This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

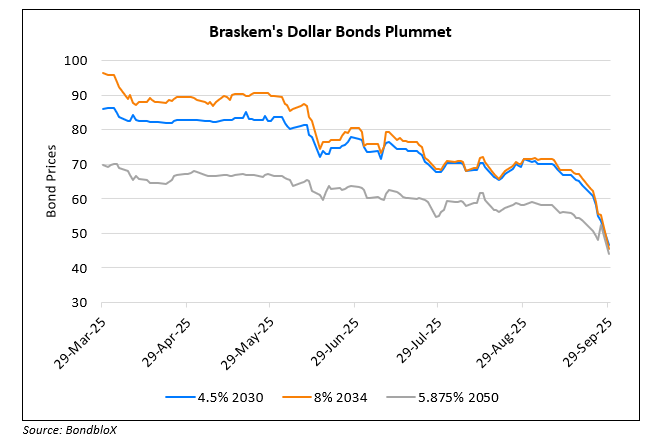

Braskem’s Dollar Bonds Plunge; Downgraded by S&P and Fitch to CCC+ and CCC-

September 29, 2025

Braskem was downgraded to CCC+ and CCC- from BB- and B+ respectively, by Fitch and S&P. The rating actions came on the back of increased credit and liquidity risk, cash burn, bond amortization pressures coming due in 2028, and a potential debt restructuring process. Braskem’s net leverage is expected to remain elevated, exceeding 10x in 2025 and 2026. Fitch adds that alongside the Alagoas project related cash outflows, Braskem is likely to have a lessened liquidity headroom. As of end-June, Braskem had a cash position of BRL 9.3bn ($1.7bn) and a revolving credit facility equivalent to about BRL 5.5bn ($1bn) available until December 2026. However, S&P believes that it might be difficult for the company to renew the RCF with similar terms. As per sources, the company is said to be in talks to renew the RCF. Braskem’s creditors also said to have approached Moelis & Co. and Houlihan Lokey with a possibility of having restructuring talks. In a filing on Friday, Braskem hired advisers to prepare a “diagnosis of economic and financial alternatives to optimize its capital structure”.

For more details, click here

Go back to Latest bond Market News

Related Posts:

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018