This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

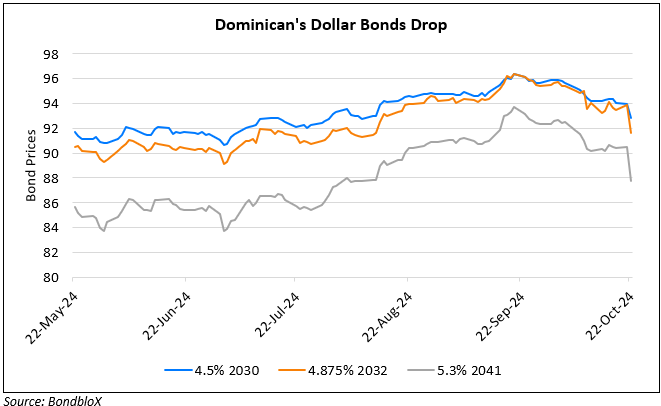

Dominican Republic’s Dollar Bonds Drop 3 Points on Tax Bill Withdrawal

October 22, 2024

Dominican Republic’s dollar bonds fell by over 3 points across the curve after its President Luis Abinader, withdrew a tax bill that was aimed at increasing collections. Despite having a majority in the Congress, he was unable to gather sufficient support to pass the bill. Bloomberg notes that the tax collection bill was considered necessary to raise Dominican’s existing low levels of tax collection and also tackle its rising debt burden. Estimates suggested that it would have likely boosted revenues by 1.5% of GDP. Analysts note that the bill might have been essential to the sovereign’s hopes of being upgraded to investment grade by the major rating agencies. Moody’s and Fitch both rate Dominican Republic at Ba3 and BB- respectively, three notches below IG-status. S&P rates it slightly higher at BB.

For more details, click here

Go back to Latest bond Market News

Related Posts: