This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

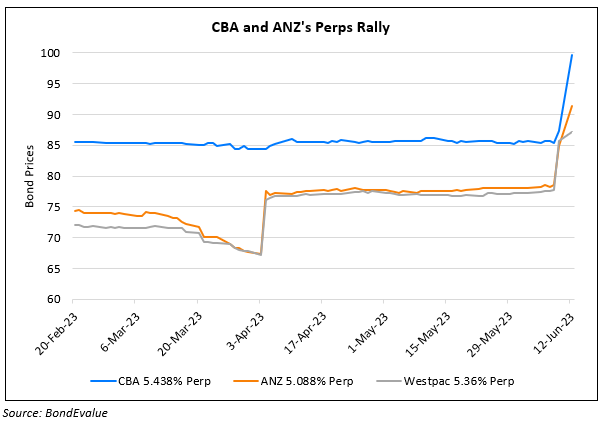

Aussie Banks’ Grandfathered Bonds Rally Towards Par

June 12, 2023

Grandfathered dollar bonds of Australian banks including CBA’s 5.438% Perp, ANZ’s 5.088% Perp and Westpac’s 5.36% Perp rallied by 7-14%. CBA announced that it will redeem its $125mn 5.438% (floating) Perp issued in 1986 at par plus accrued interest on its next call date of July 7. The note jumped from 85 cents on the dollar to currently trade at 99.7. While ANZ and Westpac have not made any announcement intending to redeem their bonds, it is likely that the rally in their Perps comes on expectations of the notes being called as well. ANZ’s $300mn 5.088% Perp is callable on October 30 with the bond rallying from 79 cents on the dollar to currently trade at 91. Westpac’s 5.36% Perp is callable on September 30 with the bond rallying from 78 cents on the dollar to currently trade at 87.

Go back to Latest bond Market News

Related Posts: