This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Aussie Regulator Proposes Phasing Out AT1s

September 10, 2024

Australian regulator APRA has proposed the phasing out of AT1 bonds by banks and replace them with Tier 2 and CET1 capital. Under their proposal, the transition will start from 1 January 2027, with all current AT1 bonds expected to be replaced by 2032. This comes after the APRA started examining the AT1 bonds in September 2023, following the events at Credit Suisse. The regulatory body’s chairman said that AT1s did not fulfill the function of stabilizing a bank during times of crisis due to its complexity, the potential for legal issues and the risk of contagion. Particularly in Australia, he said that such risks are further heightened due to an “unusually high proportion” of AT1s being held by retail investors. Australia’s big four banks hold AT1 bonds equal to at least 1.5% of their risk-weighted assets (RWAs). Under the new proposal, they will be able to replace AT1s with 1.25% Tier 2s and 0.25% CET1 capital.

For more details, click here

Go back to Latest bond Market News

Related Posts:

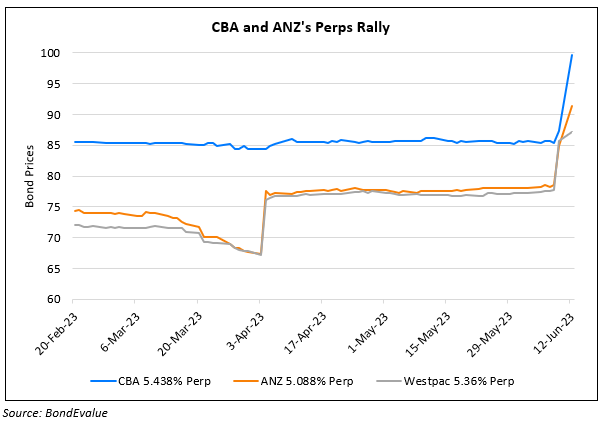

Aussie Banks’ Grandfathered Bonds Rally Towards Par

June 12, 2023

SocGen Prices PerpNC5.5 AT1 Bond at 10%

November 8, 2023