This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Meltdown Seen Across Chinese Property Dollar Bonds after Evergrande and Fantasia Incidents

October 6, 2021

Chinese real estate developers’ dollar bonds saw carnage yesterday after Fantasia’s default. What started as a drop in investor sentiment towards the sector beginning with the systemic impact of Evergrande, has now translated into a domino-effect with most developers’ bonds, including investment grade rated names such as Country Garden, taking a beating.

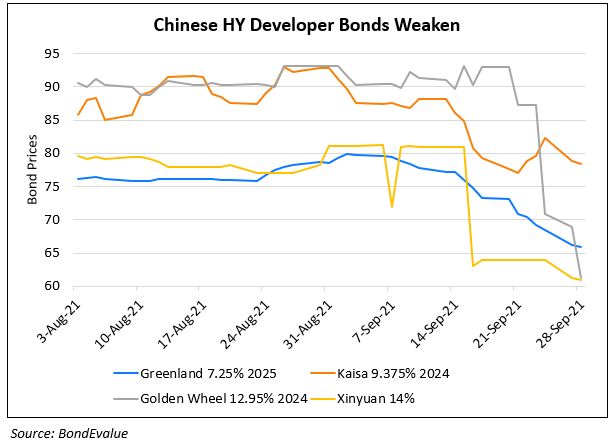

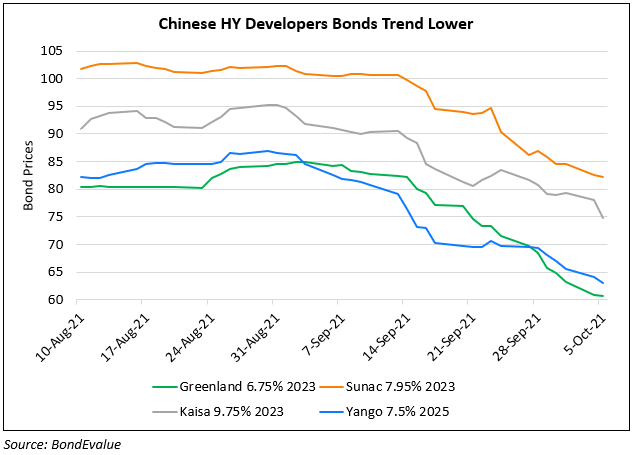

The chart below shows the fall in high yield developers’ dollar bonds that fell a further ~7% on Tuesday. The issuer ratings of the developers are as follows: Kaisa (B1/B/B), Yango (B1/-/B+), Central China (Ba3/B+/BB-), Yuzhou (B1/-/B+), Golden Wheel (B3/-/-), Redsun (B2/-/B+), Greenland (Ba/BB/-), China South City (-/B/B), Ronshine (B2/B/B+). To view an interactive chart of the fall in developers’ bonds, click on the chart image below.

Go back to Latest bond Market News

Related Posts: