This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Chinese Developers Buyback Small Amounts of Bonds

October 7, 2021

As the turmoil in Chinese property developers’ dollar bonds unfolds, some developers bought back small quantities of their dollar bonds in a bid to lend confidence to investors.

- Central China Real Estate (CCRE) repurchased $13.9mn in principal of three of its dollar bonds in September, as per an exchange filing on October 6. CCRE bought $2.7mn of its 7.9% 2023s, $2.451mn of its 7.75% bonds due May 2024 and $8.77mn of its 7.25% bonds due August 2024. The bonds are currently trading at 53.39, 54.63 and 53.86 respectively.

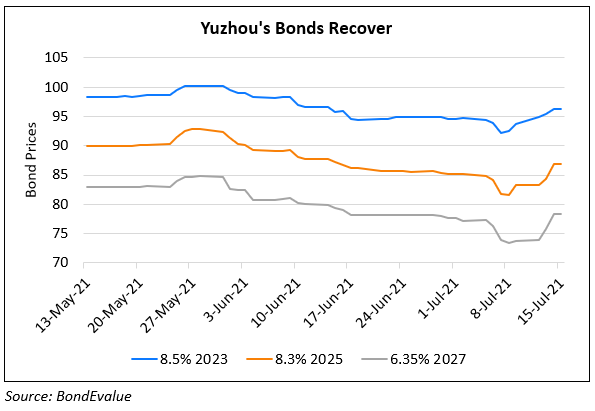

- Yuzhou Group bought back $10mn in principal of its 6% bonds due 2022. The amount outstanding now stands at $340mn. The 2022s currently trade at 76.48 cents on the dollar.

- Redsun Properties repurchased $3mn in principal amount of its 13% bonds due October 30. The amount outstanding now stands at $97mn. The bonds currently trade at 99.92 cents on the dollar.

- Radiance Holdings bought back $18.2mn of its bonds due January 2022 on October 6. This comes after the developer bought back $53.5mn of its 11.75% bonds due this month on October 31 and $3.2mn of its 2022s earlier. The 2022s currently trade at 97.34 and the notes due October 31 this year trade at 99.89.

Last month, while S&P and Moody’s revised their outlooks on CCRE to negative, they did state that the company should have sufficient cash to meet its upcoming maturities of $400mn on November 8 this year and $500mn in August 2022. All the four developers CCRE, Yuzhou, Redsun and Radiance said that they may repurchase more bonds in the future.

Fantasia, which has now defaulted on its dollar bond, had also repurchased $6mn worth of five of its dollar bonds between mid-August to early September.

Go back to Latest bond Market News

Related Posts: