fitch

January 8, 2025

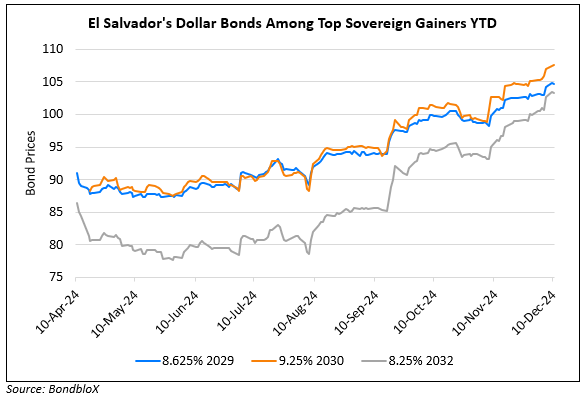

El Salvador was upgraded by a notch to B- from CCC+ by Fitch. The upgrade reflects reduced financing needs and easing financial constraints. This improvement follows its regained access to international markets and a newly announced IMF program. Fitch expects the IMF program to help with fiscal consolidation and reduce the country’s short-term debt, supporting investor confidence and the potential for future debt issuances. Fitch expects financing needs for El Salvador to be manageable in 2025 and in 2026 following declines in the deficit and short-term amortizations. El Salvador’s net international reserves rose to $3.7bn in November 2024 and is expected to rise further to $4.4bn in 2025, bolstered by IMF disbursements and higher multilateral financing.

El Salvador’s dollar bonds traded stable with its 6.375% 2029s at 98.88, yielding 6.97%.

Go back to Latest bond Market News

Related Posts: