This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BHP Reports Weak FY25 Results; To Sell Copper Assets for $465mn

August 19, 2025

BHP Group reported weak FY2025 results with annual profit dropping over 26% to $10.2bn, hit by weaker iron ore and coking coal prices due to China’s prolonged property slump and steel glut. Revenues fell by $4.4bn, partly cushioned by stronger copper earnings, which rose on higher prices and production. The mining company is facing declining profitability since its 2022 peak, with higher capital spending and debt weighing on shareholder returns. Net debt climbed up by $3.8bn to $12.9bn, and capex for next year is expected at $11bn, the highest since 2015. BHP is entering a heavy investment cycle, with up to 10 projects over the next 5–6 years.

Separately, the company also agreed to sell its Carajas copper assets in Brazil to CoreX Holding for up to $465mn. The deal, expected to close in early 2026, includes $240mn upfront and up to $225mn in contingent payments tied to production and project milestones from 2027 onward. The sale follows a 2024 strategic review, with BHP concluding the assets would achieve greater growth under a dedicated owner.

BHP’s dollar bonds traded slightly weaker with its 5.125% 2032s down by ~0.2 points to 102.745 yielding 4.62%.

Go back to Latest bond Market News

Related Posts:

Sabadell Explores Sale of Subsidiary TSB

June 17, 2025

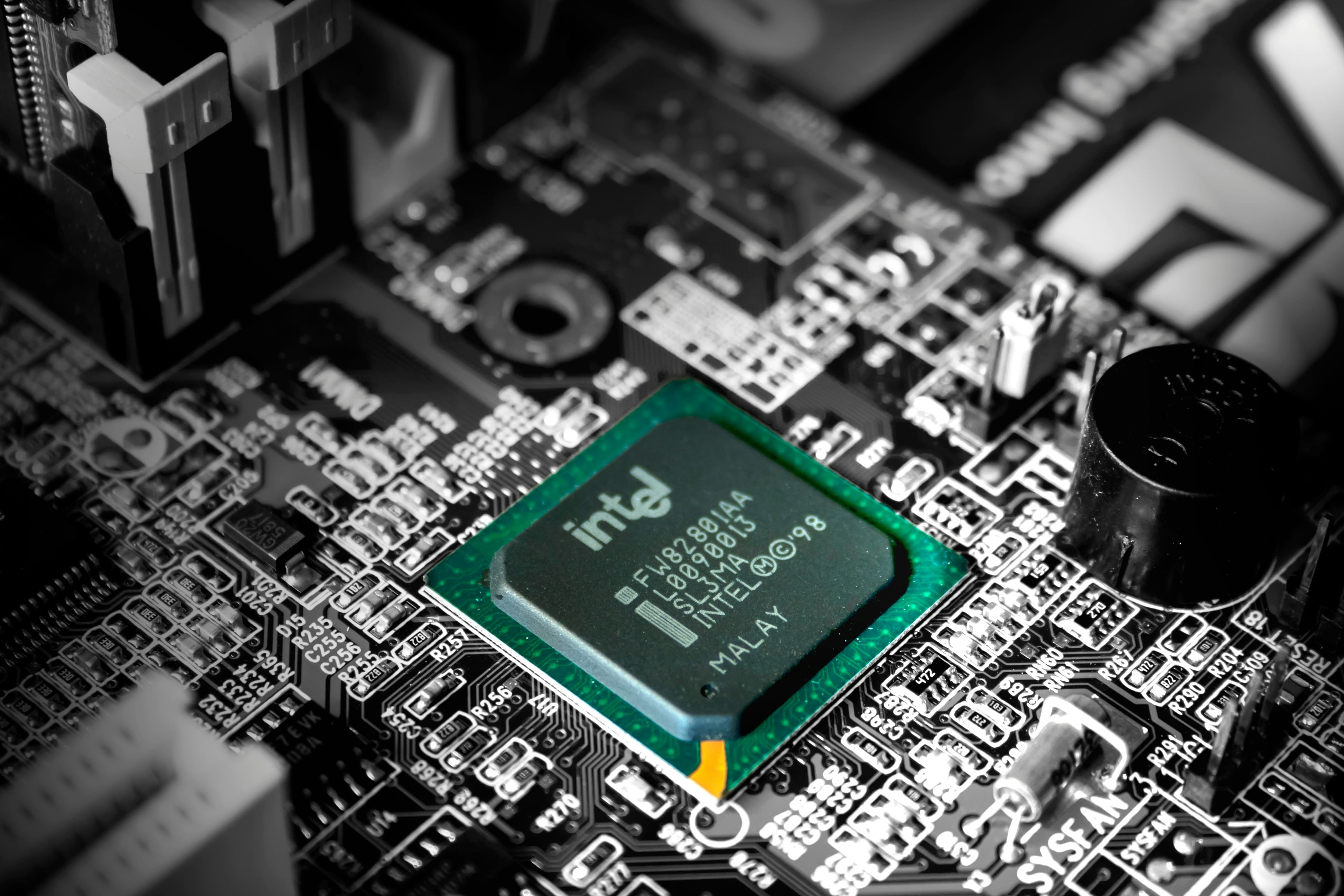

Intel Downgraded to BBB by Fitch

August 5, 2025