This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Casino Guichard’s CDS Holders to Get Payout

September 7, 2023

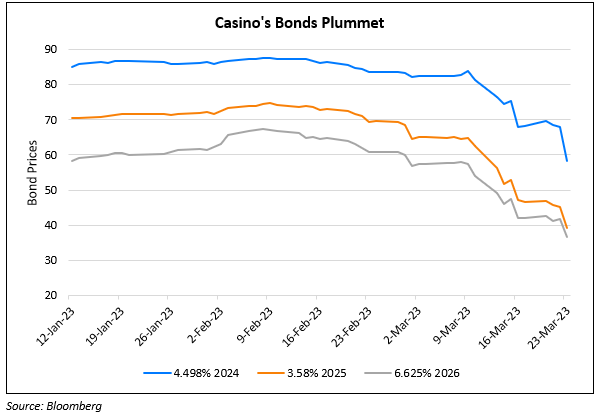

Casino Guichard’s CDS holders are set for a payout, as ruled by the Credit Derivatives Determinations Committee (CDDC). The committee ruled that Casino failed to pay a coupon due on its bonds due in 2026 on July 17 and did not pay the amount within its 30-day grace period. They said that as per ISDA definitions, a failure-to-pay credit event had occurred. This comes after months of speculation whether the non payment of coupons amounted to a default on its CDS. The net notional outstanding amount of CDS contracts was $360.7mn, as per Bloomberg, in the week ending August 18. Casino’s liquidity has been depleting with a cash burn of €700mn in the first quarter. Early last week, rating agencies Fitch and S&P downgraded the issuer to RD and D as they said a default had occurred under the 2026s.

Casino’s bonds are trading at deeply distressed levels of ~2-3 cents.

Go back to Latest bond Market News

Related Posts: