This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

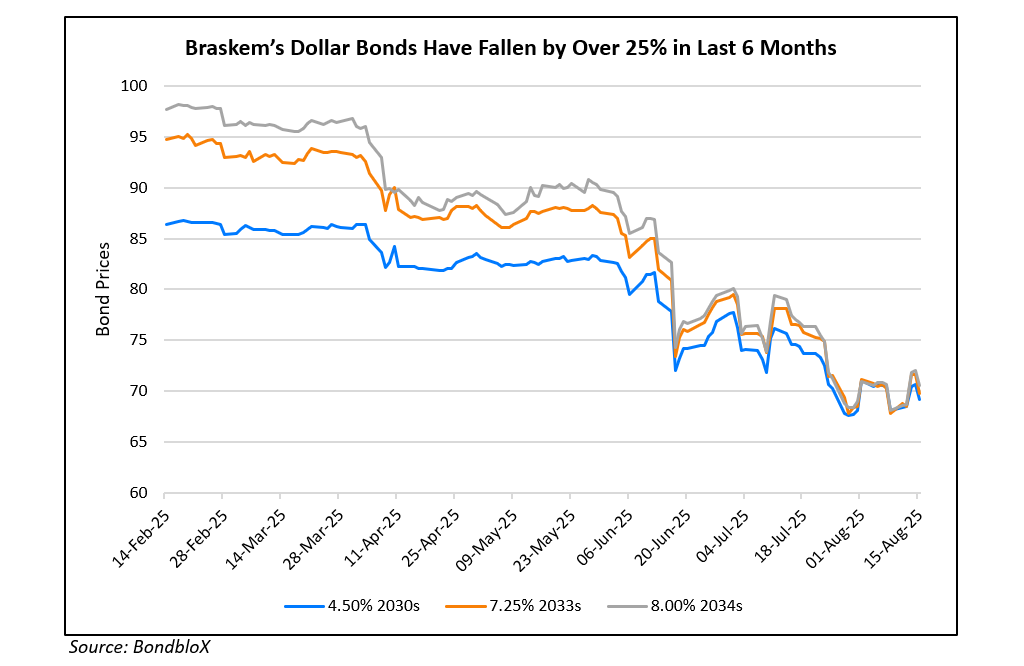

Braskem Downgraded to B2 by Moody’s; Dollar Bonds Weaken

August 15, 2025

Braskem was downgraded to B2 from Ba3 by Moody’s amid persistent credit and operational pressures, marking another downgrade for the Brazilian petrochemical giant just days after its downgrade by Fitch to BB-. Moody’s adjusted leverage estimate for Braskem (including Mexico) peaked at 15.3x in the 12 months ending in June 2025. Free cash flow was negative at BRL8.8 bn ($1.63bn). The combination of these numbers reflect the weak level of Braskem operations and the disbursements related to the provisions in Alagoas, they said. Moody’s expects leverage to remain between 11x–13.5x over the next 12–18 months, as subdued petrochemical spreads and macro headwinds continue to strain profitability.

Currently, Braskem boasts a large cash buffer – BRL10.3 bn ($1.9bn) in cash and a $1bn credit facility due late 2026, with just BRL1.9 bn ($351mn) of debt maturing until end-2026. However, Moody’s expects free cash flow to stay negative this year and refinancing risk to loom for major maturities in 2028. Braskem bond prices have fallen sharply in the last 6 months, mirroring its deteriorating credit profile and market sentiment.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018