This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Best and Worst Performing Issuers and Bonds in 2024

December 19, 2024

In this piece, we take a look a the top gainers and losers in 2024 and the reasons behind their moves. The table below shows the list of the top gainers and losers among issuers/companies.

Top Gainers

Lumen’s bonds, with a median return of 112.5%, were the top gainers in the year. Its bonds started rallying after the company announced a strategic partnership with Microsoft in July. Lumen’s bonds continued their rally further on the back of several positive news like partnership announcement with Amazon, rating upgrades and tender offer announcement.

Bonds of Shui On were the second best performer during the year with the median return of 66.6%. Shui On’s notes rallied after there was market talk of the company planning to issue a dollar bond, following which they priced the note. Also, the Chinese Government announced a stimulus package for the struggling real estate sector and eased home purchasing rules, helping in a rally across several Chinese developers’ notes.

With the median return of 55.3%, Buenos Aires’ bonds were the third best performers in 2024. The gains came on the back of Argentina getting clearance from the IMF for $800mn of funds and negotiating a $2.7bn loan with banks like Banco Santander and JPMorgan to meet its debt obligations.

GLP China’s notes were another top performer during the year, resulting mainly from the China announcing state-support measures for the real estate sector and the company launching a tender offer for its 2025s.

Vedanta was also among the top gainers, with a median return of 46.8%. The outperformance came after the company completed its debt restructuring early in January post which it also did a QIP to pay back KCM creditors. The company also got multiple upgrades by the rating agencies during the year after it priced new bonds in September and November and bought back its higher interest bearing debt.

Bonds of WAPDA, the utility company owned by the Pakistan government, with a median return of 43.2% also rallied on the back of the sovereign’s outperformance. The sovereign outperformance resulted from the nation securing support from the IMF and bilateral creditors along with rating upgrade by Moody’s and Fitch.

Fosun’s dollar bonds witnessed a median return of 34.1%, on the back of the sale of non-core assets by the company to repay its debt obligations amid further progress.

Rakuten’s bonds with a median return of 28.4% also outperformed after it launched a dollar bond and it was reported that the company was considering a reorganization of its fintech businesses into one group to strengthen collaboration.

Other notable top gainers include bonds of Braskem Idesa and SBL with a median return of 31.2% and 22.5% respectively.

Top Losers

Xerox’s bonds, with a median return of -20.3% were the top losers during the year. The underperformance was a result of weak operating performance by the company, resulting in rating downgrades by Moody’s and S&P.

With a median return of -12.4%, Gol bonds were among the worst performers, after the company filed for Chapter 11 bankruptcy protection in January, and reported large losses during the year.

Gazprom’s bonds with a median return of -11.9% also underperformed during the year as a result of company reporting its worst loss in two decades.

Bonds of both Hertz and Intel witnessed a median return of -9.9% during the year. Hertz bonds came under pressure after it was downgraded by S&P to B earlier in June. Intel’s bonds underperformed after it was downgraded by Fitch and S&P on the back of weak operating results reported by the company.

Vanke’s bonds remained volatile throughout the year ending with a median return of -9.9%. Initially its bonds came under pressure after the company was said to be in talks for debt restructuring and downgrades by the rating agencies. Its bonds recovered some of the losses after reports of asset sales by the company and the talks for financing. Post that, its bonds again dropped when the company reported its first interim loss in two decades, but recovered soon after the stimulus package announcement by China in late September.

Road King’s bonds witnessed a median return of -9.6% during the year and the company deferred the coupon payments on its 7% and &.7.75% Perp.

Bonds of another HK developer, New World Development (NWD) also remained volatile during the year. Its bonds started to rise after company sold its non-core assets and purchased back some of its notes. However, its notes witnessed a sharp drop after the company warned of annual loss in 2024, recovering to some extent, thanks to the supportive measures by China, thereby ending the year with a median return of -5.9%

Other notable losers included Embarq, and Microsoft bonds with a median return of -16.6% and -3.7% respectively.

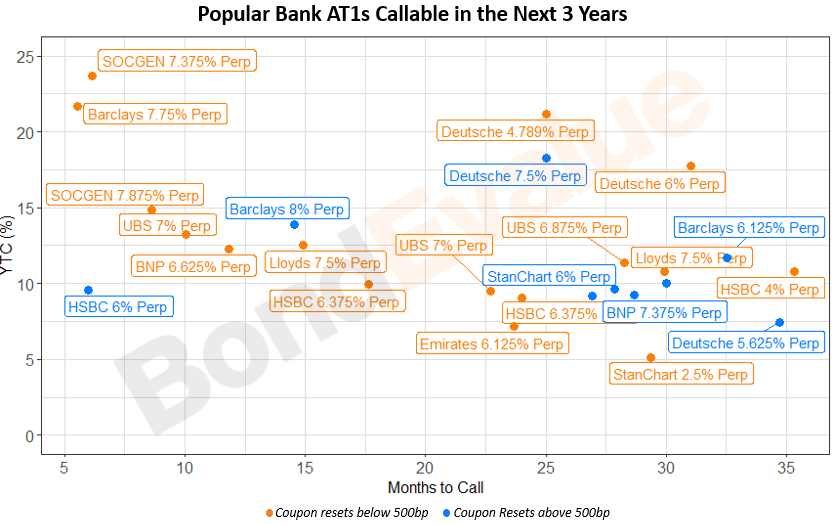

We have further analyzed the performance of European Bank AT1s, Sovereign Bonds and the overall bond markets in 2024. Click on the links below to access the reports.

Performance of European Bank AT1s

Performance of EM and Frontier Sovereign Dollar Bonds

Bond Markets in 2024

Disclaimer

The materials and information contained herein are solely for general information reference and educational purposes only, and not intended to constitute nor as a substitute for legal, commercial and/or financial advice from an independent licensed or qualified professional. The information, opinions and views expressed herein are not, and shall not constitute an offer or a recommendation to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, or a recommendation, to purchase or sell any investment product or service or engage in any investment strategy. Nothing herein has been tailored to the investment objectives or financial situation of any specific individual, are current only as of the date hereof and may be subject to change at any time without prior notice. No representation, warranty or claim whatsoever is made nor implied as to the accuracy or completeness of any material or information contained herein, nor we have no liability whatsoever for any error, inaccuracies or omissions. No reliance should be made on the materials or information herein for any investment decision, and we accept no liability whatsoever for any direct or indirect loss whatsoever which may arise from the use or reliance of any such material or information. The business of investing is a complicated matter that requires serious financial due diligence for each investment. No representation whatsoever on the suitability or otherwise of any securities, products, or services for any particular investor. Each investor is solely responsible for its own independent investment decision based on its personal investment objectives, financial circumstances and risk tolerance, and should seek its own independent legal, tax and other professional advice prior to any such decision.

The inclusion of any hyperlinks or external links should not be seen as an endorsement or recommendation of that website or the views expressed therein. We do not have any control over the content or actions of the websites we link to and will not be liable for anything that occurs in connection with the use of such websites.

All intellectual property rights, title and interest (including but not limited to copyrights, trademarks, patents and other proprietary rights) in and to these materials and the contents therein, shall remain the sole and exclusive ownership of and are fully reserved by Bondevalue Pte. Ltd.. No licence or rights whatsoever in or to these materials or their contents or any part thereof is granted or deemed to be granted to any recipient. No form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of these materials or any part of its contents, shall be permitted.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023