This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Considers Plan to Help Vanke Repay $6.84bn Debt

February 13, 2025

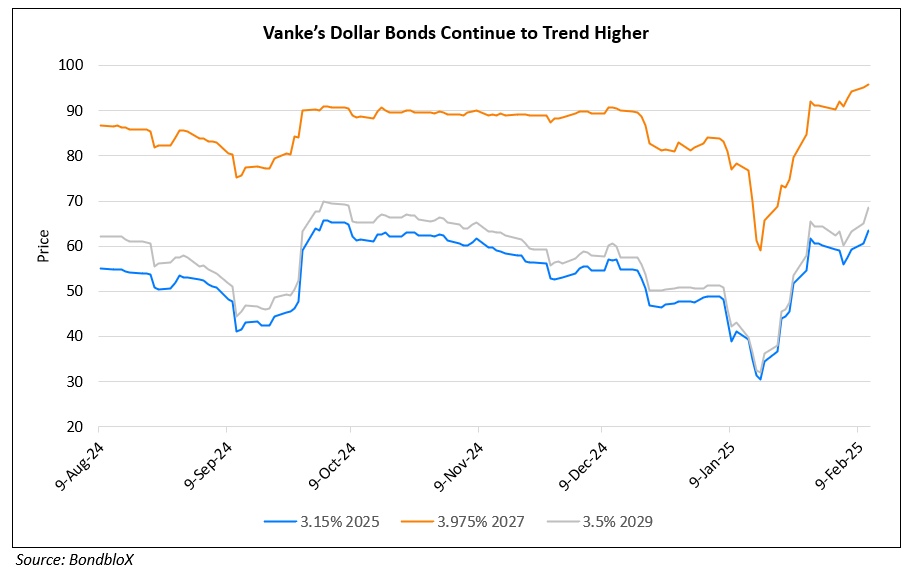

Chinese authorities are considering a plan to assist China Vanke in covering a funding shortfall of about RMB 50bn ($6.84bn) this year. Regulators intend to allocate RMB 20bn ($2.74bn) in special local government bonds to buy unsold properties and vacant land from Vanke. The proposal aligns with Vanke’s intention to “go all out” to raise funds for the repayment of $4.9bn in overall debt maturing throughout the year. This comes in addition to support secured by Vanke of up to RMB 2.8bn ($380mn) from its largest state shareholder, Shenzhen Metro Group. Bloomberg reports that Vanke will be allowed to tap other financing sources such as new bond sales and bank loans for its debt payments, but details are still unclear. Vanke was recently downgraded by a notch to Caa1 from B3 by Moody’s, marking its second downgrade by the rating agency this year.

Vanke’s dollar bonds moved higher by 2 points yesterday, and have now pulled back. Its 3.5% 2029s are trading at 65.7 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

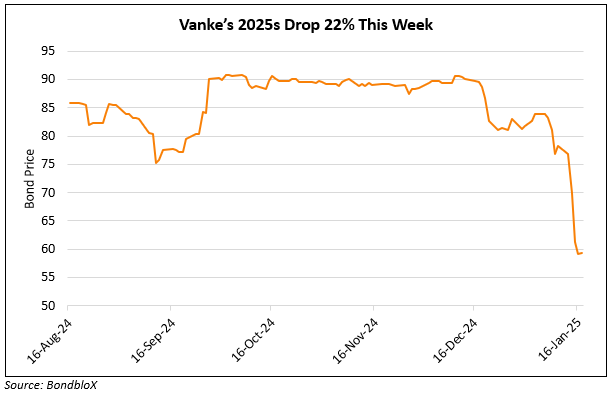

Vanke Downgraded to B3 by Moody’s

January 20, 2025

Vanke’s Dollar Bonds March Higher on Securing Additional Support

February 11, 2025