This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Comparing the Yield Pick-Up of US Corporate Credit Curves vs. US Treasuries

February 11, 2025

The chart below shows the US corporate composite credit curves across rating categories, and its yield premium over US Treasuries. Looking deeper, we notice that the belly of the corporate curves (particularly the 5Y and 10Y) offer a better yield pick-up when shifting towards a longer tenor.

For instance, when an investors moves from a 5Y US Treasury into a 10Y Treasury, he/she will get a 15bp pick-up in yield. On the other hand, US AAA, AA, BBB and BB credit curves offer 35bp yield pick-up or more, when moving from their respective 5Y bonds into 10Y bonds. In other words, investors can get a 20bp (35bp minus 15bp) or higher pick-up from such corporate bonds just arising out of their credit spreads.

However, when moving into further longer tenors (i.e., from the 10Y to the 20Y/30Y), investors get only a 10-20bp pick-up arising from credit spreads, whilst also taking a much higher duration risk, implying greater sensitivity of the bond price’s move due to changes in underlying yields of longer-tenor US Treasuries.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

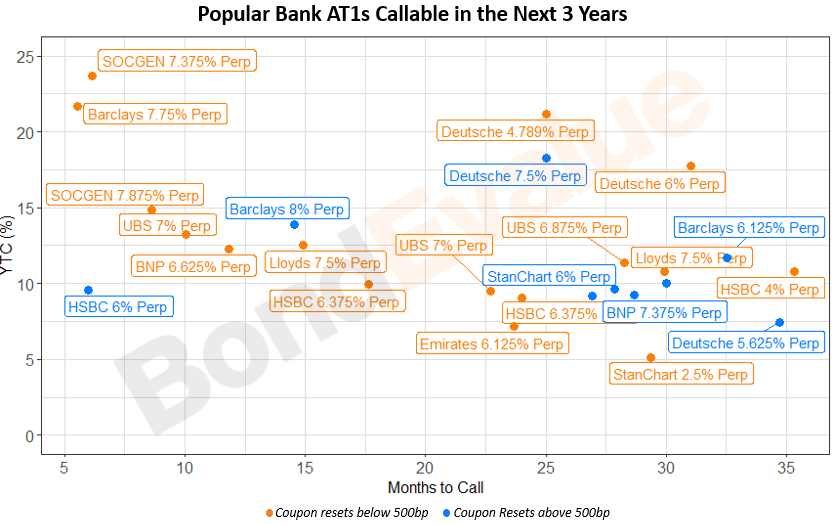

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023