This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Casino Finalizes Debt Restructuring Deal to Avert Bankruptcy

October 6, 2023

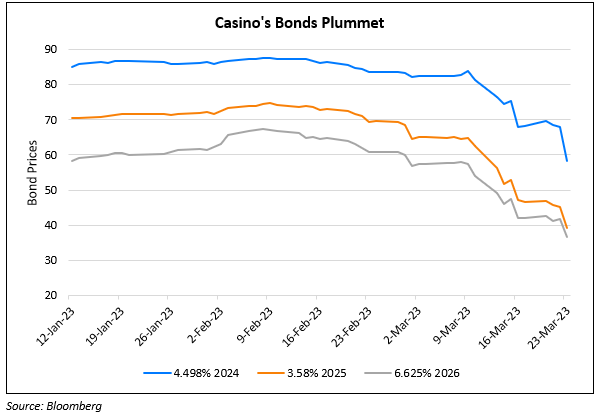

French supermarket group, Casino Guichard finalised a debt restructuring deal with billionaire Daniel Kretinsky to avert a bankruptcy. The consortium deal was led by Kretinsky’s company EPGC alongside Casino’s biggest creditor Attestor, its second-biggest shareholder Fimalac and the retailer’s secured creditors. The deal is expected to lead to a massive dilution of shareholders and the company will formally change hands at the end of March next year. Earlier the company had come to the verge of default after conducting debt-fueled acquisitions over the years and losing market share to rival players over time.

Casino’s dollar bonds continue to trade at distressed levels of 1-3 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: