This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

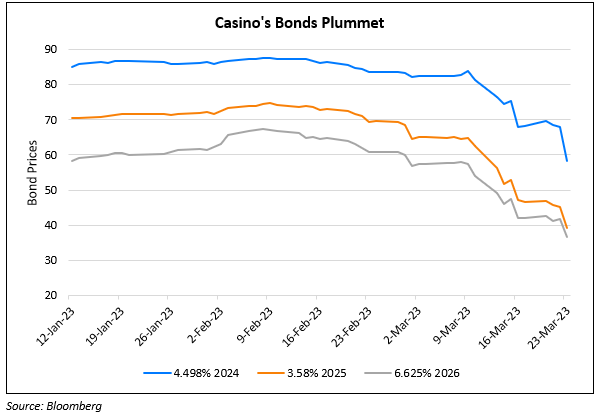

Casino Guichard’s Bonds Plunge on Warning Requiring Equity Injection

June 27, 2023

Casino Guichard’s bonds plunged after the retailer warned that it requires an equity injection of at least €900mn ($981mn) and to convert its debt into equity. The retailer’s warning comes amid falling revenues from its French operations, a negative EBITDA after leases and a cash burn of €700mn. Casino has €7bn in total debt and is looking to convert at least half of it into equity with maturity extensions for the remainder. This is to ensure “sufficient headroom to execute its plan” with adequate liquidity, it said. Casino has thus far seen interest of equity injection from two groups of investors of €1.1bn each. The first is by billionaire Daniel Kretinsky who holds a 10% stake in Casino alongside French company Fimalac. The other is by telecoms businessman Xavier Niel and two business partners. Casino has €1.4bn in debt maturities due over the next 12 months and another €1.8bn due in 2025. To preserve liquidity, it has reached an agreement in principle with the French government to defer payments of about €300mn in tax and social security liabilities due between May and September.

Casino’s bonds were down over 3-4 points across the curve with its 5.25% 2027s down to trade at 10.5.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Casino Guichard’s Bonds Drop Post Downgrade to Caa1

March 24, 2023

Evergrande Downgraded to C from CC by Fitch

September 30, 2021