This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

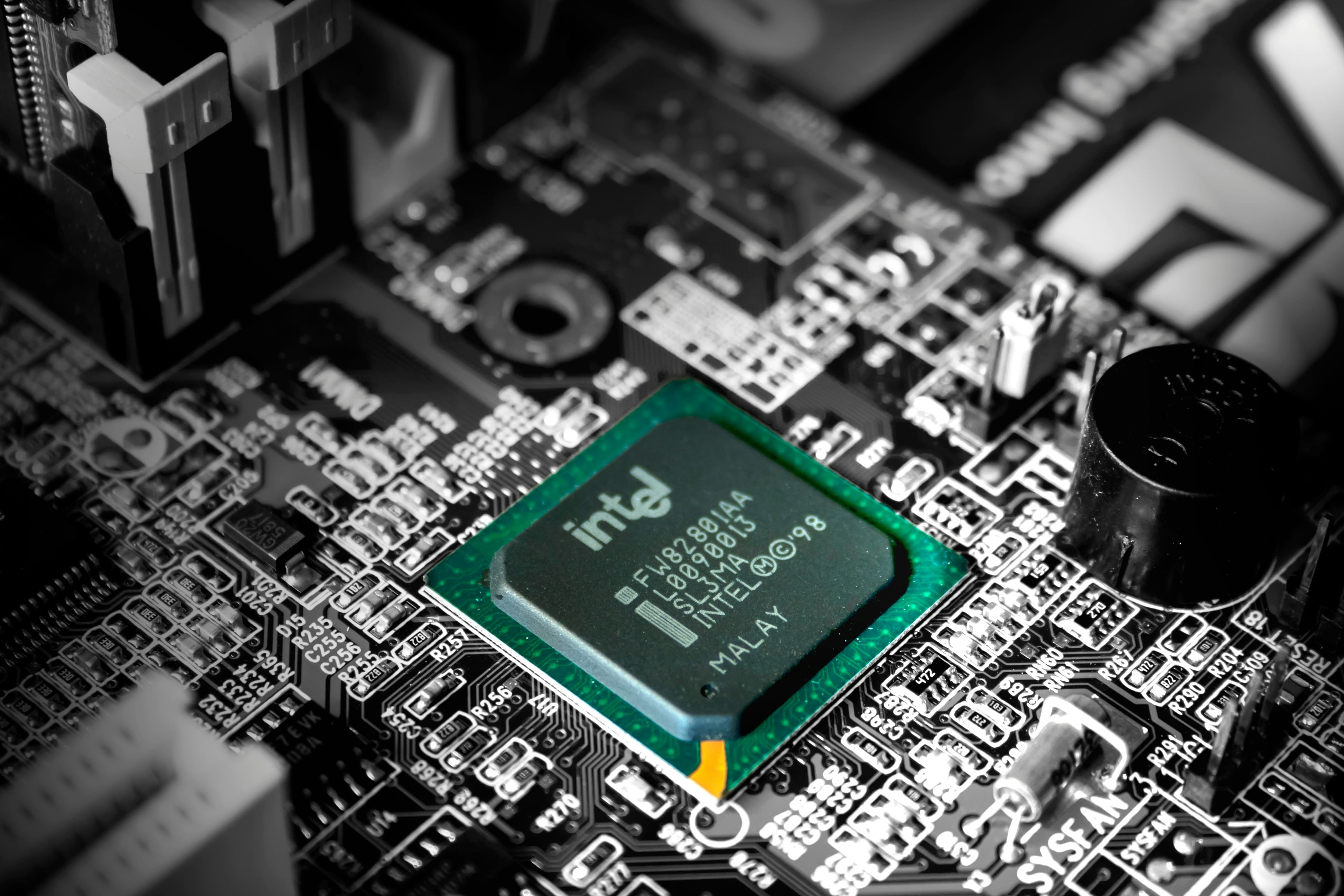

Intel Downgraded to BBB by Fitch

August 5, 2025

Intel was downgraded to BBB from BBB+ by Fitch with a negative outlook. The action reflects weak demand, low profitability growth, and continued elevated leverage. While Fitch expects debt-to-EBITDA to improve to 4.0x by end-2025 from 5.0x in 2024, it sees Intel achieving its negative rating sensitivity threshold of 2.5x by 2027 only. Fitch also cautioned on continued high R&D and capital intensity above 40%, significant execution risks tied to Intel’s 18A technology ramp, and lack of a clear AI strategy, all amid volatile global demand and intensified trade tensions.

However, Fitch acknowledged Intel’s foundry investment approach, with the company cancelling significant capital additions across multiple projects to outline sustainable adjusted FCF margins in the near term. To support profitability, Intel is planning to reduce operating expenses from $19.4bn in 2024 to $16bn in 2026, aiming to lift EBITDA margin to 30% in 2026 from 20% in 2024. Asset monetization, including sales of shares in Mobileye and a majority stake in Altera, is expected to generate $5.3bn, along with $1.9bn received from the memory business sale in 1Q2025.

Intel’s 5.2% 2033s were trading at 100.94, yielding 5.04%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: