This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

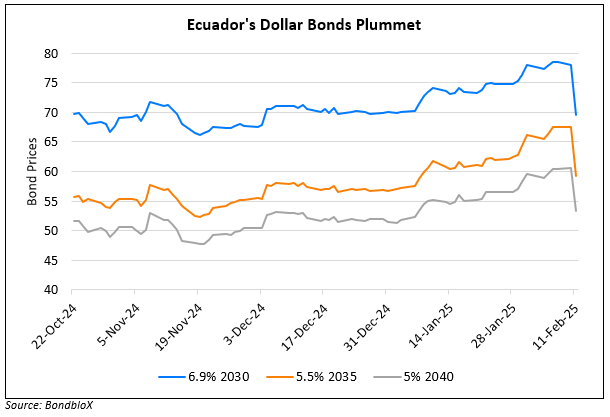

Ecuador’s Dollar Bonds Sell-Off as Election Goes into a Second Round

February 11, 2025

Ecuador’s dollar bonds fell by over 8 points across the curve, after its presidential elections are set to enter a second round as the incumbent Daniel Noboa, and his main challenger Luisa González received nearly identical percentages of the vote. The pair will face a second round run-off in April. The results came as a negative surprise as market participants were expecting Noboa’s victory following the polls. “Investors overestimated Noboa’s first-round advantage, placing excessive confidence in polling data”, said Bruno Gennari, a strategist at KNG Securities. Noboa is considered market-friendly candidate by investors and had helped reach an agreement with the IMF for a $4bn loan, designed to help the nation avoid a debt default. The new candidate Gonzalez, does not intend to object to the agreement, provided that there will be no increase in VAT or a reduction of subsidies for families, a measure that Noboa implemented. The indigenous vote may potentially have a significant impact on the outcome of the second round, analysts remarked. Leonidas Iza, from a party representing the nation’s Indigenous communities, had 5% of the vote in the first round.

Go back to Latest bond Market News

Related Posts: