This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt, Scotiabank, JPMorgan Price $ Bonds

January 31, 2025

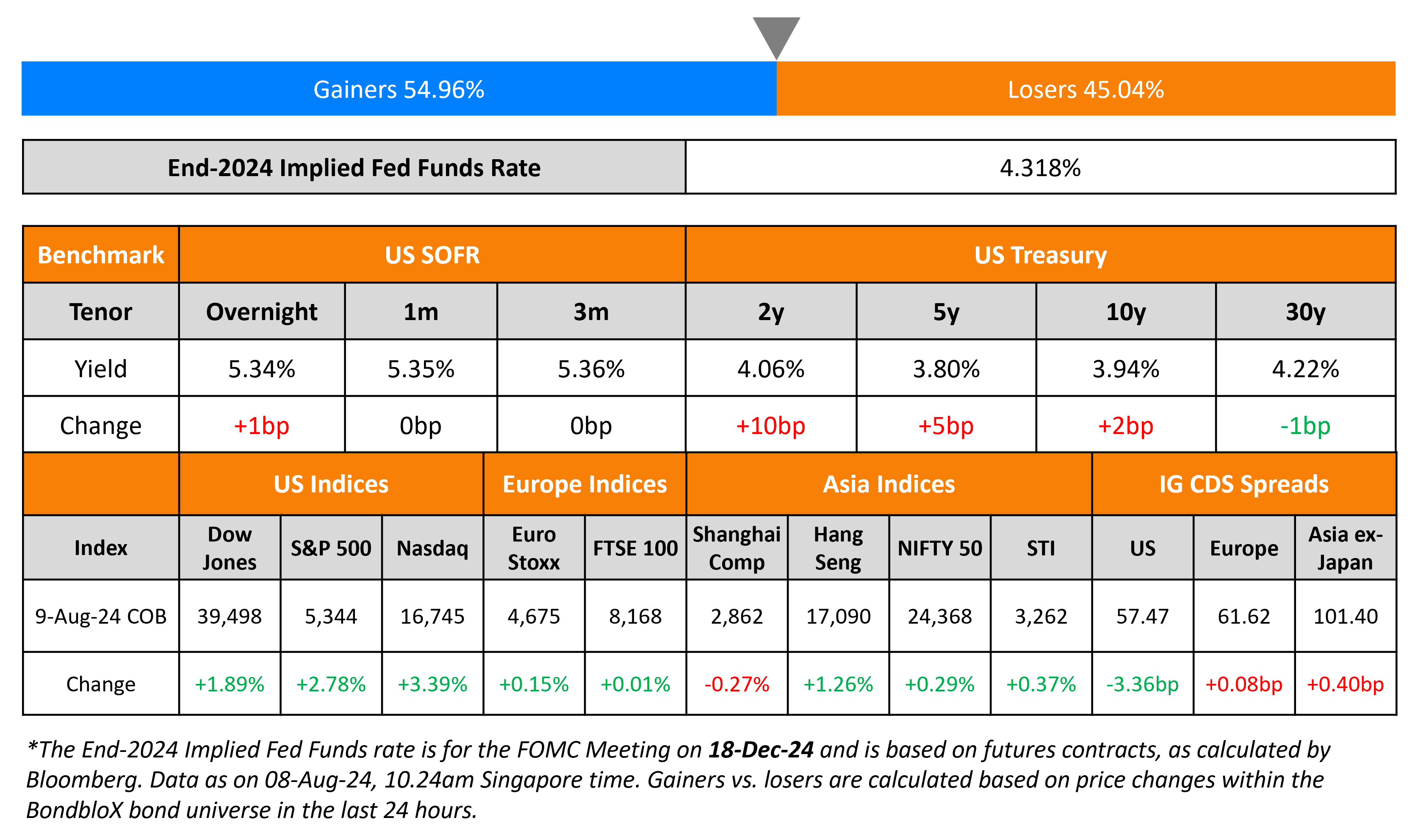

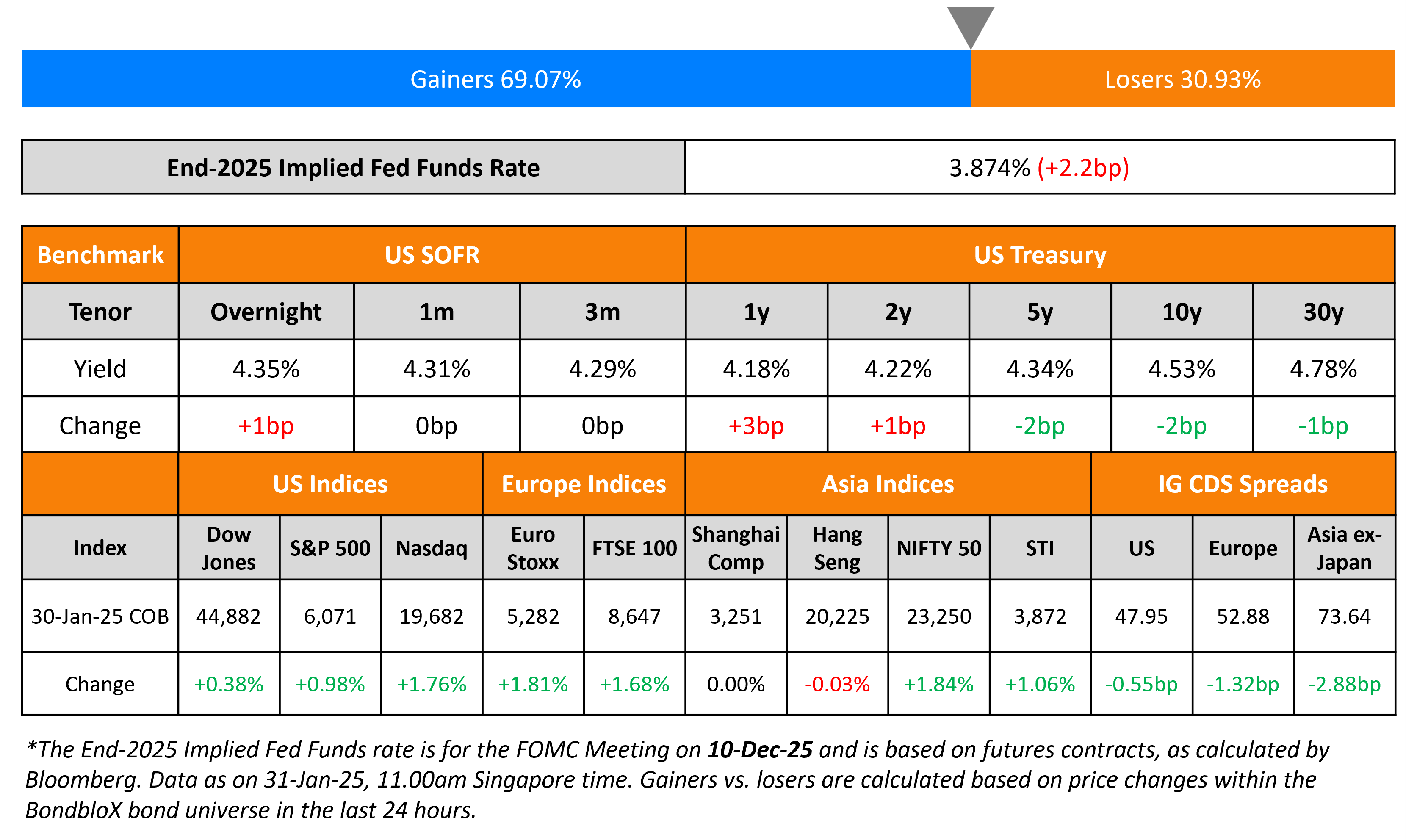

US Treasury yields were broadly stable. The preliminary US Q4 GDP estimate rose by 2.3%, lesser than expectations of a 2.6% rise, and the previous quarter’s 3.1% rise. Initial jobless claims for the previous week rose by 207k, better than the estimated 225k. Separately, US Durable Goods Orders for December saw a 2.2% drop, worse than the surveyed pick-up of 0.6%, with the previous month’s figures also revised lower to -2.0%. On late-Wednesday, the FOMC left interest rates unchanged, as expected, with Fed Chairman Jerome Powell adding that they need not be in a hurry to adjust their policy stance.

