This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

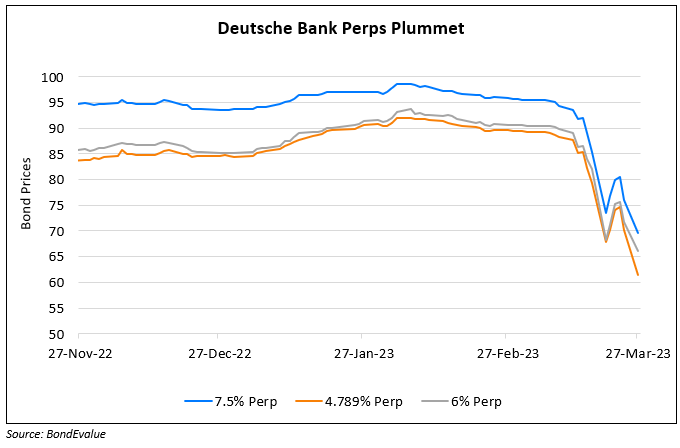

Deutsche Bank to Skip Call on 4.789% Perp; Announces to Redeem 7.5% Perp

March 24, 2025

Deutsche Bank chose to skip the call option on its $1.25bn 4.789% Perp. The bank stated that it was approaching the decision on the call option of its AT1s on a case-by-case basis. This was the second successive instance of the bank choosing to skip the call date for the above AT1 bond. The notes were previously not called in 2020, and the next call date comes due in 2030. Skipping a call typically tends to have a negative impact on a bond.

However, Deutsche Bank’s 4.789% Perp rose to trade above par, as the coupon will now reset to a higher rate of roughly 8.34% based on the reset formula of the US 5Y Swap (currently at 3.984%) plus a reset spread of 435.8bp. Bloomberg notes that investors had likely anticipated this outcome, as analysts had flagged the possibility of the call being skipped earlier this year. Simon Adamson from CreditSights notes that the reason was likely due to the FX loss arising, as German banks account for AT1s as equity using the exchange rate at the time of issuance. He noted that the EURUSD rate was at $1.37 during the time of issuance in 2014 vs. $1.07 currently. However, Deutsche Bank announced that it will redeem its $1.5bn 7.5% Perp callable on April 30.

Go back to Latest bond Market News

Related Posts: