This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

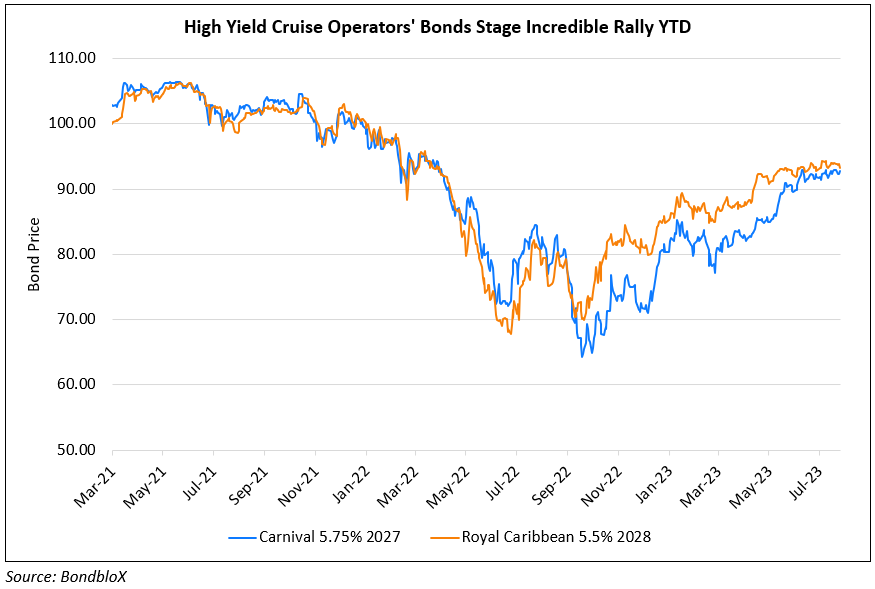

Carnival and Royal Caribbean’s Bonds Top US Junk Bond Performance YTD

August 18, 2023

The strong recovery in leisure and travel has led to a strong rally in cruise operators’ bonds. The leading players, Carnival and Royal Caribbean, have seen their bonds emerge as the top performers within the US junk bond space this year. Carnival’s 5.75% 2027s for instance have rallied 25% YTD, from lows of 74 cents at the start of the year to currently trade at 92.75 cents on the dollar, yielding 8.16%. Similarly, Royal Caribbean’s 5.375% 2027s have rallied 16% YTD to currently trade at 94.5, yielding 7%. In comparison, the average YTD return on US junk bonds is 6.2%. Carnival Chief Financial Officer David Bernstein said in an interview, “People view us and say, ‘Oh there is not as much risk…With the lower level of risk and the higher level of performance, their view of us paying back the bonds improves.” Cruise operators’ bonds have attracted institutional asset managers including PIMCO and Neuberger Berman Group. Sonali Pier, a high-yield and multi-sector credit portfolio manager at PIMCO said, “Services are still pretty strong. The consumer is healthy and unemployment is low. There are still some tailwinds.”

For more details, click here

Go back to Latest bond Market News

Related Posts:

Carnival Forecasts 2022 Loss on Fuel Price Surge

March 23, 2022

Royal Caribbean Bonds Move Up as Losses Narrow

August 1, 2022

Carnival and Royal Caribbean cut to B2 by Moody’s

August 11, 2022