This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Placed on CreditWatch Negative; To Retain Subsidiary Huarong International

April 12, 2021

S&P Ratings affirmed China Huarong Asset Management Company (CHAMC) and its subsidiaries at BBB+ but placed it on CreditWatch negative from stable on the back of uncertainty due to its delayed results. S&P noted that downgrade pressures could accumulate if interest-bearing debt to adjusted total equity is close to or trends towards 12x from 8.5x in June 2020. Also, if audited financials show worsening asset quality, a one-notch downgrade is likely, S&P noted. Overall, S&P noted that extraordinary government support is highly likely if conditions significantly worsen.

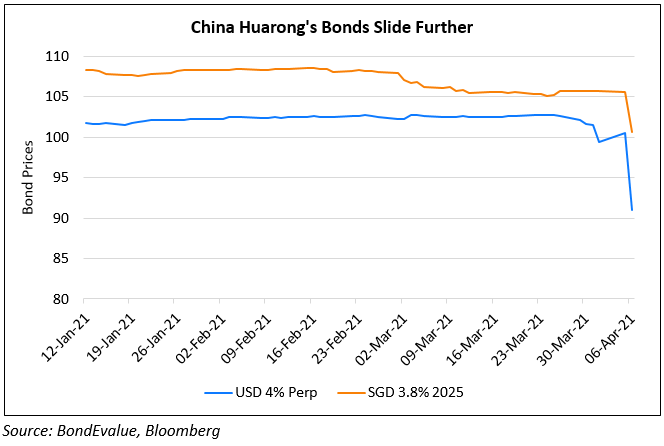

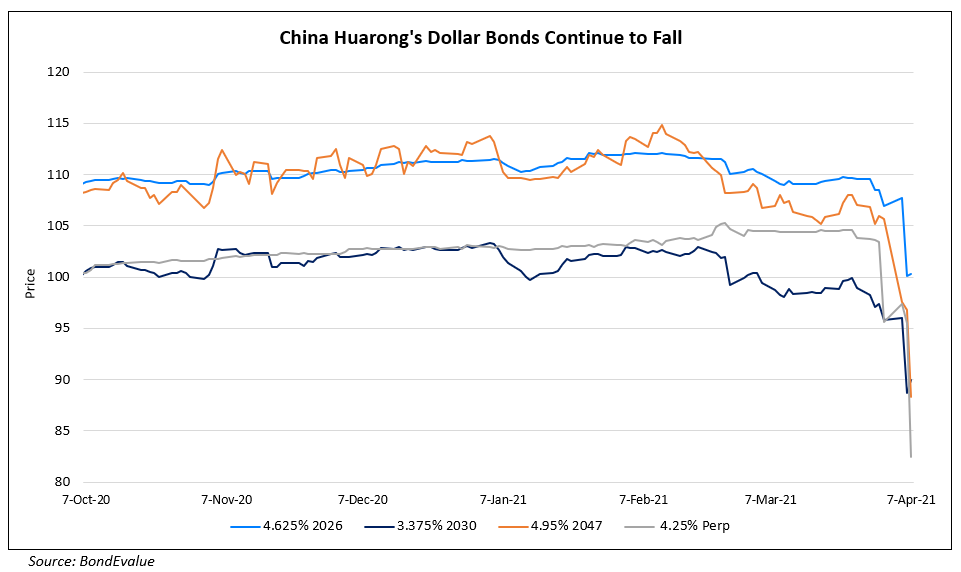

Separately, CHAMC said they intend to retain its offshore unit China Huarong International Holdings Ltd.in a follow-up of their plans to dispose off non-core and unprofitable assets. Huarong International issues/guarantees CHAMC’s dollar bonds. Bloomberg reports that the overhaul plan still requires approval from Chinese regulators and will not change Huarong International’s ownership or restructure its bonds, the people said. Sources say that Huarong International has been stepping up its collection of bad debt. According to a report by HSBC analysts, almost all of Huarong’s $22bn in dollar bonds are issued or guaranteed by Huarong International and most have so-called keepwell provisions from the onshore parent. CHAMC stated that debt payments have been made ‘on time’ and its operations are running as ‘normal’ in an effort to calm investor sentiment. CHAMC’s dollar bonds continue to fall further – its USD 4% Perp is down 3 points to 87.78, yielding 12.9% and its USD 4.5% 2029s are down 4 points to 91, yielding 5.9%.

Go back to Latest bond Market News

Related Posts: