This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOJ Hikes by 25bp; MAS to Ease Policy

January 24, 2025

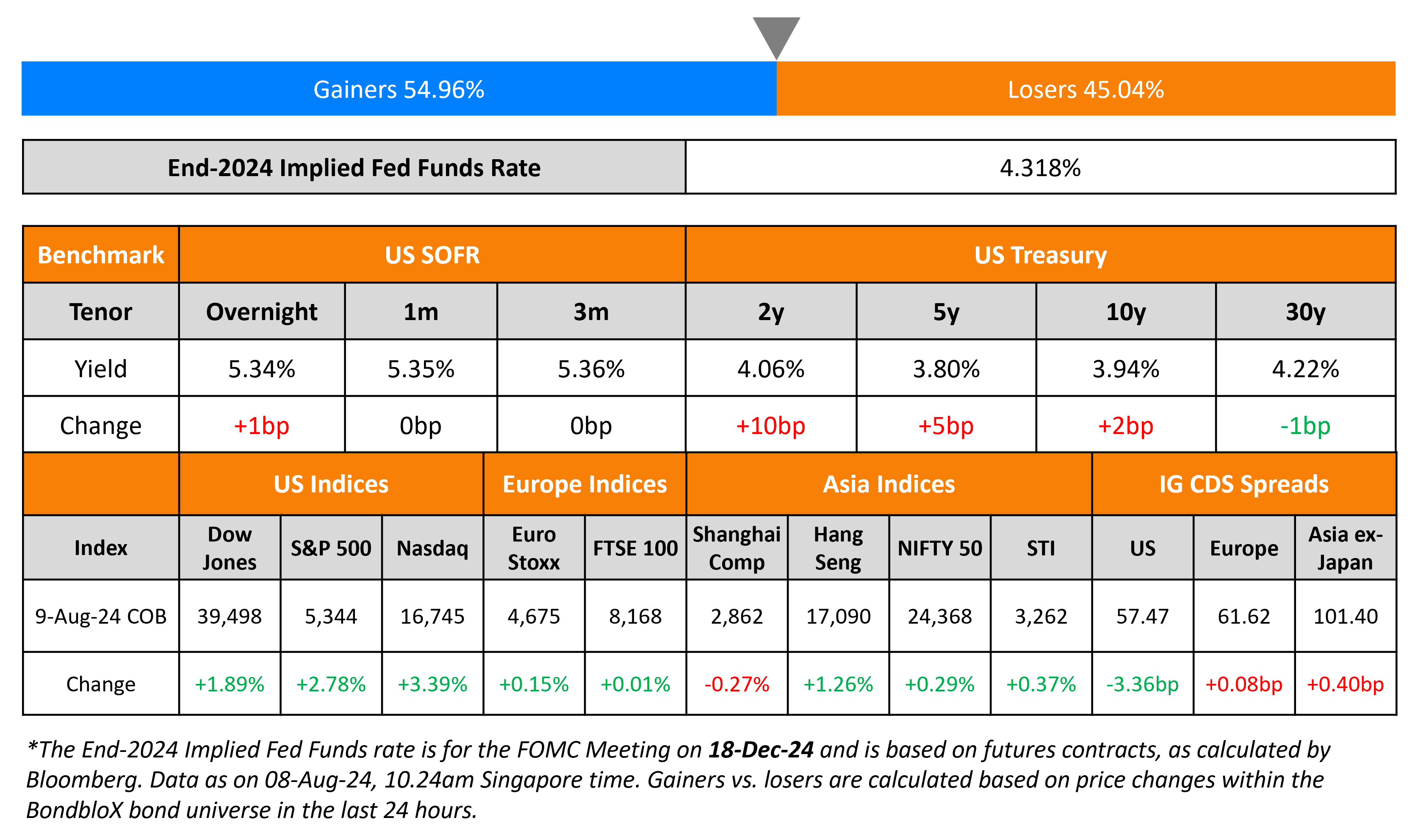

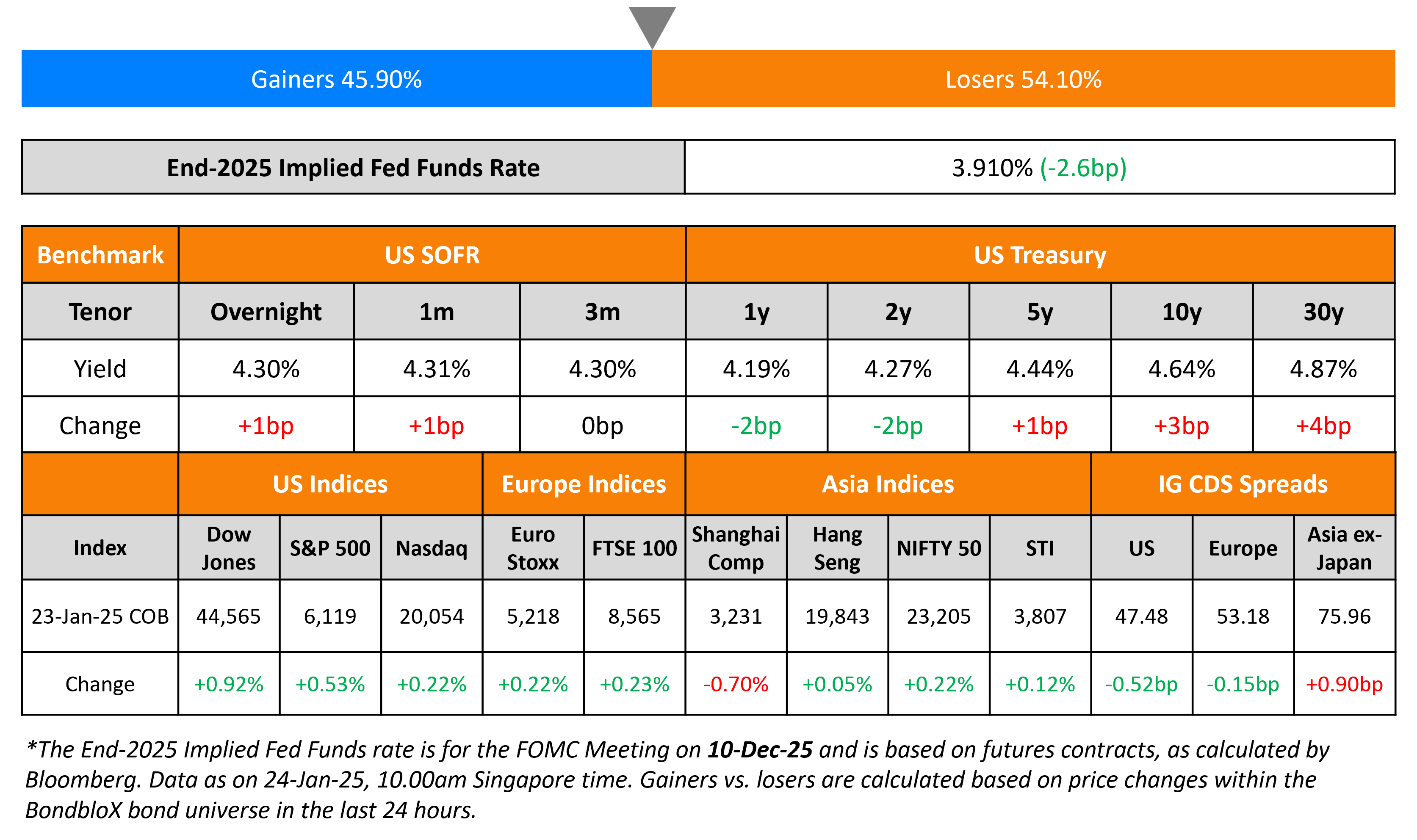

The US Treasury curve steepened marginally with the 2Y yield down 2bp while the 10Y yield rose 3bp. In his WEF Davos address, US President Donald Trump indicated potentially imposing tariffs on the EU, in addition to Mexico, Canada and China. Separately, US initial jobless claims for the previous week stood at 223k, slightly higher than expectations of 220k.

US IG and HY CDS spreads tightened by 0.5bp and 2.7bp respectively. US equity markets ended higher, with the S&P and the Nasdaq up by 0.5% and 0.2% respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 0.7bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 0.9bp wider. The BOJ raised its key policy rate by 25bp to 0.5%, its highest level in 17 years. Also, Singapore’s MAS indicated easing monetary policy for the first time in nearly five years. It said that it will “reduce slightly” the slope of its policy band.

New Bond Issues

Philippines raised $2.25bn via a two-tranche deal. It raised $1.25bn via a 10Y bond at a yield of 5.548%, 30bp inside initial guidance of T+120bp area. It also raised $1bn via a 25Y sustainability bond at a yield of 5.9%, 20bp inside initial guidance of 6.1% area. The SEC registered, senior unsecured bonds are rated Baa2/BBB+/BBB, with the proceeds going towards general budget financing and to finance/refinance assets in accordance with their framework.

Arcos Dorados BV raised $600m via a 7Y bond at a yield of 6.45%, inside initial guidance of high 6%s area. The senior unsecured bond is rated Ba1/BBB- (Moody’s/Fitch) and will be used to fund the concurrent tender offer of its existing notes due 2027, and for general corporate purposes.

Rating Changes

- Moody’s Ratings downgrades Thames Water’s CFR to Caa3, stable outlook

- Moody’s Ratings affirms Kimco’s Baa1 senior unsecured rating, changes outlook to positive

- Cinemark Holdings Inc. Outlook Revised To Positive From Stable On Strong Box Office Expectations

- Zhejiang Geely Holding, Subsidiary Geely Auto Outlooks Revised To Stable On Expected Margin Recovery; Ratings Affirmed

Term of the Day: SEC Registered Bonds

As the name suggests, these are bonds registered with the US Securities and Exchange Commission (SEC). These are not to be confused with 144A bonds, which are privately placed, not SEC registered and have lesser documentation and are traded among Qualified Institutional Buyers (QIBs). Given 144As are restricted securities, they have resale and transfer restrictions that are not applicable for SEC-registered securities. Besides these, they also have a few other differences like being eligible for inclusion in bond indices like Barclays Aggregate Bond Index, no investment restrictions and no private placement restrictions on communications.

Talking Heads

On Singapore’s Record Yield Gap With US to Widen on Debt Supply

Eugene Leow, DBS Bank

“The yield on 30-year Singapore Government Securities could see a further discount relative to 30-year Treasuries if US fiscal worries kick up another notch, which might not be imminent”

Kaushik Rudra & Jonathan Koh, Standard Chartered

“We could potentially see the long-dated spread remaining wide” between Singapore and US bonds

On Pimco, Dodge & Cox Lead Revival in Actively Managed Bond Funds

Anmol Sinha, Capital Group

“High quality bonds that provide diversity in periods of stress” appeal to investors “in a world where people want more consistency in returns and more diversification benefits”

Ford O’Neil, Fidelity Investments

“It’s a pretty good time to own Treasuries given where the yields are relative to the average of the last 20 years… look at credit spreads, whether it’s investment grade, high yield, those have never been tighter… doesn’t have a lot of upside from a spread tightening perspective”

On Emerging economies facing “sudden stop” of capital flows – JPMorgan

“Put simply, using the widely accepted academic definition, this would signal that EM ex China is on the verge of a sudden stop… not a situation where specific EM countries are under pressure and are facing balance of payments or currency pressures”

Top Gainers and Losers- 24-January-25*

Go back to Latest bond Market News

Related Posts: