This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Baidu, Thai EximBank Launch $ Bonds; JSW to Issue $ Bonds; Mexico Govt’s New Inv Plan Focuses on Pemex; JLR Sales Improve; ArcelorMittal Tender Offer

October 6, 2020

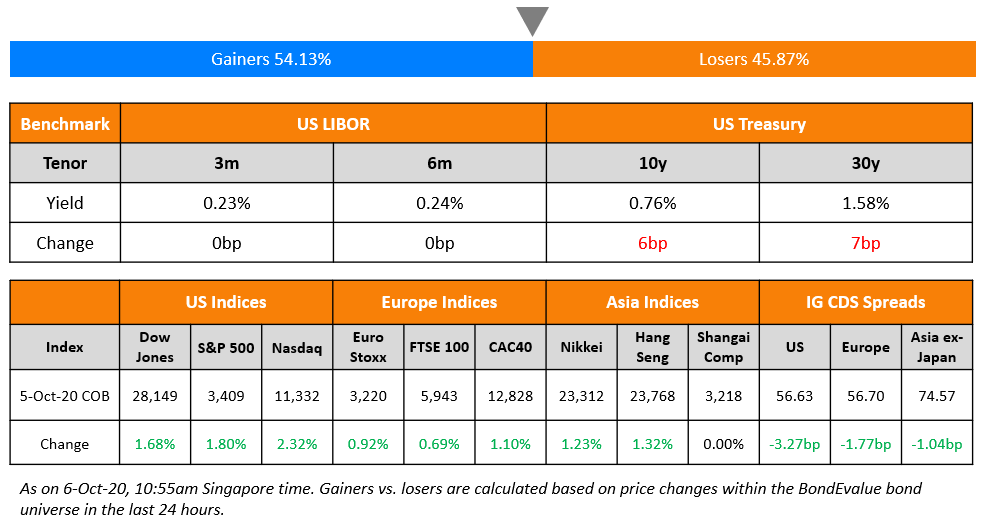

S&P rallied over 1.8% led by tech, energy and financial sectors. Nasdaq Composite was up 2.3% with big tech companies up 2-3% while banking and energy were up 1.6% and 3% respectively. US 10Y Treasuries sold-off with yields moving higher by 6bp and the curve bear steepening with strong risk-on sentiment. Besides Trump getting discharged and returning to the White House and expectations of a relief package, economic data also surprised on the upside with the ISM Non-Manufacturing numbers printing at 57.8, better than expectations and coming back to pre-Covid levels. Asian equities are higher today by 0.3%. US CDS IG Spreads tightened 3bp while HY was flat. Europe Crossover CDS spreads tightened 8bp on the overall risk-on sentiment. Asia ex-Japan CDS spreads tightened by 1bp as the primary market reopens with new dollar deals post the Mid-Autumn Festival.

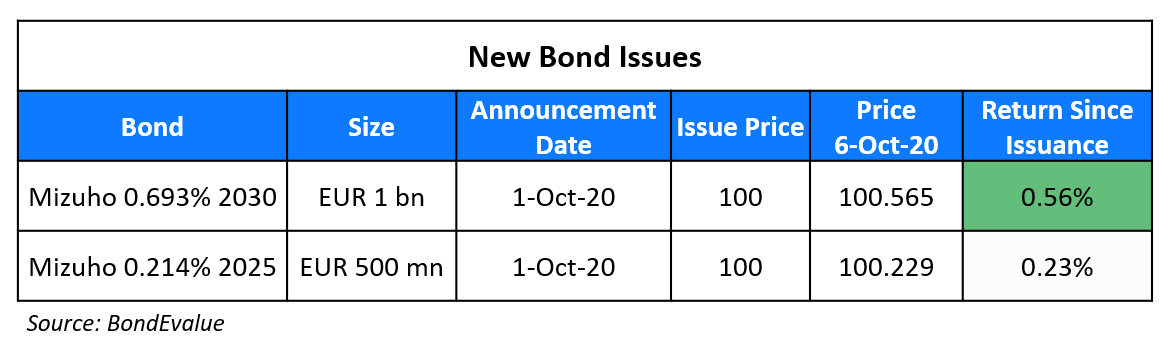

New Bond Issues

- Baidu $ 5.5/10yr @ T+170/190bp area

- Export-Import Bank of Thailand $ 5yr @ T+150bp area

- Star Energy $790mn green amortizing 18NC9 (WAL 14.1) @ 5.125% area

New Bonds Pipeline

Shinhan Card $ 3Y or 5Y Covid-19 response bond

Kasikornbank $ Basel III AT1

Sumitomo Mitsui Trust Bank 7Y EUR covered bond

Pakistan $ Bond/Sukuk

Rating Changes

Fitch Downgrades Armenia to ‘B+’; Outlook Stable

Moody’s upgrades Owens & Minor to B2 CFR; Outlook changed to positive

Moody’s revises Shimao Group’s outlook to positive

Fitch Revises IHS’s Outlook to Stable; Affirms at ‘B’

Fitch Affirms Fidelity Bank at ‘B-‘; off Rating Watch Negative; Outlook Stable

Fitch Affirms Access Bank at ‘B’; off RWN; Outlook Negative

Fitch Affirms United Bank For Africa at ‘B’; off RWN; Outlook Stable

Fitch Affirms Zenith Bank at ‘B’; Off Rating Watch Negative, Outlook Stable

Moody’s changes the outlook on A.P. Moller-Maersk A/S to positive; Baa3 ratings affirmed

Moody’s affirms Bayer’s Baa1 rating revises outlook to negative

JSW Steel Hires Banks for Up To $600 Million Bond Issuance

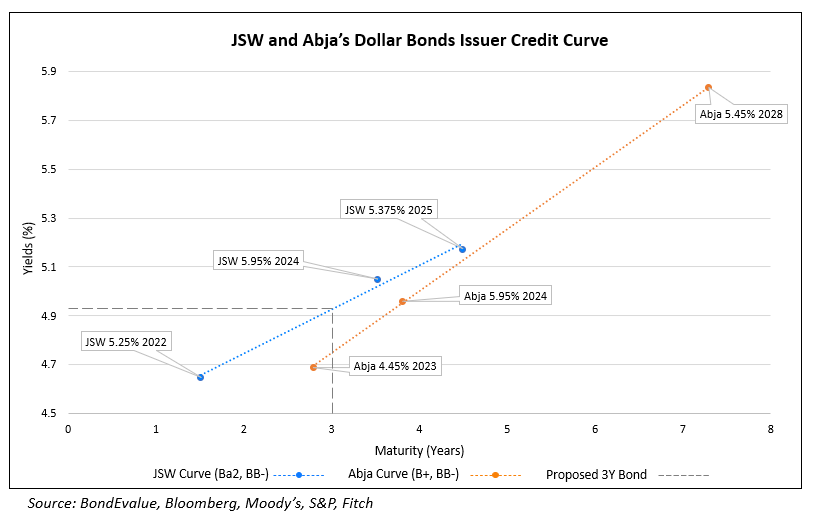

Indian steelmaker JSW Steel has hired Deutsche Bank, Credit Suisse, Standard Chartered, BNP, Citigroup, Mashreqbank and Mizuho Securities for a dollar bond. IFR reported that total issue size could be up to $600mn with a 3Y and/or 5.5Y tenor. The proposed bonds are expected to be rated BB- by Fitch and will be issued by wholly-owned indirect subsidiary Periama Holdings with a guarantee from JSW Steel. Fitch said, “Although the notes are guaranteed to the extent of 125% of outstanding principal, we consider it full and worthy as it should cover 100% of principal payments plus all interest accrued up to the point at which all principal is paid, as per Fitch’s criteria.” Proceeds from the issuance will be used to repay debt and for general corporate purposes. The new bonds could launch as soon as tomorrow.

We have plotted the USD issuer credit curve of JSW Steel and peer Tata Steel (Abja). The credit curve plots a line of best-fit using its existing outstanding dollar bonds. Looking at the 3Y and 5.5Y mark can give some color on the pricing on the proposed new bonds.

Mexico Govt’s New Investment Plan Focuses on Pemex Refining

Mexican President AMLO presented a ~$14bn infrastructure investment plan to lift the economy on Monday. The plan ranges from reviving a train link planned between Mexico City and the central city of Queretaro to investments in Pemex with roughly 39 projects. Roughly $4.65bn focuses on energy projects, of which:

- 54.7bn Pesos (~$2.5bn) is to complete a partly-built coking plant at Pemex’s Tula refinery in Mexico

- 15.4bn Pesos ($720mn) is for Pemex’s existing coking plant at its northern Cadertya refinery

- 25.2bn Pesos ($1.2bn) is for a project to build a natural gas liquefaction plant at the southern port of Salina Cruz – Pemex’s biggest refinery is situated there

For the full story, click here

Moody’s Reports All-Time Low Covenant Quality Score for Emerging Markets

A few days after a report on all-time low Covenant Quality (CQ) scores of Asian issuers, Moody’s has come out with an all-time low CQ score on Emerging Markets (EMs) at 3.45 with five of their six parameters weaker. The CQ score is based on a 1-5 scale with a higher number denoting a weaker score. The parameters cover (1) cash leakage (2) risky investments (3) leveraging (4) lien subordination (5) structural subordination and (6) change of control. While Chinese property developers contributed to weaker scores as observed in the previous report’s analysis, the current report includes non-Asian EMs.

The bond with the weakest score among EMs is Chile’s VTR Comincaciones $600 million 5.125% 2028. Moody’s highlights significant lien subordination risk, credit facility and debt carve-outs and a repurchase income basket to make restricted payments despite it not meeting the $1 test. The $1 Debt Incurrence test is either a Debt to EBITDA or a Fixed Charge Coverage Ratio (FCCR) test like EBITDA to Interest Expense – if a company’s leverage ratio exceeds or FCCR ratio falls below the threshold established in its covenant, incurring additional units of debt would be difficult. They pointed out that four LatAm bonds, all from Brazil, had the worst scores of 5 – the companies included Petrobras (Ba2), Vale (Ba1) and Nexa Resources (Ba2). Overall, they mention that EM bonds still compare strongly to North American and EMEA bonds issued in the last six months.

For the full story, click here

JLR Sales Improve, Bonds Inch Up

Jaguar Land Rover (JLR) reported cheerful numbers for the quarter ended September, especially from China. Its retail sales were up QoQ as most of its retailers worldwide opened up after relaxation in lockdowns, although the numbers were still lower YoY. JLR sales were up over 50% QoQ at 113,569 while remaining below the pre-Covid level by 11.9%. Sales from China were particularly good – monthly sales up 28.5% vs. September last year, 14.6% QoQ and 3.7% YoY. The company ended the quarter with positive free cash flows and ~ £3bn ($3.9bn) of cash and short-term deposits, up £300mn ($390mn).

Felix Brautigam, the Chief Commercial Officer of JLR said, “Covid-19 and second lockdowns continue to impact the global auto industry but we are pleased to see sales recovering across our markets. In China, the first region to come out of lockdown, our performance has been particularly encouraging. But we are also seeing strong improvement versus the preceding quarter in other key markets, with sales up more than 50% worldwide.”

Tata Motors’ sales in September 2020 were also very encouraging as its sales breached the 21,000-mark after eight years. The carmakers Tata Nexon, Tiago, Tigor and Harrier helped it boost sales by 162% YoY and with 21,200 units sold this month, placing it third overall in the Indian market. JLR is a wholly owned subsidiary of Tata Motors since 2008. Sales in the automobile industry have been picking up. Tesla reported record quarterly deliveries of 139,300 vehicles while BMW also reported sales of 69,570 vehicles in North America.The bonds of the auto majors were largely stable on the secondary market.

For the full story, click here

Vedanta Releases FY20 Financials; Delisting Process Begins

Vedanta Resources’ latest annual report was released on Monday. It stated that the metals and mining conglomerate maintained EBITDA margins at 29% despite the pandemic while also seeing higher volumes from some of its iron-ore, zinc, aluminium and steel businesses alongside currency depreciation benefits. A $76mn increase in EBITDA from its Karnataka iron-ore plant helped offset some losses from its shut-down iron-ore operations in Goa. Gross debt decreased by $900mn due to repayment of debt and the latest report shows debt at $15.1bn and cash of $5.1bn making its net debt position at $10bn or 3.3x EBITDA. With overall USD-denominated financial liabilities at ~$11bn, legal issues on its Indian copper plant, a shut-down of its iron-ore plant and decline in commodity prices, revenues and operating profits fell by 9% and 23% YoY respectively.

Meanwhile subsidiary Vedanta Ltd., the Indian mining company began its delisting process, the bidding of which would end on October 9. A successful completion of the delisting is expected to help with corporate structure and acceleration in debt reduction over the medium term helping the group with it’s overall financial position. While Vedanta Ltd has a relatively better financial position (net debt/EBITDA of ~1x), $3.15bn was raised by parent Vedanta Resources for the delisting of Vedanta Ltd, adding to its debt load. In August, the parent issued a $1.4bn 13% 2023 amortizing bond alongside a $1.75bn 3Y term-loan facility. Overall debt was seen as a negative, leading to its bonds falling over 6% last month. Vedanta’s bonds inched up yesterday with yields down over 40bp across – its 6.125% 2024s were up 1.7 points since Friday’s close to 72 cents on the dollar, yielding 16% (down 65bp). while its 8% 2023s traded higher by ~2 points to 81.4 cents on the dollar yielding 17.4% (down over 100bp). Its recently issued 13% amortizer due 2023 is currently trading at 104, yielding 11.3%.

ArcelorMittal Announces Tender Offer For Bonds Upto €1 Billion

ArcelorMittal announced a tender offer to buyback up to €1bn of its EUR 3.125% bonds due 2022 and EUR 0.95% bonds due 2023 for payment in cash. The purchase price payable by the company would be €1,036 and €998 for every €1,000 in principal. The current outstanding amounts of the two bonds amount to €1.25bn ($1.47bn) in total – €750mn ($884mn) of the 3.125% 2022 and €500mn ($590mn) of the 0.95% 2023.

The invitation commenced on Monday and will close on October 13. ArcelorMittal would fund the repurchases with existing cash and the buyback is part of their plan to reduce gross debt, which currently stands at $13.5bn. Their latest numbers show net debt at $7.8bn, EBITDA of $0.7bn and a liquidity position of $11.2bn across cash ($5.5bn) and credit lines ($5.7bn). Simultaneously, ArcelorMittal is also making an offer to repurchase for cash partially or fully its USD 6.125% bonds due 2025. The repurchase price is $1,170 per $1,000 of principal. These bonds are currently trading at 116.2.

For the full story, click here

Morgan Stanley Completes Acquisiton of E*Trade

Morgan Stanley (MS) has completed its acquisition of financial services E*Trade in an all-stock deal valued at $13bn after receiving the Fed’s approval last week. The deal announced in February will position MS as a leader in the Wealth Management industry and comes with ~$56bn of low cost deposits. Moody’s views the deal positively. It has upgraded Morgan Stanley’s (MS) long- and short-term ratings to A2 from A3 and has also upgraded E*TRADE Financial Corp.’s (E*TRADE) senior unsecured ratings to A3 from Baa2 on October 2 while stating, “The acquisition of E*TRADE is another deliberative step in MS’s clear and consistent strategy to shift its business mix towards generating recurring, profitable revenue-streams in wealth and investment management. These revenue-streams are generally more stable and of lower risk…” Dollar bonds of Morgan Stanley and E*Trade were largely stable on the secondary market.

For the full story, click here

TC Energy (TransCanada) Initiates a Purchase of Rest of Its US Pipe Business

Alberta, Canada based TC Energy Corp (formerly TransCanada) has offered to buy the remaining shares of TC PipeLines LP that it does not already own for ~$1.48bn. This values Houston-based TC PipeLines LP at ~$27 a share, a premium of over 5% as per Bloomberg. TC PipeLines is a master limited partnership (MLP), which is a publicly traded entity in the US that is taxed as a partnership. MLPs, commonly used by energy companies to attract US investors in the past, have become less popular since the 2014-2016 crude-market crash and change in US tax policies. TC Energy’s dollar bonds traded stable on the secondary markets with its 2.49% bonds due 2067 trading at 71.5 cents on the dollar, yielding 3.73% and its 5.5% bonds due 2079 trading at 105.3 cents on the dollar, yielding 4.8%.

For the full story, click here

361 Degrees Buysback More Bonds

361 Degrees International (B), the Chinese sportswear manufacturer bought back bonds worth $20.1mn in the open market. The company had issued $400mn 5Y bonds in June 2016 but gradually reduced the amount outstanding beginning with repurchases worth $44.75mn in November 2019. With the current additional bond buyback, the company has reduced the amount outstanding to $273.9mn. While the company has $900mn in cash, more than sufficient to cover the bond’s principal, Fitch notes that almost all of the cash is onshore and requires approval of State Administration of Foreign Exchange (SAFE) to repatriate the amount to payback its debt. This repatriation would face challenges as the dollar bond issuance was not registered with SAFE and the proceeds remained offshore. Fitch downgraded 361 Degrees on September 30 to B with a negative outlook on the lack of progress in transferring cash from onshore to offshore before its 7.25% bonds are due on June 2021. 361 Degrees’ 7.25% 2021s traded lower slightly to 83 cents on the dollar, yielding 39%.

.png?upscale=true&width=900&upscale=true&name=361%20degrees%20(1).png)

Term of the Day

Sustainability-linked Bonds

Sustainability-linked bonds (SLBs) are bonds wherein the issuer commits to sustainability outcomes within a timeline set in the bond document based on five elements:

- Selection of Key Performance Indicators (KPIs)

- Calibration of Sustainability Performance Targets (SPTs)

- Bond Characteristics

- Reporting

- Verification

Here however, the proceeds can be used for general purposes but the characteristics of the bond can change depending on the issuer meeting their KPIs set in the document. For example, Novartis last month issued an 8Y zero-coupon €1.85bn sustainability-linked bond (SLB) where they would pay a 25bp coupon step-up if they fail to hit the key targets incorporated in the deal structure. The key targets are that Novartis increases “innovative therapies patient reach by 200%” and that its “flagship programmes reach by 50%” before 2025.

Talking Heads

On debt cancellation needed to help poorest countries – David Malpass, World Bank President

“It is evident that some countries are unable to repay the debt they have taken on. We must therefore also reduce the debt level. This can be called debt relief or cancellation,” Malpass said. “It is important that the amount of debt is reduced by restructuring. These investors are not doing enough and I am disappointed with them. Also, some of the major Chinese lenders did not get enough involved. The effect of the aid measures is therefore less than it could be,” the World Bank head said. “The enormous budget deficits and debt payments are overwhelming these economies. In addition, the banks there are getting into difficulties due to bad loans,” Malpass added.

“A PEPP expansion is likely to be more powerful in supporting the recovery of the euro-area economy — particularly in southern Europe, where it is most needed — than a rate cut or an expansion of the regular asset-purchase program,” Goldman analysts including Soeren Radde wrote. That’s because PEPP “would be more powerful in compressing credit spreads.”

On Goldman Sachs’ bets on curve steepening

“In a Democratic sweep scenario, markets could start to contemplate earlier liftoff, which would disproportionately affect this portion of the curve,” Goldman strategists led by Praveen Korapaty wrote, referring to the timing of possible of interest-rate hikes.

“We think curve positioning could be behind those moves,” they wrote in a note to clients Friday. “While outright exposure to duration positions are not large, curve steepening positions remain large relative to historic ranges, and the risk is these trades could be unwound.”

On emerging market banks looking at sustainability-linked bonds

Farnam Bidgoli, head of sustainable bonds at HSBC

So-called sustainability-linked bonds may suit emerging-market lenders because they sidestep challenges found in green and social notes, said Bidgoli. “We’ve seen a lot of interest in the structure, especially from the emerging markets,” said Bidgoli. “I’m sure we’ll see banks do them.”

Nicholas Pfaff, head of sustainable finance at International Capital Markets Association

“The beauty of this new product is the flexibility,” Pfaff said. Still, “it does require a significant amount of thinking, planning and top management buy-in,” he said.

“Not just in Singapore, but in all the G3 countries across Asia, you see that high-yield issuance has come down, and the market has become dominated by investment-grade issuances. The market has turned more risk averse as a result of the volatility, and that is understandable.”

“We have consistently said that we can see positive momentum building in our core investment banking client franchises as our refocused strategy begins to pay off,” Rivett said.

Top Gainers & Losers – 6-Oct-20*

Go back to Latest bond Market News

Related Posts: