This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecuador Launches Buyback As Part of Debt-for-Nature Swap

December 4, 2024

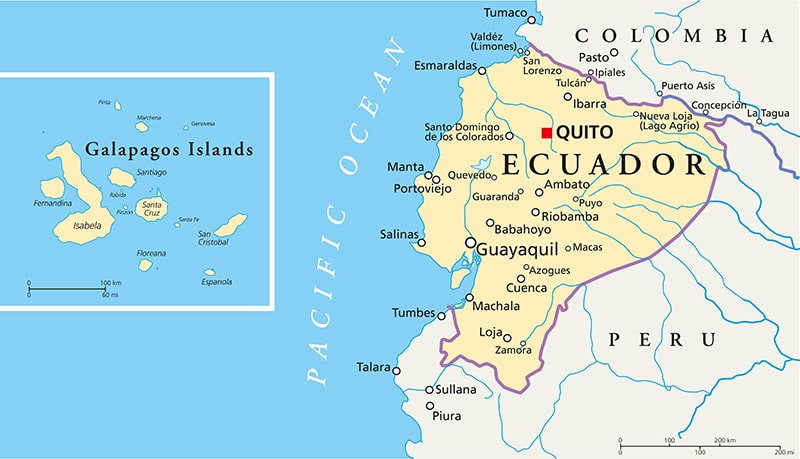

Ecuador launched a buyback offer for four of its dollar bonds maturing between 2030 and 2040, as part of a debt-for-nature swap. This would allow it to buy back relatively expensive debt and use the savings generated to fund conservation efforts in the Amazon rainforest. Below are the details of the buyback offer:

- 6.9% Step-up Coupon Notes due 2030 at a purchase price of $730 per $1,000 in principal. The bonds are currently trading at 70.64.

- 5.5% Step-up Coupon Notes due 2035 at a purchase price of $605 per $1,000 in principal. The bonds are currently trading at 57.73.

- 5% Step-up Exchanged Coupon Notes due 2040 at a purchase price of $555 per $1,000 in principal. The bonds are currently trading at 52.70.

- 5% Step-up Amended Coupon Notes due 2040 at a purchase price of $475 per $1,000 in principal. The bonds are currently trading at 41.94.

The buyback which will be financed by up to $1bn of new bonds issued by an SPV, Amazon Conservation DAC. The tender offer expires by December 10. Ecuador had completed a $1.63bn debt-for-nature swap for the Galapagos Islands last year.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Luxembourg Banks Freeze Ecuadorian Assets

August 2, 2022

Ecuador Bonds Drop on Debt Renegotiation Talks

December 15, 2023