This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BEA Launches $ Bond; HSBC, Barclays, Ford, Israel, BBVA and Others Price Bonds

March 6, 2024

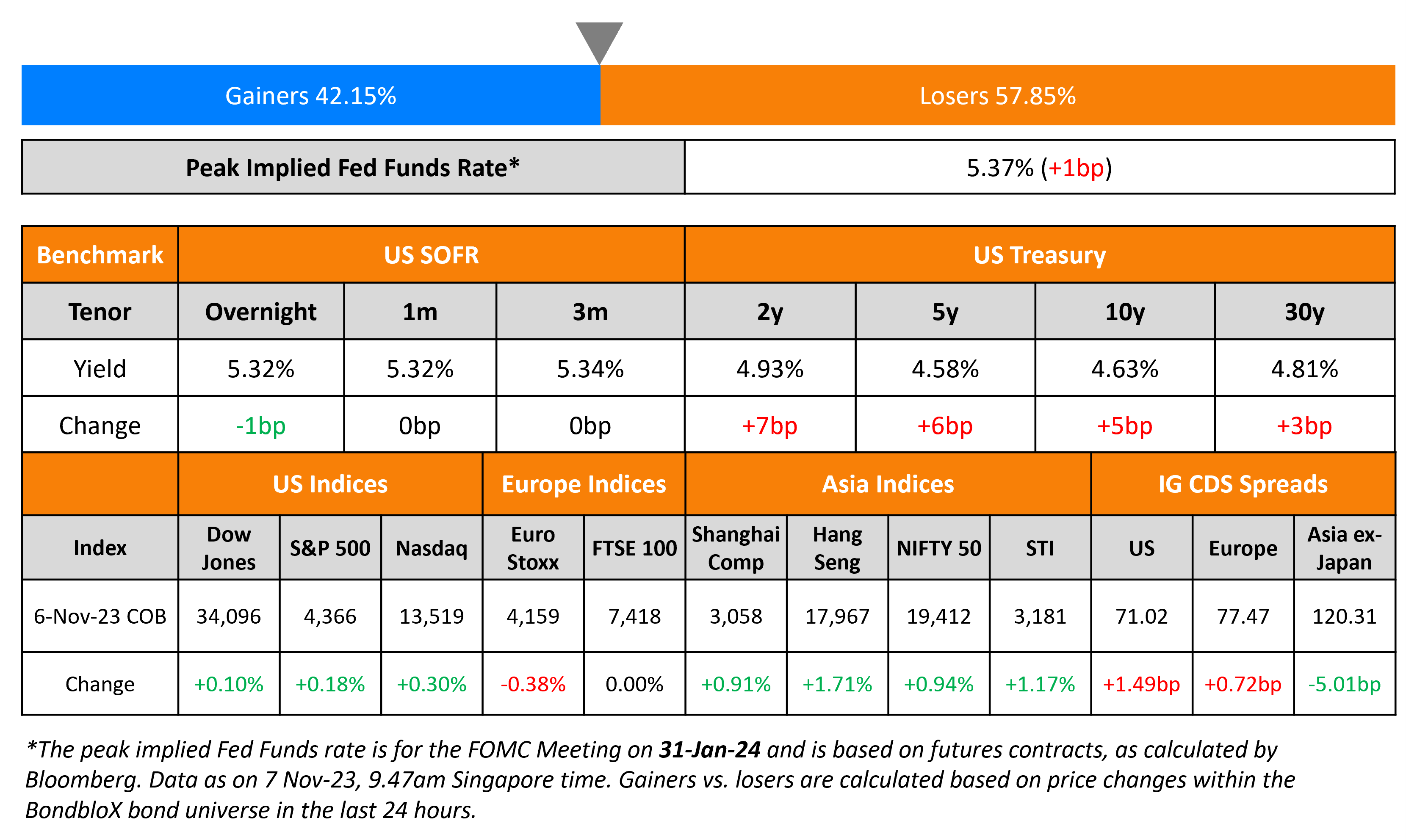

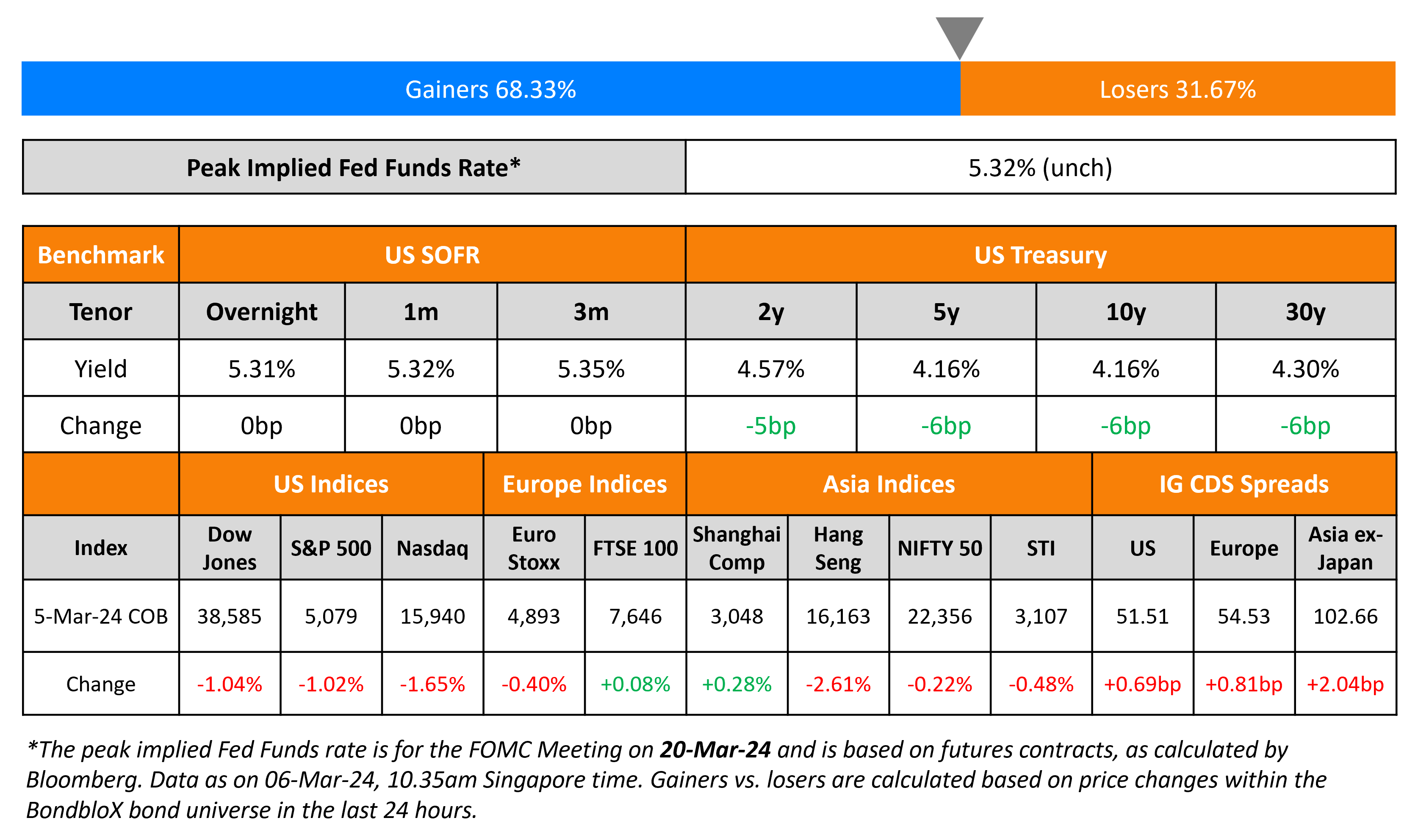

US Treasury yields fell by 5-6bp across the curve after a softer than expected ISM Services print. US ISM Services PMI came at 52.6 for February, lower than expectations of 53 and the prior month’s 53.4. The Price Paid component fell to 58.6 from 64 with analysts suggesting it may indicate a slowdown in inflation. The Employment component fell to 48 from 50.5 while the New Orders component jumped to 56.1 from 55. Looking at credit markets, US IG CDS spreads widened 0.7bp and HY CDS spreads were 4bp wider. Equity markets closed lower with the S&P and Nasdaq down 1% and 1.7% respectively.

European equity markets ended mixed. Credit markets in the region saw the European main CDS spreads widen 0.8bp and crossover spreads widen by 6bp. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads were 2bp wider.

New Bond Issues

- Bank of East Asia $ 3NC2 loss absorbing at T+270bp area

.png)

HSBC raised S$750mn via a 10.5NC5.5 Tier 2 bond at a yield of 4.75%, 25bp inside initial guidance of 5% area. The subordinated notes are rated Baa1/BBB/A-, and received orders of over S$1.1bn, 1.5x issue size. By investor type, private banks took 56%, fund managers/insurers/pension funds took 37% and banks and other took 7%. By region, Singapore accounted for 90% and Europe/Rest of Asia took 10%. The bonds have a call/reset date on 12 September 2029. Proceeds will be used for general corporate purposes and to maintain or further strengthen issuer’s capital base pursuant to requirements under the UK CRR. The issuer may redeem notes in whole (but not in part) in sole discretion upon occurrence of certain tax events. Below is a table comparing the new issuance to comparable SGD Tier 2s, sorted by the yield to call.

Barclays raised $4.5bn via a four-trancher. Details are given in the table below:

The senior unsecured notes are rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes of the issuer and its subsidiaries and/or the group, and to further strengthen their capital base.

BBVA raised $2bn via a two-part deal. It raised $1bn via a 5Y senior-preferred bond at a yield of 5.381%, 25bp inside initial guidance of T+150bp area. It also raised $1bn via a 11NC10 senior non-preferred bond at a yield of 6.033%, 25bp inside initial guidance of T+215bp area. The senior-preferred notes are rated A3/A/A- and the senior non-preferred notes are rated Baa2/BBB+/BBB+. Proceeds will be used for general corporate purposes.

Israel raised $8bn via a three-part deal. It raised:

- $2bn via a 5Y bond at a yield of 5.375%, 25bp inside initial guidance of T+160bp area, 5.5bp tighter than its existing 7.25% note that currently yields 5.43%

- $3bn via a 10Y bond at a yield of 5.603%, 30bp inside initial guidance of T+175bp area, and offer a new issue premium of 14.3bp over its existing 4.5% note due 2033 that currently yields 5.46%

- $3bn via a 30Y bond at a yield of 6.043%, 30bp inside initial guidance of T+205bp area

The notes are rated A2/A+. Proceeds will be used for general budgetary purposes.

Ford Motors raised $2.5bn via a two-part deal. It raised:

- $1.6bn via a 5Y note at a yield of 5.818%, 27-32bp inside initial guidance of T+195-200bp area, and offer a new issue premium of 34.8bp over its existing 6.375% note due 2029 that currently yields 5.47%

- $900mn via a 10Y note at a yield of 6.139%, 25-30bp inside initial guidance of T+225-230bp area

The notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

Al Rajhi raised $1b via a 5Y sukuk at a yield of 5.047%, 30bp inside initial guidance of T+120bp area. The senior unsecured notes are rated A1/A- (Moody’s/Fitch). Proceeds will be used to finance and/or refinance, in whole/part, eligible sustainable projects as set out in its sustainable finance framework. The new bonds are priced ~3bp tighter to it existing 4.75% 2028s that yield 5.07%.

Doha Bank raised $500mn via a a 5Y bond at a yield of 5.436%, 30bp inside initial guidance of T+160bp area. The senior unsecured notes are unrated, and received orders of over $1.7bn, 3.4x issue size. The issuer is Doha Finance Ltd. and proceeds will be used for general corporate purposes.

HDB raised S$700mn via a 7Y bond at a yield of 3.151%. The notes are rated AAA by Fitch. Proceeds will be used to finance development programs of HDB and its working capital requirements, and to refinance existing borrowings.

New Bond Pipeline

- Aston Martin hires for $ 5Y/7Y bond

Rating Changes

- Moody’s upgrades Rolls-Royce to Ba1; maintains positive outlook

- Uber Technologies Inc. Upgraded To ‘BB+’ On Strong Earnings Momentum; Outlook Positive

- NCL Corp. Ltd. Upgraded To ‘B+’ From ‘B’ On Expected Deleveraging; Outlook Stable

- Moody’s upgrades Indiabulls to B2; outlook remains stable

- Moody’s downgrades Xerox Holdings’ CFR to Ba3 and assigns B1 rating to proposed backed senior unsecured notes; outlook remains negative

Term of the Day

Restricted Tier 1 (RT1)

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual with a minimum 10-year non-call, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

- Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

- Drop of solvency ratio below 75% of the SCR

- Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene

NN Group priced a €750mn debut RT1 issuance at 6.375%.

Talking Heads

On Emerging Markets Slip Amid Fed Caution, China Growth Woes

Juan Perez, director of trading at Monex USA

“They’re going to keep us guessing for the short term. Now finally people are getting out of that mentality that there’s going to be a dovish Fed or that the Fed is saying one thing and that message is not entirely how they’re going to act “

Commerzbank analyst Tommy Wu

“Given the strong headwinds that China is facing, including the real estate troubles, a 5% target for this year is ambitious”

On US services sector slowing in February; inflation moderating

Tim Quinlan, senior economist at Wells Fargo

“While the easing of price pressure and moderation in hiring tilt this report in a dovish direction, the Fed will ultimately want to see these developments translate to the hard data on inflation and job growth”

Oren Klachkin, financial market economist at Nationwide

“The underlying trend suggests that services inflation will remain on a downward trend in the first half”

Mark Streiber, economic analyst at FHN Financial

“The ISMs have not been reliable bellwethers of payrolls since the pandemic”

Top Gainers & Losers- 06-March-24*

Go back to Latest bond Market News

Related Posts: