This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecuador Expected to Hold Firm on Subsidy Cuts, Analysts Note; Dollar Bonds Inch Higher

September 26, 2025

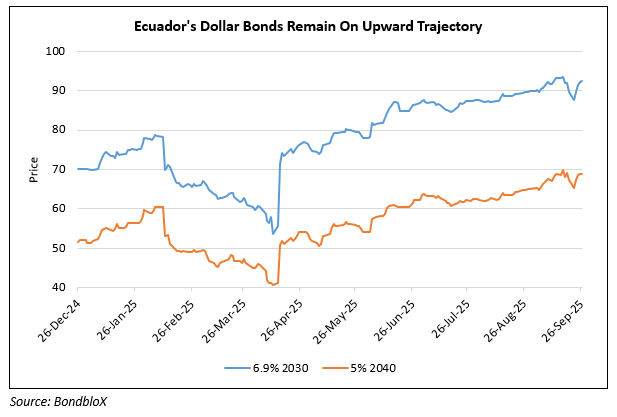

Ecuador President Daniel Noboa is said to be pressing ahead with plans to phase out costly diesel subsidies, a move that eluded his predecessors due to violent nationwide protests. Market participants sounded optimistic that he will succeed on this front. Unlike past mass uprisings under Lenin Moreno and Guillermo Lasso, current demonstrations remain localized in indigenous regions north of Quito. Analysts attribute this to Noboa’s strategy of pairing subsidy cuts with temporary compensations for vulnerable groups, as well as the weakened influence of CONAIE, the indigenous organization behind the strikes. Protests have seen some violence, but Noboa has responded decisively with a state of emergency and security deployments. Analysts viewed Noboa’s leadership and outreach positively, and expect him to resist pressure to reinstate subsidies. The IMF projects Ecuador’s fiscal deficit to shrink and turn into a surplus by 2028. Risks remain, however, as political instability could intensify with a constitutional referendum later this year. As per Bloomberg, bond spreads are at six-year lows with its dollar bonds seeing YTD returns of ~42%. They highlighted that many money managers believe Ecuador is on a firmer fiscal and political footing than in the past. Earlier in June, the country had reached a staff-level agreement with the IMF for a $1bn loan boost.

For more details, click here

Go back to Latest bond Market News

Related Posts: