This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Braskem Downgraded to BB- Amid Weak Financials

August 13, 2025

Braskem has been downgraded to BB- from BB by Fitch. The rating agency cited Braskem’s ongoing financial stress and poor Q2 results, and they forecast net leverage (excluding Braskem Idesa) in the low teens for 2025-26. Fitch projects EBITDA at $600mn in 2025 and $700mn in 2026. This level is considered insufficient to offset rising net working capital requirements and annual maintenance investments of $400mn. Fitch also expects free cash flow before disbursements related to Alagoas to remain negative through at least 2027. Braskem’s ability to refinance large upcoming maturities, including the 2028, 2030, and 2031 bonds, is at risk, says Fitch. Sector volatility and slow industry rationalization continue to weigh on margins, and closure of less profitable plants is not happening at the required pace.

Meanwhile, event risks such as potential change in Braskem’s controlling shareholder and speculation around Novonor’s stake sale add to the existing pressure. However, Fitch pointed to the green polyethylene business as one of the few long-term growth drivers for Braskem.

However, Braskem’s dollar bonds have rallied by over 3% across the curve, following the speculations that Nelson Tanure may abandon his bid to acquire control of Braskem as his 90-day exclusivity window with current owner Novonor nears its August 21 expiration. This was considered significant as analysts had earlier anticipated that investors might be pessimistic with the prospect of a deal with a restructuring-focused buyer.

Braskem’s 6.99% 2032s are currently trading at 63.75, yielding 16.2%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

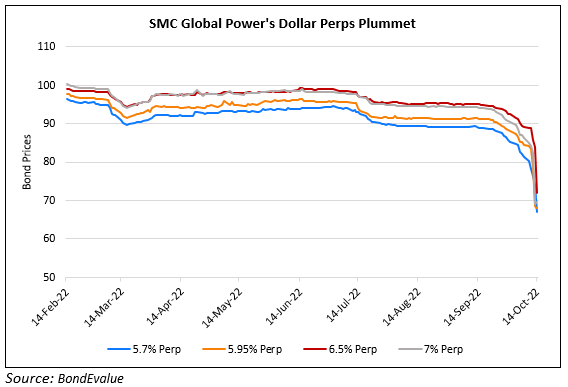

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023