This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia Announces Tender Offer to Buyback Dollar Bonds

August 5, 2025

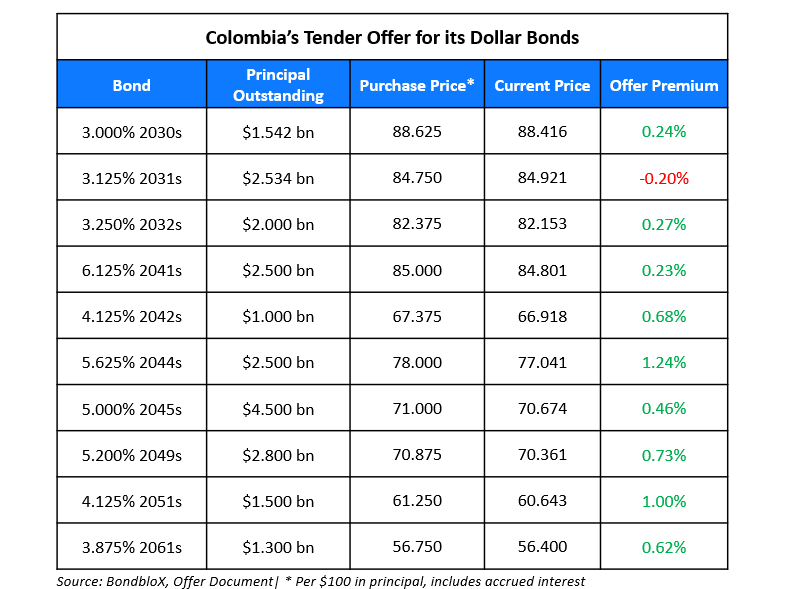

Colombia has launched a cash tender offer to repurchase several series of its outstanding dollar bonds. The sovereign aims to revamp its financing strategy amid concerns about a widening budget deficit. Colombia’s fiscal deficit target for 2026 was recently increased to 2% of GDP vs previous levels of 1.4%, with the overall deficit remaining at 7.1%. The government also aims to tap international markets once in 2025 and twice in 2026, seeking to raise about €5bn. The initiative is designed to lower borrowing costs and reduce the debt-to-GDP ratio, as the government leverages its cash resources for the operation. The offer is not conditioned on any minimum participation and expires on 8th August 2025.

Colombia’s dollar bonds have rallied by over 5% since early July, as the nation was in talks with banks to secure up to ~$10bn in Swiss francs to buyback relatively expensive peso and USD-denominated bonds. Also, progress on its debt management plan to reduce interest burden has helped with the rally in its bonds.

For more details, click here.

Go back to Latest bond Market News

Related Posts: