This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CSN Downgraded to Ba3 by Moody’s

February 13, 2025

CSN and its senior unsecured debt was downgraded by a notch to Ba3 from Ba2 by Moody’s. The downgrade reflects CSN’s weakened credit metrics, driven by lower steel and iron ore prices. The company’s EBITDA fell from BRL11.5bn ($2bn) in 2023 to BRL10bn ($1.7bn) in 2024, and its leverage ratio increased from 4.0x to 5.5x. CSN’s ratings are constrained by aggressive financial policies, high leverage, and exposure to price volatility in steel and iron ore. Despite previous efforts to reduce leverage, CSN’s debt and leverage have increased in the past two years due to acquisitions and dividends. CSN’s liquidity is strong, with BRL19.5bn ($3.38bn) in cash but the company needs more conservative financial management to stabilize its credit profile, according to Moody’s.

CSN’s bonds traded broadly stable with its 7.625% 2026s at 100.3, yielding 7.34%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

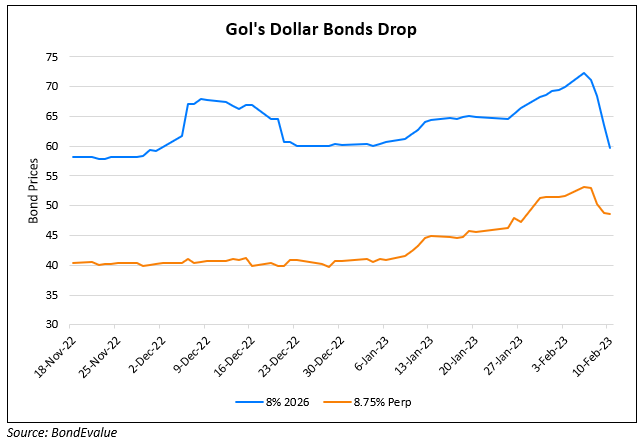

Gol’s Dollar Bonds Drop on Downgrade to CC by S&P

February 10, 2023

LMIRT Downgraded by Fitch to CCC

March 9, 2023

Treasuries Sell-Off on Hawkish FOMC Rate Cut

December 19, 2024