This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

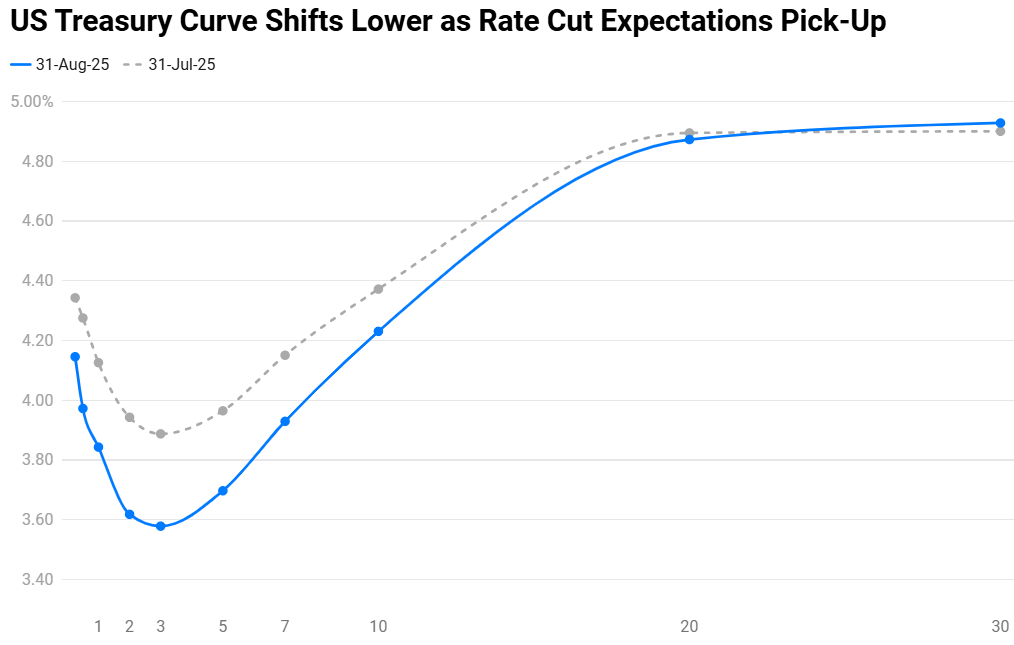

August 2025: 88% of Dollar Bonds Rally as Yields Drop Amid Rate Cut Bets

September 1, 2025

August 2025 was a strong month for bond investors, with 88% of dollar bonds ending higher (price returns ex-coupons). 90% of Investment Grade (IG) and 81% of High Yield (HY) bonds ended in the green. The move was broadly helped by the sharp shift lower in US Treasury yields thanks to a steady increase in expectations of Fed rate cuts during the remainder of the year. Corporate bonds also saw a credit spreads continue to tighten during the month — global credit spreads measured by Bloomberg Global Aggregate Corporate OAS Index are currently at multi-decade lows.

The month of August saw the Treasury yield curve shift sharply lower from July, with a bull steepening move — the 2Y yield fell by 33bp while the 10Y ended 14bp lower. The month started with a poor jobs report that indicated signs of a weaking economy – US NFP saw job additions of 73k, softer than expectations of 104k. The prior month’s reading was revised significantly lower to just 14k, the lowest in nearly five years, after rising by a previously reported 147k. The unemployment rate weakened to 4.2% from 4.1%. The ISM Manufacturing PMI continued to contract, at 48.0, underscoring the weakness in the sector. The ISM Services PMI came-in at 50.1, just above the 50-mark that indicates a plateau. The Headline and Core CPI reading showed a moderation in inflation. US CPI YoY for July rose by 2.7%, softer than expectations of 2.8% and in-line with the prior month’s reading. Core CPI came-in at 3.1%, slightly higher than expectations. Following the relatively soft economic data, several FOMC members including Chairman Jerome Powell hinted at a potential 25bp rate cut in their upcoming meeting in September.

In the IG-space most of the gains were seen in ultra long-dated bonds of issuers like Aramco, CK Asset, PTT Global and others. Separately, Thai Oil’s dollar bonds rose by ~5%, continuing its uptrend from April, supported by improving sentiment around its operations and outlook. There were no notale losers in this space.

Among the gainers in the high yield space, GLP China’s dollar perps rallied the most, by ~24% after GLP secured a $1.5bn commitment from the Abu Dhabi Investment Authority (ADIA). Telesat’s dollar bond due 2026 also rallied by over 20% after reporting its Q2 earnings, revealing a significant revenue increase that beat expectations. Dollar bonds of NWD rallied by ~15% after a media report on a potential refinancing and take-private deal. Besides, there were also reports that NWD was in talks with potential investors including Blackstone and Capitaland Group to buy some of its assets. DISH’s bonds rallied by over 10-15% after AT&T agreed to buy spectrum licenses from EchoStar in a $23bn deal. Among the losers, Waldorf Energy’s dollar bonds fell 19% after a high court refused to sanction its restructuring plan. Xerox’s bonds fell by ~13% after reporting a loss per share of $0.64, sharply missing the forecasted EPS of $0.07 duiring their Q2 results. Some of Russia’s dollar bonds also fell by over 10% amid continuing geopolitical factors.

Issuance Volumes

Global corporate dollar bond issuances stood at $211bn in August, just 1% lower MoM. As compared to August 2024, issuance volumes were up 4%. 81% of the issuance volumes came from IG issuers with HY comprising 17% and unrated issuers taking the remaining 2%.

Asia ex-Japan & Middle East G3 issuance stood at $18bn, down 21% MoM but higher by 47% YoY. 77% of the volumes came from IG issuers with HY issuing 14% and unrated issuers taking the rest.

Largest Deals

The largest deal globally was led by Eli Lilly’s $6.75bn seven-trancher, Chevron’s $5.5bn seven-trancher and Argos Holdings’ $5.4bn four-part deal. Other large deals included TransDigm’s $5bn and Merck’s $4bn four-part deals each and Barclays’ $3.65bn four-tranche issuance.

In the APAC and Middle East region, deal volumes were led by DBS Group’s $2bn issuance and Temasek’s $1.5bn two-part issuance. This was followed by other large deals like NAB’s €1.75bn deal, OCBC’s $1bn Tier-2 issuance, CBA’s €1bn, Macquarie’s and Wynn Resorts’ $1bn issuances each.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024