This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Chong Hing, Everbright, Korea SE Power Launch $ Bonds; Greenko Upgraded; Hyflux Gets Another Potential Suitor

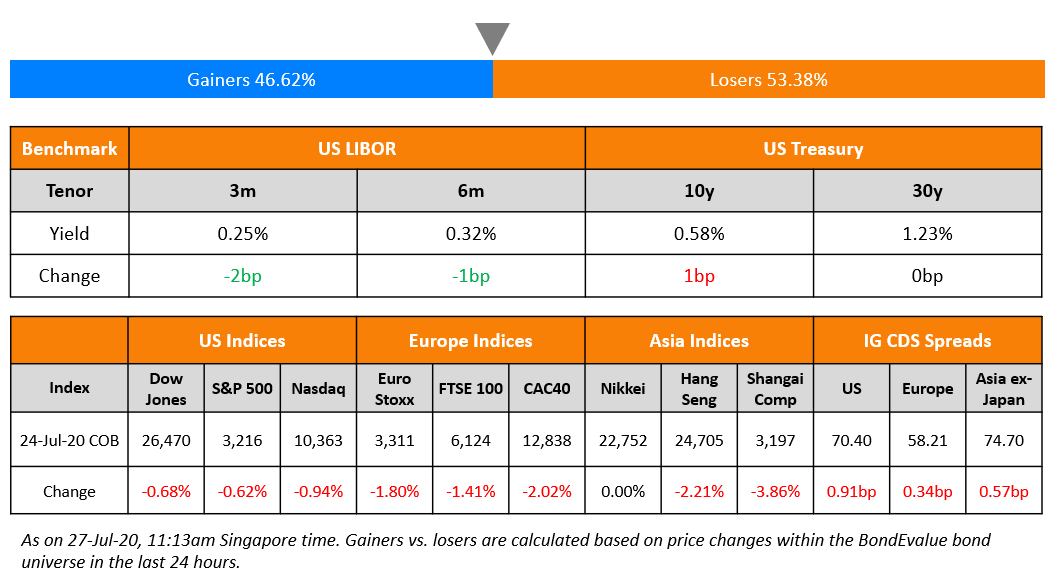

An uptick in daily coronavirus fatalities in the US combined with rising US-China tensions caused a downtick in Wall Street on Friday. European shares did worse with major indices down 1-2%. Treasuries were mostly unchanged as safe haven demand was offset by the prospect of more supply once Congress agrees on the next stimulus package. This week, the FOMC meeting and quarterly results of major companies like Apple, Amazon and Alphabet will give further direction. US Q2 GDP is expected later and estimates show a massive contraction of 35%. US and Europe IG CDS spreads widened a tad but Asian dollar bond spreads tightened for a 13th consecutive week on Friday. Asian markets are opening lower this morning.

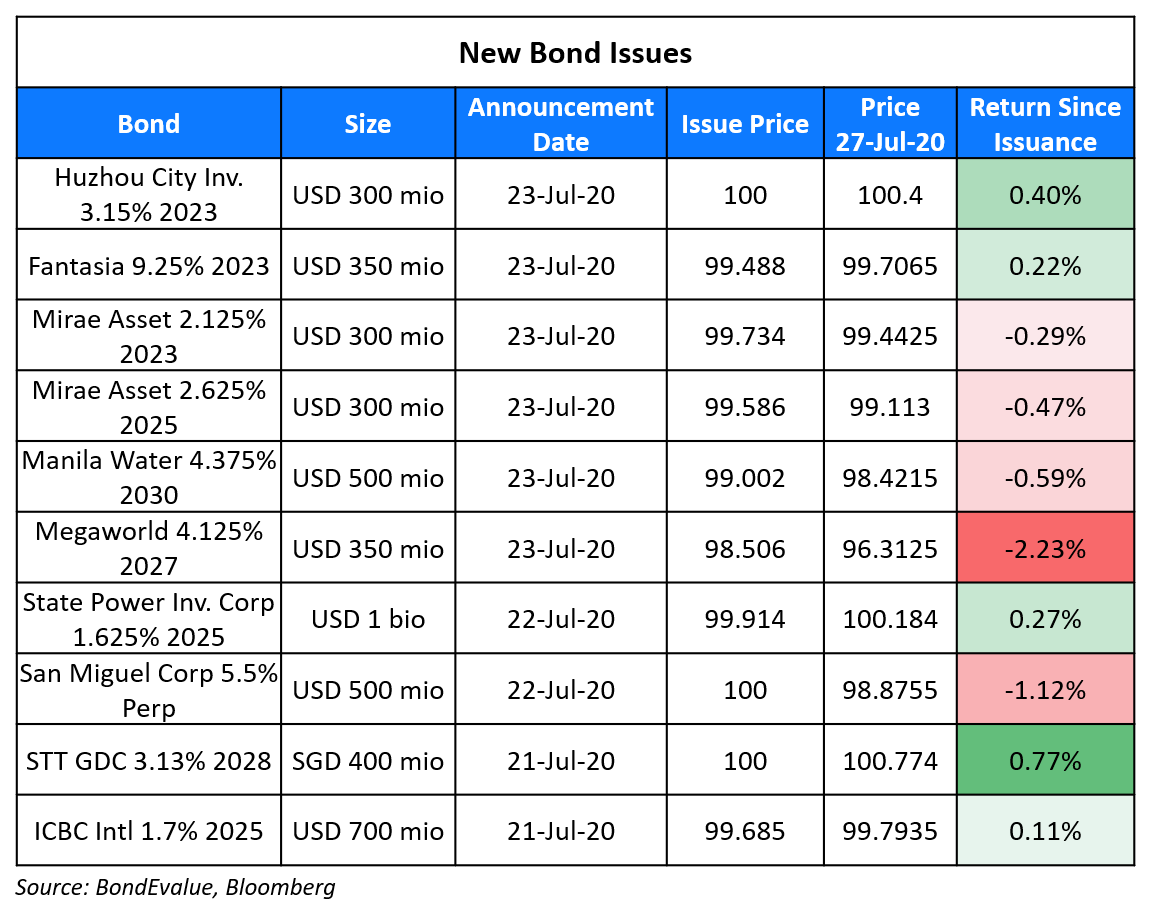

New Bond Issues

- China Everbright Bank HK $ 3yr floater @ 3mL+125bp area

- Korea SE Power $ 5.5yr Sustainability @ T+125bp area

- Chong Hing Bank $ Perp NC5 AT1 @ 6% area

- DaFa Properties $ 2yr @ 13.875% area

Rating Changes

Fitch Upgrades India-Based Greenko Energy to ‘BB’; Upgrades GSM and GIL Notes, Affirms GBV Notes

Fitch Downgrades India’s Future Retail to ‘C’ on Missed Coupon

Fitch Rates Fantasia’s Proposed USD Senior Notes ‘B+’

Moody’s assigns Ba2(hyb) rating to Chong Hing Bank’s proposed Additional Tier 1 securities drawdown

Slovakia Outlook Revised To Negative On Rising Economic Risks; Affirmed At ‘A+/A-1

Hyflux Receives Binding Offer from Utico to Restructure Debt; Also Receives a Letter from North American Fund for Possible Investment

Singapore-based Hyflux revealed late last week that it has received a firm and legally binding offer from Utico FZC to restructure the group’s debt. Under the terms of UAE-based Utico’s offer, debt owed to unsecured creditors, bondholders and trade creditors will be exchanged into Utico and Hyflux shares while Hyflux’s perpetual and preference shareholders (P&P holders) will receive cash or Utico and Hyflux shares, depending on the size of the investors’ holdings. Small P&P holders, who own less than S$10,000 in principal will be entitled to a cash payment of lesser of S$1,500 or 50% of the aggregate principal amount of P&P held. The cash payment is capped at S$28mn. Large P&P holders, who own S$10,000 or more in principal will pro-rated shares of Utico and Hyflux shares equal to 5% of Utico’s total issued share capital and 12.5% of Hyflux’s total issued share capital, less such number of Utico and Hyflux Shares representing in aggregate and in value the P&P Cash Payment to Small P&P holders. This offer will remain open for acceptance till July 31.

In related news, Hyflux has received a letter from New York-based transaction advisory and strategy consulting firm The Spectrum Solutions Group (TSSG), which represents an unnamed North-America-based fund manager for a possible investment in the struggling water treatment company. The announcement came via an exchange filing, which stated that TSSG and the Fund are looking to structure a deal to address “the interest of all major shareholders including the P&P shareholders and the UWG”. TSSG also mentioned that the fund has deployed over $1.3bn in equity till date “with a strong

track record of investing in infrastructure, technology and real estate on a global scale and an emphasis on value creation through operational optimization and close collaboration with management.

Others in the race to invest in Hyflux include Indonesian businessman Johnny Widjaja, Singapore-based Aqua Munda, also Singapore-based Longview International and European water company FCC Aqualia.

HSBC Denies Framing Chinese Telecom Major Huawei

On July 25, HSBC defended its role in the US inquiry of Chinese telecom giant Huawei Technologies by terming the allegations by several Chinese newspapers against it as ‘misrepresentation of facts’. In the week gone by, Chinese Global Times and People’s Daily had accused the bank of ‘fabricating’ evidence and ‘maliciously framing’ Meng, who is the deputy chair of the board and chief financial officer of Huawei Technologies. Meng has been under house arrest since December 2018 at Vancouver International Airport on a warrant from the United States accusing her of bank fraud for misleading HSBC about Huawei’s relationship with a company operating in Iran. This had put HSBC at at risk of fines and penalties for breaking U.S. sanctions on Tehran. However, the role of the bank has had adverse repercussions with China and could potentially lead to it being placed on an unreliable entities list in China. According to the bank, it was obligated to disclose the details under corporate monitorship terms with US authorities. In a WeChat post, HSBC refuted the allegations by saying that “HSBC does not have any hostility towards Huawei and did not ‘frame’ Huawei,” while adding “The information provided by HSBC Group to the Department of Justice (DOJ) was done so pursuant to formal demand. In response to US DOJ’s request for information, HSBC Group simply presented the objective facts. HSBC did not ‘fabricate’ evidence or ‘hide’ facts. And HSBC would never distort the facts or sell to harm any of our clients for our own gains.” The statement from the bank is seen as an attempt to pacify China at a time when relations between the US and China continue to deteriorate.

Huawei, the world’s largest equipment supplier and a leader in 5G technology has been under scrutiny in the US over a possible espionage and intellectual property theft on technology related to 5G. The company had been adversity hit by a trade ban imposed by the US. This has been accentuated by the US seeking its allies support in isolating Huawei. HSBC and Huawei’s bond prices remained largely unchanged after the news broke out.

For the full story, click here

Goldman Sachs Agrees to Pay $3.9 Billion to Malaysia for 1MDB Settlement

Goldman Sachs has agreed to settle charges filed against it in 2018 in a kleptocracy scandal. The bank would pay $2.5bn directly to the Malaysian government and also cover any shortfall from the sale of assets worth $1.4bn seized by the Malaysian government. In 2018, Malaysia took the Wall Street major to court on charges of the bank’s role in raising billions of dollars for a sovereign wealth fund known as 1 Malaysia Development Berhad (1MDB). The money raised through this fund allegedly went to personal accounts of officials including the then PM Najib and financier Jho Low. Goldman Sachs had helped the fund in raising $6.5bn in 2012 and 2013 through a series of bond sales, of which allegedly $2.5bn was siphoned out. According to the prosecutors in the US, ~$4.5bn was taken out from 1MDB fund. Revelation of the scam led to the ouster of then Malaysian prime minister, Najib Razak. This also led to foreign bribery and corruption investigations by the prosecutors in the US against Goldman Sachs. The current Ministry of Finance said that “This settlement represents assets that rightfully belong to the Malaysian people,” and added that “We are confident that we are securing more money from Goldman Sachs compared to previous attempts”. Goldman’s bonds were stable on the secondary market.

For the full story, click here

Hong Kong Airlines Decides Not to Exercise Call on Its Perp

Struggling carrier Hong Kong Airlines decided not to exercise its call option on its first call date, which was yesterday. The HNA Group company revealed via an exchange filing that it has breached a covenant since it has not provided financial statements on time, which has led to an increase in its coupon from 7.125% to 12.125%. The bond’s prospectus is available for download on our App.

The issuer had revealed earlier this month that it will be deferring a coupon payment due on July 26 and that its coupon will be increasing by 500bp. Its perpetual bonds have been trading at distressed levels since late last year, trading currently at ~30 cents on the dollar.

UK’s Stonegate Taps Bond Markets for High Yield Bonds

Stonegate, which owns the Yates and Slug & Lettuce pubs, sold high yield bonds worth £1.2bn on Friday to fund its takeover of Ei Group, which is the UK’s largest pubs operator. It raised:

- £950mn 5Y bonds at a coupon of 8.25%

- €279mn 5Y floaters at a coupon of 3-month Euribor + 575bp (currently 5.302%)

According to the FT, a banker on the deal said that the high coupon was to compensate investors for the risk of another possible shutdown should the number of coronavirus cases spike. Drinking in pubs is an indoor activity and can thus be negatively impacted if another shutdown is imposed. The bonds are said to backed by the group’s freehold pubs. This is one of the largest sterling junk bond issues and signals a recovery in high yield issuance amid the current low interest rate environment.

For the full story, click here

Term of the Day

Coupon Step-Up

Coupon step-up refers to a feature seen in certain bonds wherein the coupon increases (steps-up) either as per a predefined schedule or upon the occurrence of an event. Coupon step-ups can either be a single step-up or multiple step-ups through the life of the bond. A commonly seen step-up is for perpetual bonds, wherein the coupon increases in the event that the bond is not called on its first call date.

Last week, Philippine beermaker San Miguel raised $500mn via a perpetual bond. The bond carried a coupon step-up of 500bp if the bond is not called on its first call date of July 29, 2025. The new coupon, if not called, would be the bond’s initial spread of 523.7bp over the 5Y Treasury yield plus the coupon step-up of 500bp.

Talking Heads

On the Risks to the US Economy If Stimulus Packages Lapse

Larry Summers, Former U.S. Treasury Secretary

“I personally doubt what I think is the market’s view, which is that we’re going to have most people vaccinated and life returning to normal, sometime by spring of next year,” Summers said. “Everybody makes a mistake — they focus on the size of the package, and they don’t focus on the duration of the package, so they don’t focus on the rate of flow of stimulus,” Summers said. “We need to maintain a very substantial fiscal impulse in the economy for quite some number of months.”

William Dudley, Former New York Fed President

“We’re basically right at the edge of a huge fiscal cliff with the expiration of the $600 a week unemployment compensation benefits,” Dudley said on Bloomberg Television.

On the US-China Wa r- Ray Dalio, Billionaire Investor and Founder of Bridgewater Associates

“There’s a trade war, there’s a technology war, there is a geopolitical war and there could be a capital war,” Dalio said. “If you say by law ‘Don’t invest in China,’ or even possibly withholding the payment of bonds that the United States owes payment on in China — these things are possibilities, and they have big implications, such as for the value of the dollar,” he said. The U.S. is already endangering the dollar’s stability by being “our own worst enemy,” he said. “The things I worry about the most are the soundness of our money,” Dalio said. “You can’t continue to run deficits, sell debt or print money rather than be productive and sustain that over a period of time.”

“If we don’t work together to do the sound things, to be productive, to earn more than we spend, to build the stability of our currency and build the balance sheet, we are going to decline,” he added. “We are declining because of those things.”

On The Health of European Banks – Luis de Guindos, European Central Bank Vice President

“In a few days’ time, the ECB will be publishing the outcome of its vulnerability analysis of banks, which is a substitute for the stress tests,” De Guindos said in an interview with the Spanish news website El Independiente. “There is every indication that, with this high level of solvency, most European banks could withstand a 9% fall in GDP and survive the two years it will take to return to the level of output seen before the spread of Covid-19.”

Still, banks should be “extremely prudent” when distributing dividends, according to De Guindos, who noted that the average capital ratio of European lenders is around 15%. The ECB recommendation to suspend dividend payments is geared toward preventing a credit crunch, he said. “Bank profits should not be used to pay dividends, but to further support lending,” De Guindos said.

On the Upcoming Fed Meeting (July 28-29)

Gregory Faranello, head of U.S. rates at AmeriVet Securities in New York

“The message from the Fed will be strong — that they are all in — with it clear that they are getting more concerned about Covid’s effects and economic growth in the second half,” said Gregory Faranello. “Long-end Treasury rates are hugging the bottom of their range and seem to want to go lower. That reflects also that there’s a ton of uncertainty about the virus and geopolitics.”

Bill Dudley, former president of the New York Fed

“The Fed has indicated that they’re going to shift their large-scale asset purchase programs from focusing on market function — which is now good — to focusing on how do you actually stimulate the economy,” , said Bill Dudley. “That does imply they’re going to buy a greater proportion of longer-dated Treasuries.”

“There are still pockets of value out there in the IG (investment grade) credit market, even after all the positive gains in the past few months,” Trindade said. “There are areas in the eye of the storm that have underperformed the market and bonds that haven’t recovered their losses despite the wider rally.”

“The strong financial position of these airlines was such that despite the relaxation in travel restrictions, they could quite conceivably go on for quite some time with no revenues at all,” he said. “The airlines also have the benefit of unencumbered assets. They own their fleets rather than lease them and have low debt levels associated with planes.”

“European-focused airlines, so-called low-cost carriers, tend to have stronger balance sheets than their intercontinental counterparts,” Trindade said. “Some of the former have gone into the crisis with very low levels of debt and a very low-cost base.”

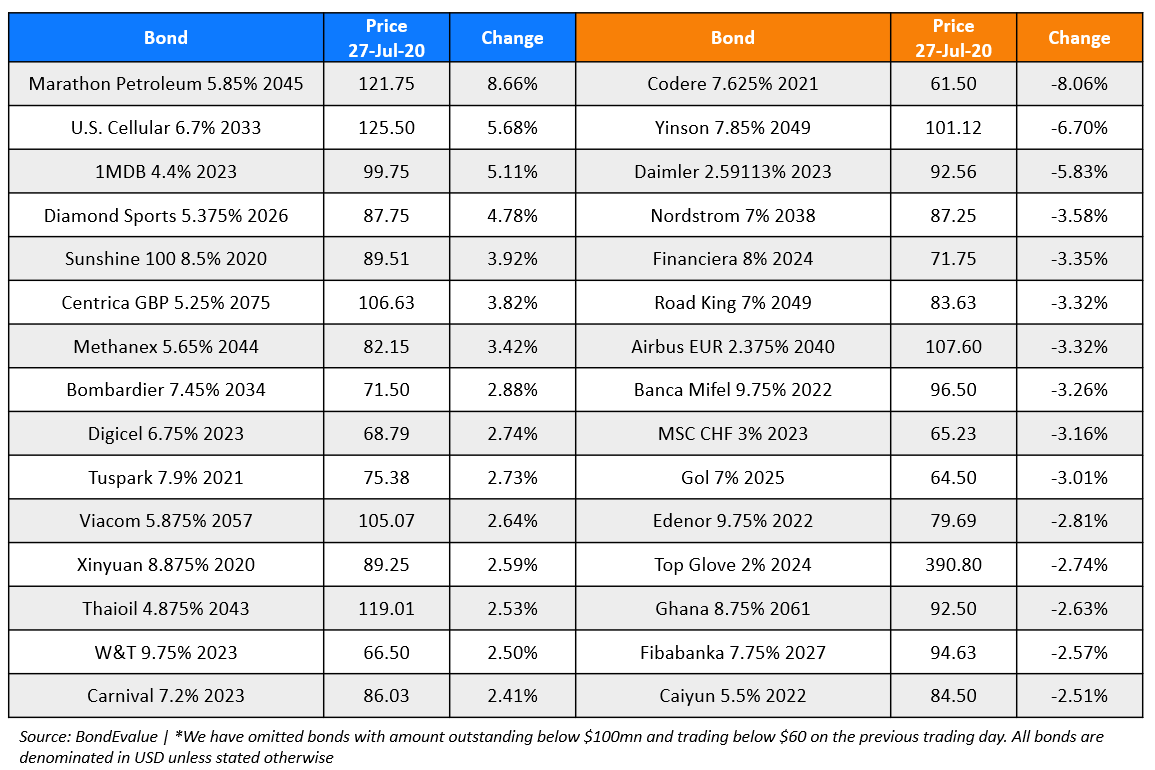

Top Gainers & Losers – 27-Jul-20*

Go back to Latest bond Market News

Related Posts: