This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Diversification – Using the Rule of 20 to Build a Bond Portfolio

July 30, 2024

Why Diversification Reduces Risk

“Don’t put all your eggs in one basket” is an adage that is often hard to implement. While a broken egg or two won’t cause financial ruin, putting all your financial assets in a single basket (of bonds or stocks), can cause significant distress that is hard to recover from. Investment-grade bonds seldom default, but there is always a possibility. For instance, the Chinese property developer Country Garden, rated BBB- in August 2022, defaulted in October 2023. This article focuses on building diversification into a bond portfolio and how to monitor it.

Harry Markowitz won the Nobel Prize in 1990 for his work on reducing portfolio risk through diversification. While this concept is intuitively understood, many remain under-diversified, especially in the bond market. This issue affects not only individual investors but also professional fund managers. Looking at a recent prolific example, many investors suffered when they found their “diversified” bond fund full of Chinese real estate bonds.

Reasons for Concentration in Portfolios

- High Minimum Investment Amount: The minimum investment amount for bonds is typically USD 200,000, unlike stocks where only a few, like Berkshire Hathaway, trading above this amount. The solution here is fractional bonds or BondbloX, which are USD 1,000 fractions of the original bond, allowing investors to build well-diversified portfolios.

- Overconfidence Bias: This bias stems from a firm belief that a bond you have researched and selected is “safe.” Investors are busy, and researching bonds takes time and effort. Therefore, they tend to keep buying bonds from the same issuers they know in their portfolio – a phenomenon known as “falling in love with your trade.”

One such recent example was a senior fixed income banker who had an outsized position in Credit Suisse’s (CS) AT1 bonds, only to be burned by the Credit Suisse wipeout of AT1 bonds in 2023. Defaults from “safe” issuers are not unheard of! History teaches us this, as seen with bonds from Imperial Russia and pre-communist Chinese bank debt. These bonds issued by sovereigns have since defaulted, and their physical certificates are now collectibles (see image below)

Unpredictable risks like war, natural disasters, revolutions or just bad management have led to defaults. Diversification is the key to armour-plating your bond portfolio. This then begets the following questions – how much diversification is necessary? Is having two bonds in my portfolio good enough diversification?

Diversify Under the “Rule of 20”

A simple rule of thumb is the “Rule of 20” – if you have twenty bonds in your portfolio, it is considered to be well-diversified. The rationale is that if one bond defaults, it may not cause a negative return to the portfolio. Let’s say you have a 20-bond diversified bond portfolio with a return of 5%. Now, assume that one bond defaults. Here, the principal loss of the defaulted bond would amount to 5% (calculated as one bond’s principal divided by the principal of twenty bonds). Therefore, the overall portfolio return goes to zero and, despite a significant event like a default, there is no loss on the portfolio.

The “Rule of 20” is a good guideline, but to reduce the risk of loss, you can buy more than 20 bonds. For more details on the math behind diversification, you can attend courses at the ‘BondbloX Academy’.

Example Calculation:

A simple model to determine the number of bonds needed for a one-year recovery period (i.e. no loss at end of the year) is:

No of Bonds in portfolio = 100 ÷ portfolio yield

- Portfolio yield (%) = 5

- Number of bonds = 100 ÷ portfolio yield = 100 ÷ 5 = 20

This model assumes each bond has the same notional amount.

Types of Diversification

- Across Issuers: Buying multiple bonds from the same issuer is not diversification.

- Across Countries: Country risk, particularly home country risk, is often ignored. This is known as “Home Bias.” Please note that having 20 bonds in your portfolio, with all of them from the same country, is not a well-diversified portfolio.

- Across Sectors: Different industry sectors have different risk profiles.

- Across Currencies: Currency diversification can mitigate the risk of currency fluctuations.

- Across Tenors: Diversification of portfolios across tenors is called a bond ladder. You can read about ladders here.

Implementing the “Rule of 20”

The problem with the “Rule of 20” is that it takes a lot of money—around four million dollars to implement. If your portfolio follows the 60:40 rule, you need investible assets of ten million. For investors with less than ten million dollars, there are two options: bond funds or fractional bonds. Bond funds are ideal for investors who are new to the bond world or don’t have the expertise to create their bond portfolio.

If you have a current portfolio of four bonds, you can fractionalize it on the BondbloX exchange and use the proceeds to build a diversified portfolio. Most bonds listed on the US markets, including US treasuries, are available in USD 2,000 denominations and are available on the BondbloX exchange. For example, if you own two bonds of USD 200,000 in notional each, you can now build a 20-bond portfolio with just USD 20,000 in each bond — only on BondbloX. Building a diversified bond portfolio just got easier with BondbloX, the world’s first regulated fractional bond exchange!

Click here to start your journey of diversifying your portfolio on BondbloX.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

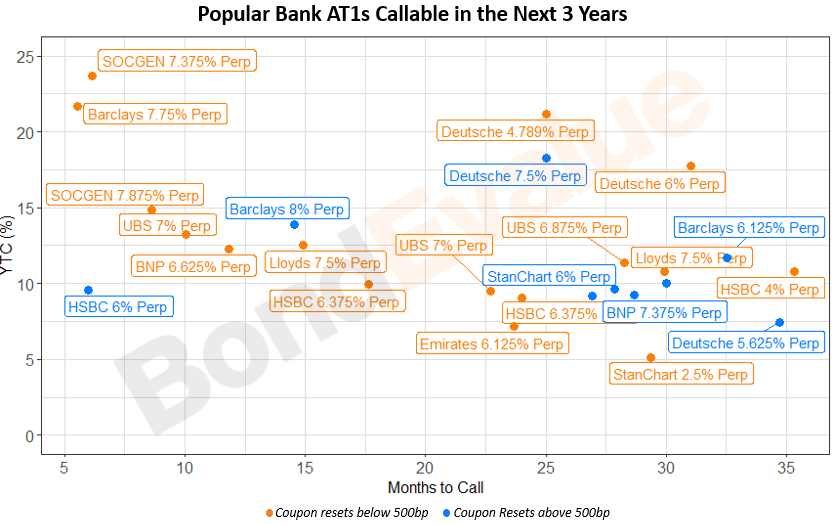

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023