This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem Taps $1bn Credit Line Amid Industry Slowdown

October 6, 2025

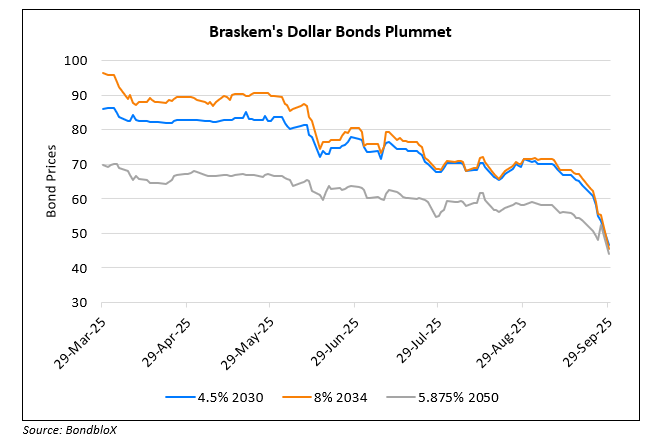

Braskem has tapped an entire $1bn credit line amid its industry downturn and investor concern. As per a filing, the company now has a cash position of $2.3bn, on an unaudited basis. Braskem said it was “focused on implementing resilience and transformation initiatives to mitigate the significant impacts resulting from the prolonged downturn” in the industry. It has an unsecured facility with a syndicate of banks due to expire in late-2026. The company has been in talks to renew a $1bn revolving credit facility (RCF), trying to avoid offering collateral, as per sources. This comes at a time when Braksem has hired advisers to assess and optimize its finances, post which, markets understood it as a possible debt restructuring in the works.

Braskem’s dollar bonds rallied by over 3 points across the curve, albeit still trading at distressed levels. For instance, its 4.5% 2030s were up 3.7 points to trade at 41.8 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: