This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

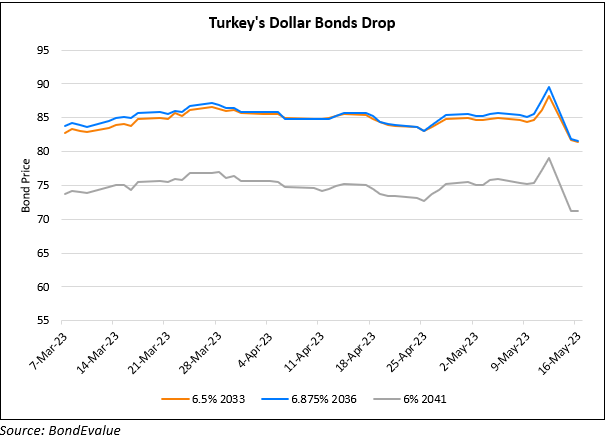

Turkey’s Dollar Bonds Drop on Election Momentum Shift

May 16, 2023

Turkey’s dollar bonds dropped across the curve due to a stronger-than-expected support for the incumbent, Erdogan after the first round of elections. The presidential election now moves into a second round runoff on May 28 as neither Erdogan nor his rival, Kemal Kilicdaroglu secured an outright majority in the first round. Markets took the news as a negative as Erdogan won 49.5% of the votes while Kilicdaroglu got just under 45% support. This would imply that Erdogan has the momentum and thereby a stronger chance of winning the second round than his rival.

Paul Greer, a PM at Fidelity said the results “shocked the market and left many participants on the back foot”. Other analysts note that credit spreads are expected to widen, with a pessimistic view on Turkish assets and a further depreciation in the Lira. Erdogan’s rival had promised to reverse many of the current economic policies, and set an interest-rate policy similar to other countries with an “autonomous” central bank chief.

Its 9.375% 2033s issued in January dropped ~8 points from 104.9 to 97 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: