This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Carnival Upgraded to Ba3 by Moody’s

February 17, 2025

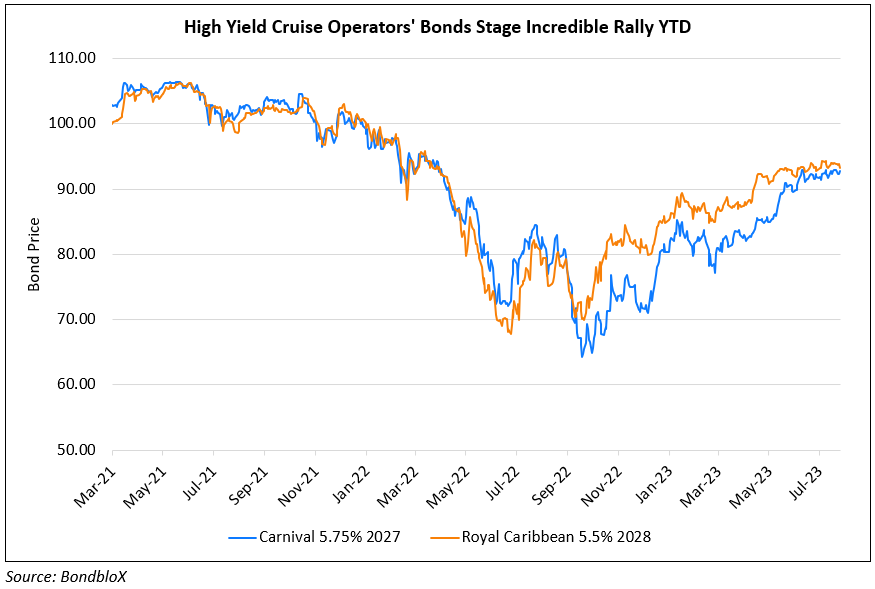

Carnival Corporation was upgraded by a notch to Ba3 from B1 by Moody’s. The rating agency also upgraded senior unsecured and secured notes of the company by a notch to B1 and Baa3 respectively. The upgrade reflects the improvement in the company’s credit metrics through the end of fiscal 2024 and Moody’s expectations of further improvements in this financial year. Carnival’s debt-to-EBITDA fell to 4.6x by 30 November 2024 with Moody’s expecting it to reach 4.0x by fiscal 2025 and 3.5x by 2026. The company also has strong liquidity, with $1.2bn in cash and marketable securities and expected free cash flow of at least $1.6bn in 2025. Carnival’s leading position in the global cruise industry and its wide customer base, bolstered by diverse brands, are key factors supporting its upgraded rating.

Carnival’s bonds traded stable with its 5.75% 2027s at 100.5, yielding 5.46%.

For more details, click here

Go back to Latest bond Market News

Related Posts: