This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

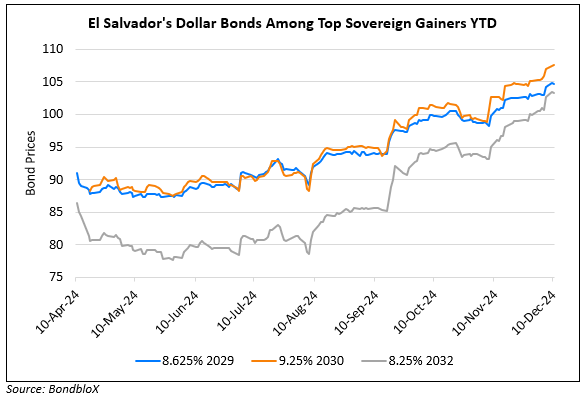

El Salvador Nearing $1.3bn IMF Agreement on Plans to Make Bitcoin Payments Voluntary

December 10, 2024

El Salvador is said to be nearing a $1.3bn loan agreement with the IMF within the next two to three weeks, as per sources. This agreement, which is expected to unlock an additional $2bn funding from the World Bank and the Inter-American Development Bank, requires El Salvador to make changes to its bitcoin policy and reduce government deficits. As part of the new agreement, El Salvador would make bitcoin payments voluntary and commit to reducing its budget deficit by 3.5% of GDP over three years, including spending cuts and tax hikes. The government would also pass an anti-corruption law and increase its reserves to $15bn. An IMF mission is in San Salvador to finalize the details with President Nayib Bukele’s government. After El Salvador adopted bitcoin as a legal tender a few years ago, the IMF had opposed the move, citing risks to financial stability. It thus urged the government to stop requiring businesses to accept bitcoin. Sources note that most citizens continue to use the US dollar for everyday transactions, even as the government has accumulated significant bitcoin reserves totaling $600mn.

Go back to Latest bond Market News

Related Posts:

El Salvador’s Dollar Bonds Rally on Debt Swap Tender Offer

October 8, 2024

El Salvador Announces Tender Offer Results

October 14, 2024

El Salvador Completes $1bn Debt-for-Nature Swap Deal

October 17, 2024