US equity markets continued to march higher, with the S&P and Nasdaq up by 0.3-0.5%. US IG and HY CDS spreads tightened 0.6bp and 3bp respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.3bp and 3.3bp respectively. The ECB cut its policy rates as expected, by 25bp, with the Deposit Facility Rate (DFR) now at 2.75%. Noting that “risks to economic growth remain tilted to the downside”, the ECB left the door open for more easing through the year. Asian equities have opened broadly higher this morning. Asia ex-Japan CDS spreads were 2.9bp tighter.

New Bond Issues

Egypt raised $2bn via a dual-trancher. It raised $1.25bn via a 5Y bond at a yield of 8.625%, 62.5bp inside initial guidance of 9.25% area. It also raised $750mn via an 8Y bond at a yield of 9.45%, 55bp inside initial guidance of 10% area. The bonds are rated B-/B (S&P/Fitch). The new 8Y note is priced 12bp tighter to its existing 7.3% 2033s that yield 9.57%.

Bank of Nova Scotia raised $2.65bn via a three-trancher. It raised:

- $1.25bn 4NC3 bond at a yield of 4.932%, ~22.5bp inside initial guidance of T+90/95bp area.

- $400mn 4NC3 FRN at SOFR+89bp vs. initial guidance of SOFR equivalent area

- $1bn 6NC5 bond at a yield of 5.13%, ~23bp inside initial guidance of T+105bp area.

The senior unsecured notes are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

JPMorgan raised $3bn via a PerpNC5 bond at a yield of 6.5%, 50bps inside initial guidance of 7% area. The SEC-registered subordinated note is unrated. If not called by 1 April 2030, the coupon will reset to the US 5Y Treasury yield plus 215.2bp. Proceeds will be used for general corporate purposes.

Geopark raised $550m via a 5NC2 bond at a yield of 8.75%, 25bp inside initial guidance of 9%. The senior unsecured bonds are rated B+/B+ (S&P/Fitch).

Ziraat Bankasi raised $750mn via a 5Y bond at a yield of 7.375%, 37.5bp inside initial guidance of 7.75% area. The senior unsecured notes are rated B+ (Fitch). Proceeds will be used for general corporate purposes.

Rating Changes

-

Moody’s Ratings upgrades MPT’s CFR to B3 and assigns B2 rating to new secured notes; outlook changed to stable

-

Brazilian Airline Azul S.A. Downgraded To ‘SD’ Following Distressed Debt Exchange

-

DirecTV Entertainment Holdings LLC Secured Debt Ratings Lowered To ‘BB-‘, New Debt Rated ‘BB-‘; Ratings Remain On CreditWatch Negative

-

Intrum Downgraded To ‘SD’ After Missing Interest Payments; Rated Notes Lowered To ‘D’

-

Fitch Places VF Ukraine on Rating Watch Negative

-

Raizen S.A. Global Rating Outlook Revised To Negative From Stable On High Leverage; ‘BBB’ Ratings Affirmed

-

Moody’s Ratings changes Precision’s outlook to positive; affirms Ba3 CFR

Term of the Day: Kung-fu Bonds

Kung-fu bonds are offshore USD denominated bonds issued by Chinese issuers, aka Chinese dollar bonds. These issuances offer a source of funding from offshore markets for local borrowers and help build an international investor base. The Kungfu bond market has been primarily dominated by government related institutions, banks and real estate developers.

Talking Heads

On Momentum in Bond Trading Continuing – Deutsche Bank CFO, James von Moltke

“The geopolitical events, shifts in economic tides, rate changes, all of those things were playing through… the first few weeks of the year have have demonstrated a continuation of those trends”

On Smaller economies’ medium term default risk could have risen

Thomas Lambert, Lazard

Some of the world’s smallest economies, especially in Africa, could be at increased risk of being unable to pay their debts in the medium term… “So it is plausible that in these years a new cycle could start again”

On Fed Has Done ‘Terrible Job’ on Banking Regulation – Donald Trump, US President

“The Fed has done a terrible job on Bank Regulation. Treasury is going to lead the effort to cut unnecessary regulation.. Because Jay Powell and the Fed failed to stop the problem they created with Inflation, I will do it”

Top Gainers and Losers- 31-January-25*

Go back to Latest bond Market News

Related Posts: