This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Vows to Ease Regulatory Crackdown, Support Property Companies

March 17, 2022

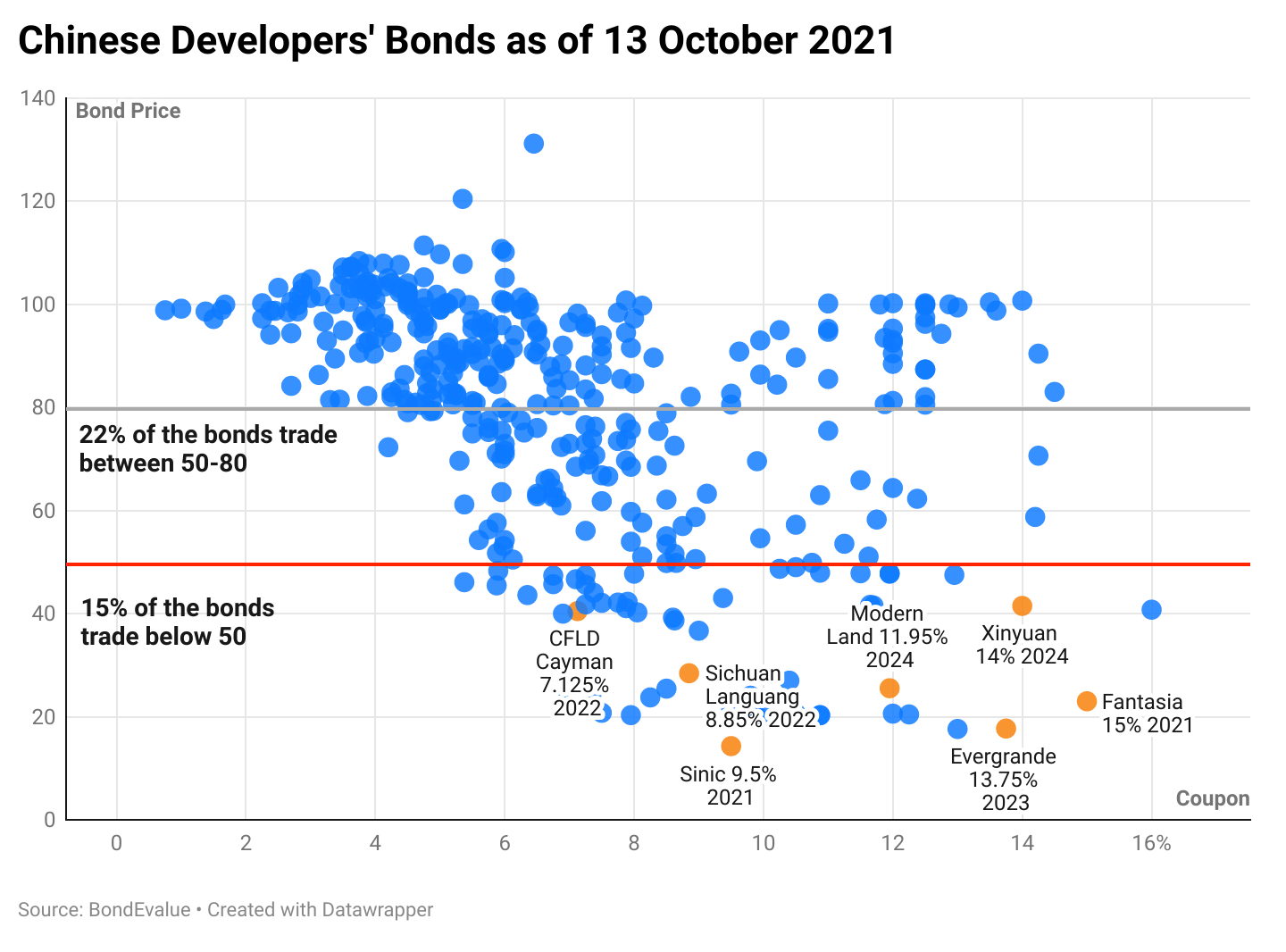

The China Financial Stability and Development Committee (FSDC) meeting concluded that it would need to boost the economy and promised to ease the regulatory crackdown and support technology companies, and distressed property markets. China’s real estate markets have been stressed for a long time and many developers have defaulted on their bonds. China said that it considers implementing a “new development model”, an effective plan to address risks for real estate and policies to support the industry. The banking and insurance regulator in China issued a statement noting that the new measures will lead trust, wealth management, and insurance companies to to stabilize capital markets, increase equity in high-quality companies and help property developers acquire real estate projects from China.

Dollar bonds of Chinese developers rose on the positive measures by the government. Country Garden’s (COGARD) bonds led the way, with some rallying 17 points. Sunac’s bonds rose over 10 points.

Previously under the regulatory crackdown, Alibaba was a major victim and had to pay large fines. The food delivery and private tutor industry were adversely affected, impacting their financial position. The financial committee indicated that they would introduce standardized, transparent, and predictable regulation for internet companies. In response, Alibaba stock has risen 37.63% to HKD 98/share over the last two days.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Fantasia Downgraded to B3 by Moody’s

September 27, 2021