This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Cinda Launches $ Bonds; Markets Pricing-in Potential Third Rate Cut

July 16, 2024

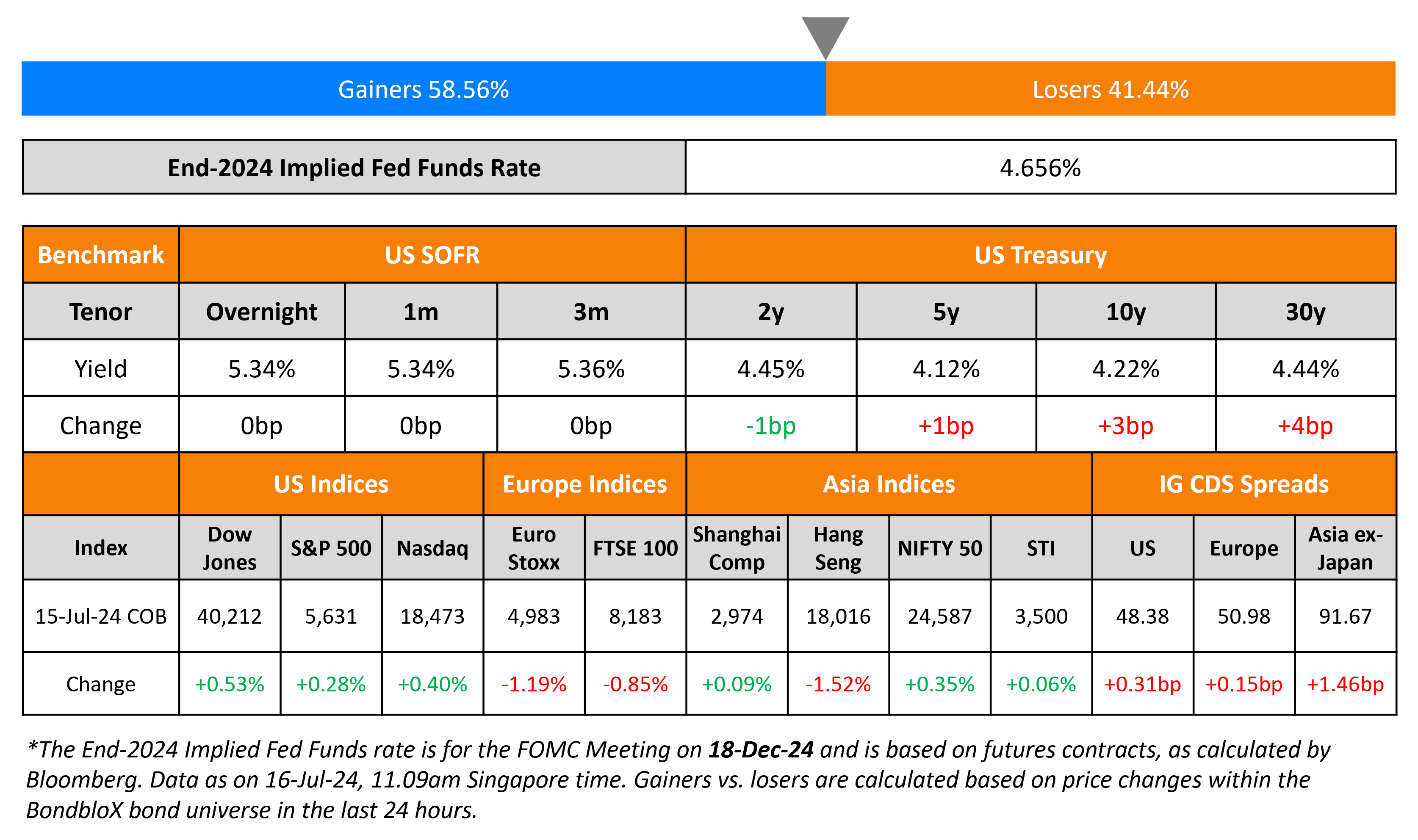

US Treasury yields inched higher yesterday with the 2s30s curve steepening to positive territory for the first time since January. The 2s10s curve continues to remain in negative territory, standing at -23bp. Fed Chairman Jerome Powell said that the latest data “add somewhat to confidence” that inflation is returning to 2%. San Francisco Fed President Mary Daly said that “inflation is coming down and doing so in a way that confidence is growing”. CME probabilities indicate that markets are pricing-in a 68% chance of a Fed rate cut in November, alongside a 25bp cut in September. The probability for a 25bp rate cut in December stands at 62%. Looking at equity markets, S&P and Nasdaq ended higher by 0.3-0.4% each. US IG spreads were 0.3bp wider and HY CDS spreads were wider by 0.8bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.2bp and 1.8bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 1.5bp wider.

New Bond Issues

-

China Cinda Finance $ 3Y/5.5Y at T+165/195bp area

JPMorgan raised $9bn via a four-part deal, following its Q2 earnings release.

The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes. The new 4NC3 and 6NC5 fixed-rate bonds were priced ~4bp wider to its existing 5.571% 2028s (callable in 2027) and 2.739% 2030s (callable in 2029) that yield 4.93% and 4.96% respectively.

PepsiCo raised $2.25bn via a three-tranche deal. It raised:

- $850mn via a 5Y bond at a yield of 4.535%, 25bp inside initial guidance of T+65bp area

- $650mn via a 10Y bond at a yield of 4.833%, 25bp inside initial guidance of T+85bp area

- $750mn via a 30Y bond at a yield of 5.267%, 25bp inside initial guidance of T+105bp area

The senior unsecured notes are rated A1/A+. Net proceeds will be used for general corporate purposes, including the repayment of commercial paper.

NongHyup Bank raised $600mn via a two-tranche social bond issuance. It raised $300mn via a 3Y FRN at SOFR+80bp, 40bp inside initial guidance of SOFR+120bp area. It also raised $300mn via a 3Y bond at a yield of 4.798%, 32bp inside initial guidance of T+100bp area. The senior unsecured notes are rated Aa3/A+. Net proceeds will be used to finance and/or refinance new and/or existing loans extended for projects within the ‘‘access to essential services’’ category of eligible social assets.

RBC raised $3.25bn via a three-tranche deal. It raised:

- $1.25bn via a 3NC2 bond at a yield of 5.069%, 24.5bp inside initial guidance of T+87.5bp area

- $700mn via a 3NC2 FRN at SOFR+79bp vs. initial guidance of SOFR equivalent area

- $1.30bn via a 6NC5 bond at a yield of 4.969%, 25bp inside initial guidance of T+110bp area

The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Government of Hong Kong SAR hires for $/€ Green bond

- Mitsubishi HC hires for $ 5.25Y bond

- SM Investments hires for $ 5Y bond

Rating Changes

- BPCE Upgraded To ‘A+’ On Increased Senior Non-Preferred Issuance To Boost Loss-Absorbing Capacity; Outlook Stable

- Fitch Downgrades Syngenta AG to ‘BBB’; Outlook Stable

- Fitch Downgrades Lippo Malls Indonesia Retail Trust to ‘C’ on DDE; Removes Rating Watch Negative

- Fitch Downgrades Engie S.A. to ‘BBB+’; Outlook Stable

Term of the Day

Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Global Markets Ramping Up ‘Trump Trade’ After Attack

Fredrik Repton, PM at Neuberger Berman

“You are seeing the favorite trade of a Trump presidency which is a curve steepener. It looks like we will see more term premium in the markets going forward”

Priya Misra, PM at JPMorgan Investment Management

“Political risk is binary and hard to hedge, and uncertainty was high as it is with the close nature of the race… adds to volatility… further increases the chance of a Republican sweep”

David Mazza, CEO at Roundhill Investments

“The attack will boost volatility… adds support for stocks that do well in a steepening yield curve, especially financials”

On Foreign Banks Are Snapping Up Short-Term Indian Bonds – BofA

“Foreign banks have also seen increased demand for government securities from foreign portfolio investors… increased their inventory to meet this demand… only way it can break that is if the fiscal deficit number comes below 5%”

On Urging Officials to Back Interest Rate Cuts – BOE’s Swati Dhingra

“Now is the time to start normalizing so that we can then finally stop squeezing living standards the way we have been to try and get inflation down… There’s merit in changing interest rates gradually for the reason that it gives people certainty of where things are going”

On Correlations Between Credit and Equities Breaking Down

Jeff Klingelhofer, co-head of investments at Thornburg Investment

“Major milestones for the Fed are all behind us…(can finally focus on) what really matters: the underlying economy.”

Priya Misra, PM at JPMorgan Investment Management

“Correlations between equities and credit are breaking down because higher-for-longer interest rates has been a negative for a large number of equities but supportive of credit in general because of yield-seeking investors”

Top Gainers & Losers- 16-July-24*

Other News

Go back to Latest bond Market News

Related Posts:.png)