This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Carnival Lining Up Fifth Dollar Bond Amid The Pandemic

February 10, 2021

The world’s largest cruise operator Carnival Corp is in early talks with investors for a $600mn bond issuance, its fifth since the pandemic broke out. As per Bloomberg, the company is sounding out investors for a 5-7Y bond with JPMorgan leading the talks. However, talks are still early and the details may change, according to people familiar with the matter. The current market environment is very conducive for junk-rated new bond issues, given that US junk bond yields are currently at an all-time low of less than 4%. Carnival, rated B/B1, last issued bonds denominated in dollars and euro in November, its first unsecured bond deal during the pandemic. The dollar and euro bonds, both carrying a 7.625% coupon and maturing in March 2026, met with solid investor demand with orders exceeding $11bn, over 5x issue size of ~$2bn. Investors’ hunt for yield has led to a rally in the bonds on the secondary market, now trading at 106.65 and 105.51 for the dollar and euro bonds respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

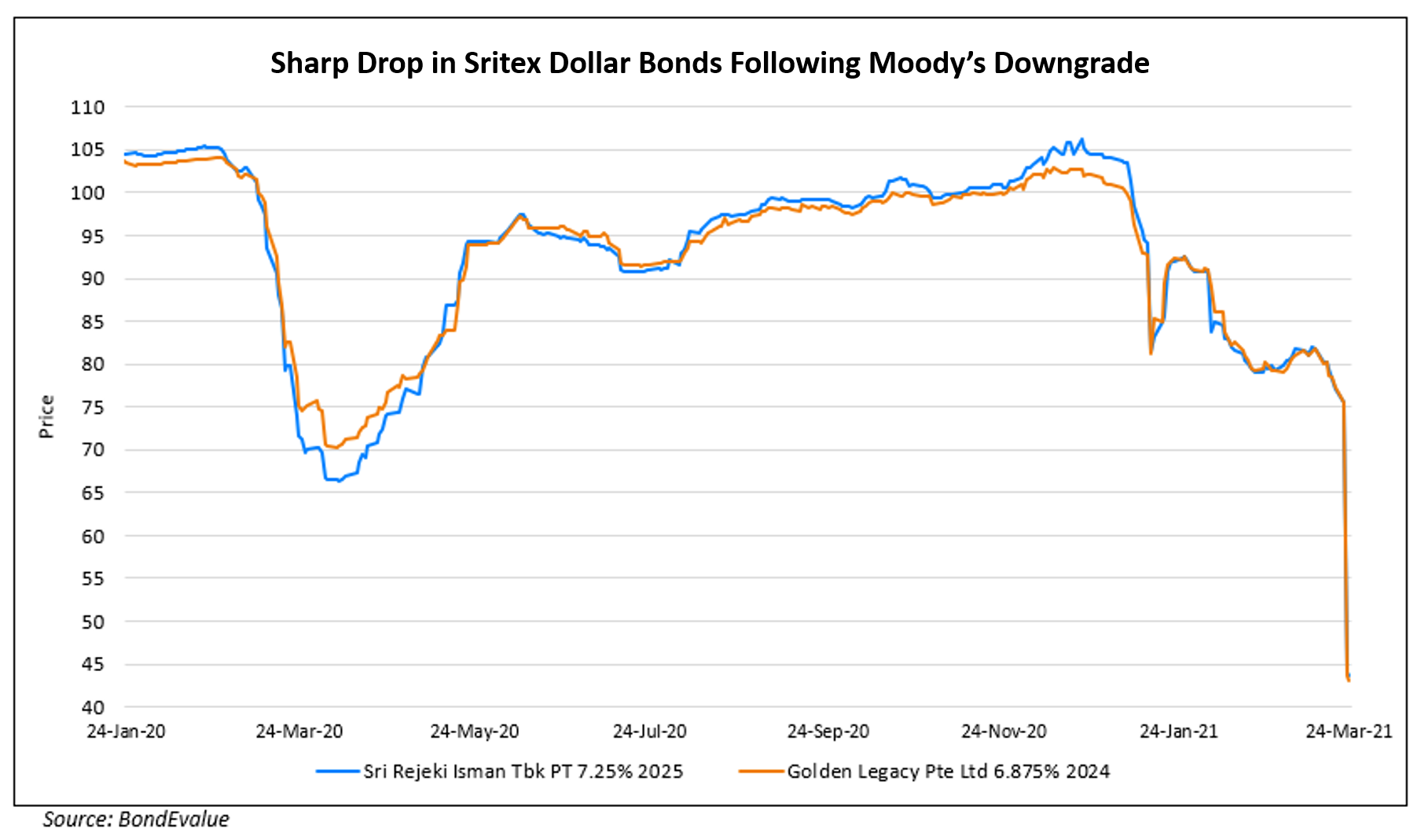

Sritex’s Dollar Bonds Nosedive Over 40% Post Downgrade

March 24, 2021

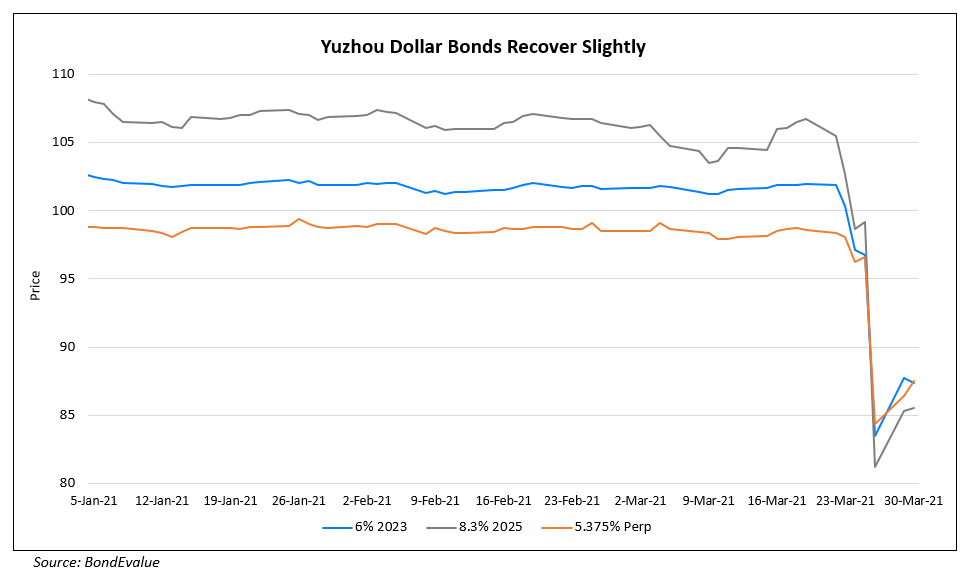

Yuzhou’s Bonds Recover Slightly

March 30, 2021