This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

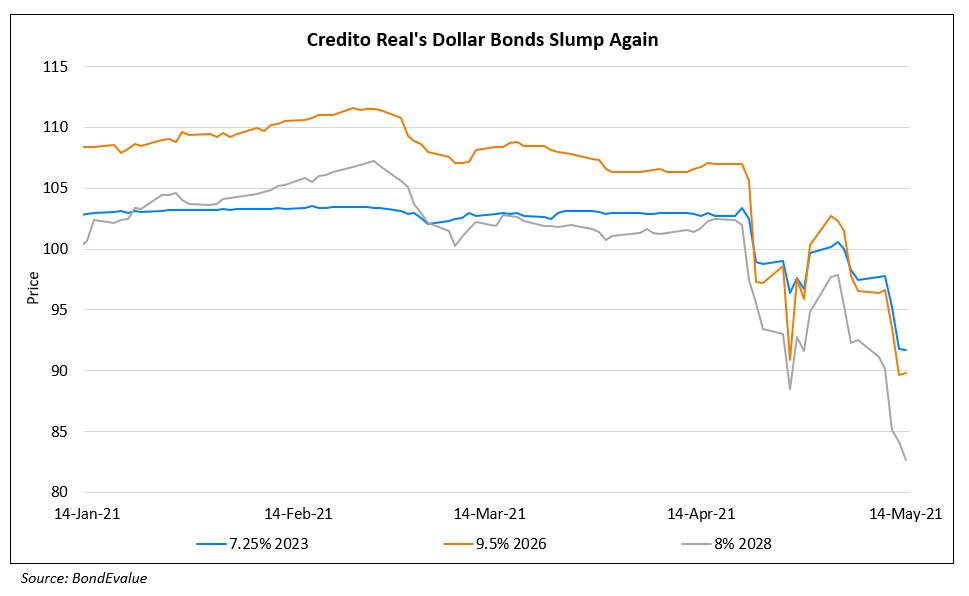

Credito Real’s Bonds Drop on Loan Book Concerns, Audit and S&P’s Downgrade To BB-

May 14, 2021

Credito Real’s bonds fell amid concerns over its loan book, heading towards its worst loss in two weeks. The company’s audited 2020 statements reported that 45% of its loan portfolio was made up of accrued interest. Credito Real’s total interest amounted to almost $1.1bn, or 45% of the $2.4bn loan portfolio. Alexis Panton, Stifel strategist said that “we might normally expect to see a very small percentage of such interest included for such a lender…This seems potentially very troubling. We hope company management will be able to explain this new information disclosure”. Separately, Credito Real purchased almost 353k shares, reflecting 18% of trading volume as per Bloomberg. On Monday Credito Real closed with over MXN 1bn ($50.1mn) out of MXN 11.4bn ($571.8mn) in renewed debt.

To add to the woes, S&P Ratings downgraded Mexican financial lending institution’s rating to BB- from BB, its senior unsecured debt rating to BB- from BB, and its issue-level rating on the subordinated perpetual notes to B- from B on lower capitalization and weaker asset quality metrics with a stable outlook. The stable outlook reflected the rating agency’s expectation that Credito Real’s strategy will help them withstand the ongoing pandemic while its asset quality metrics stabilize. S&P added that it trusts Credito Real to refinance its credit lines.

Go back to Latest bond Market News

Related Posts: