This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

August 2021: 47% of Dollar Bonds End Higher; HY Outperforms IG; Issuance Vol Drops

September 1, 2021

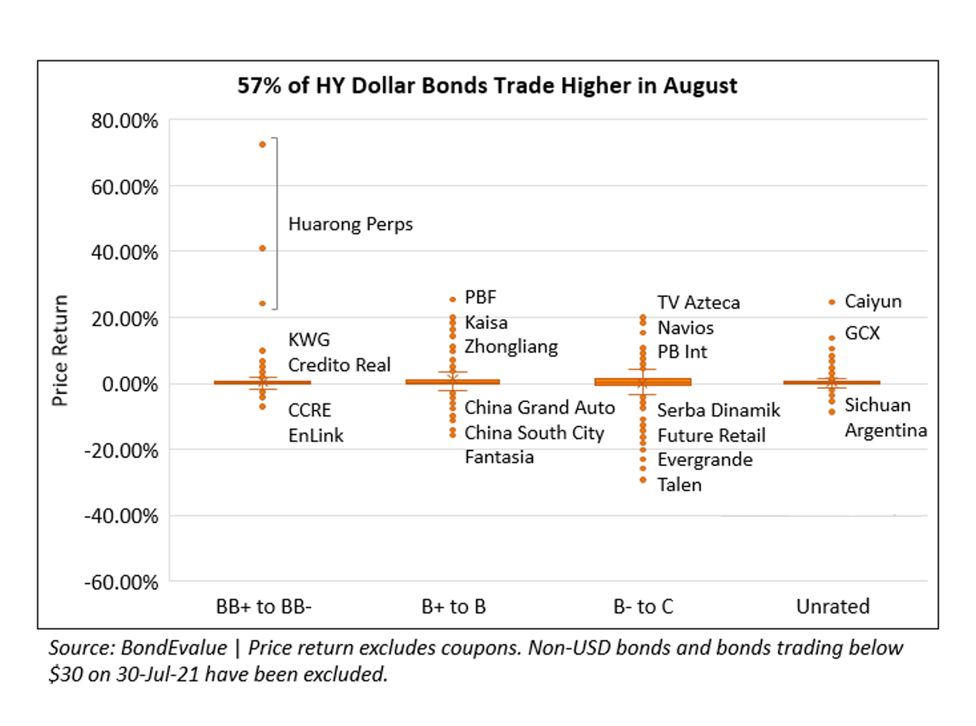

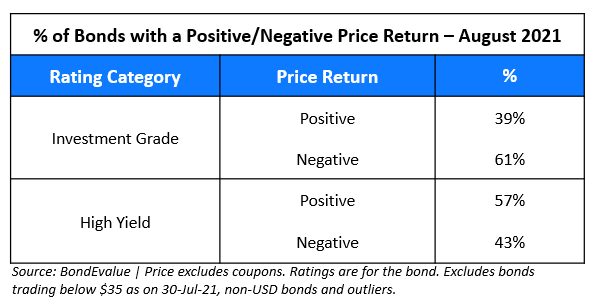

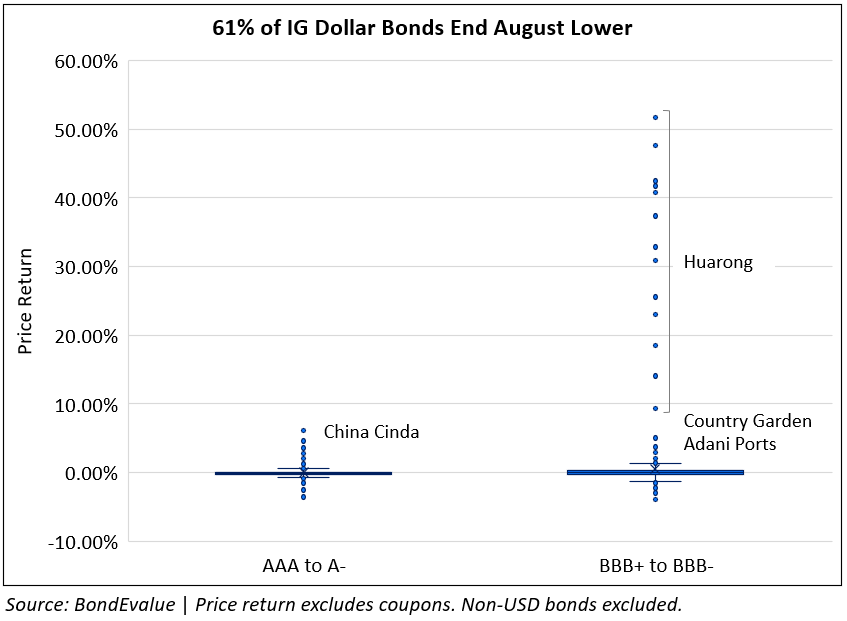

August was a mixed bag for bond investors with 47% of dollar bonds in our universe delivering a positive price return ex-coupon and 53% of the bonds ending the month in the red. This comes after June and July saw 54% and 52% of dollar bonds trading up in the months, respectively. While investment grade (IG) rated bonds outperformed in July, August saw 61% of IG dollar bonds ending the month in the red. High yield (HY) bonds outperformed with 57% of HY bonds trading higher in August.

In the IG space, China’s distressed asset manager China Huarong led the gainers with its dollar bonds rallying as much as 50% during the month after a $7.7bn capital infusion was announced around August 18. The bailout will be led by major state-backed companies including Citic Group, China Insurance Investment Co and China Life Asset Management Co. Bondholders have shrugged off the $15.9bn loss reported for 2020 as the company vouches to not restructure bonds and make arrangements to meet upcoming maturities.

In the HY space, dollar bonds of Chinese real estate developers were mixed – while bonds of China Evergrande, Central China Real Estate, Fantasia and China South City traded weaker, bonds of Kaisa, Zhongliang, Yuzhou, Zhenro Properties, Sunac, KWG, Times China and Agile ended the month in the green. Among the noteworthy gainers were PBF Energy, whose 2028s rose 25%, Vedanta’s 2024s and 2026s that rose ~15% and Guacolda Energia’s 2025s that inched up by 17% during the month. Among the losers were Suning’s Granda Century 7.5% bonds due in two weeks that have lost 46% of their value to now trade at ~31 cents on the dollar as the company seeks a debt extension. The world’s most indebted developer, Evergrande had another dreadful month with its dollar bonds falling a further 10-25% during the month as concerns grow over its liquidity position and extent (or lack of) state support. Another prominent name that traded weaker in August was Future Retail, whose 2025s lost ~15 points during the month to ~58 cents on the dollar after the Indian Supreme Court upheld the Singapore Emergency Arbitrator (EA) award to halt its $4.3bn deal with Reliance Retail.

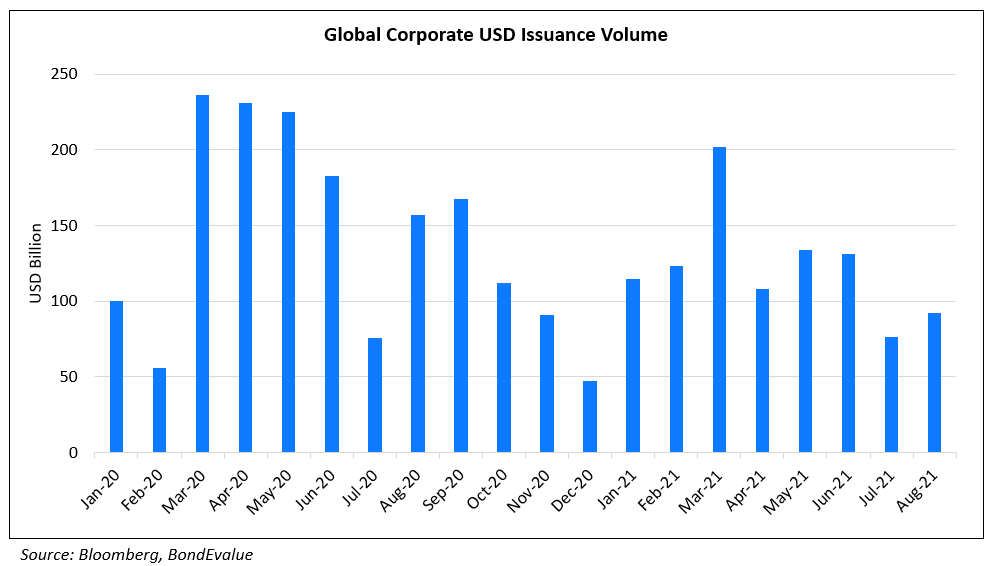

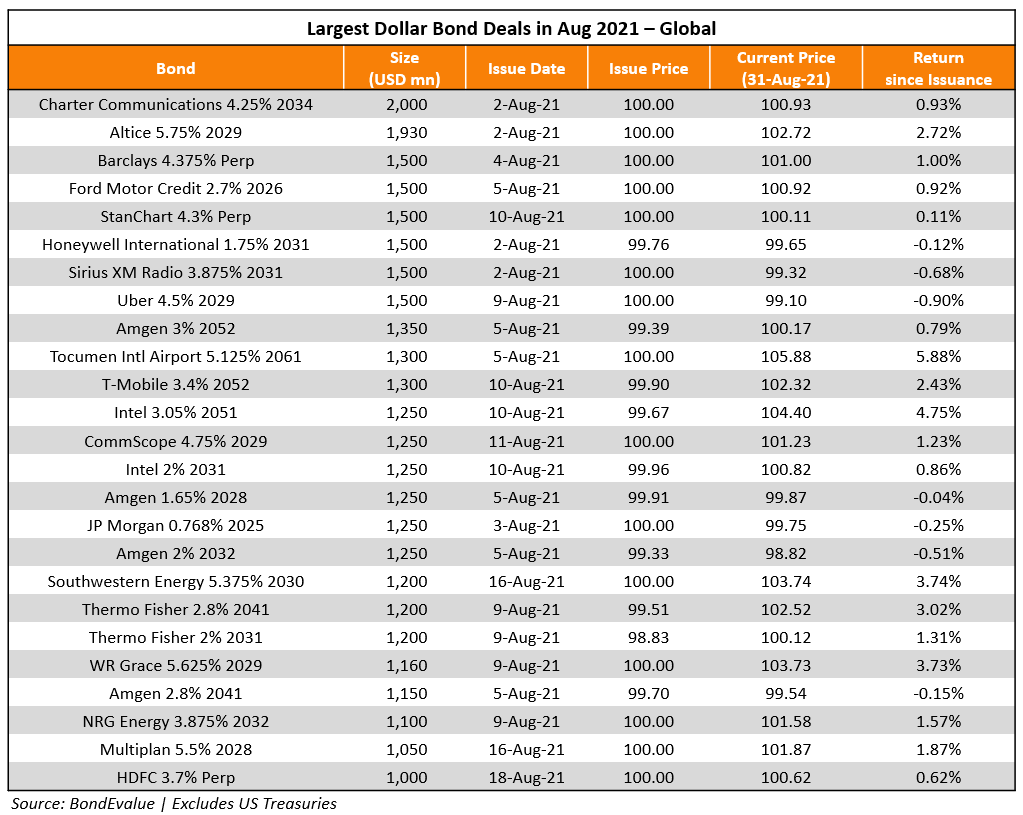

Issuance Volume & Largest Deals

Global corporate dollar issuance volume stood at $92.4bn for August 2021, 41% lower vs. last August’s issuance of $157bn but 21% higher than the prior month’s issuance of $76.5bn. According to Bloomberg, the primary market is expected to remain quiet until after the Labor Day weekend (September 6), in line with issuance activity over the past five years. The continuation of China’s regulatory crackdown and the spread of the delta-variant also contributed to wariness in the primary market.

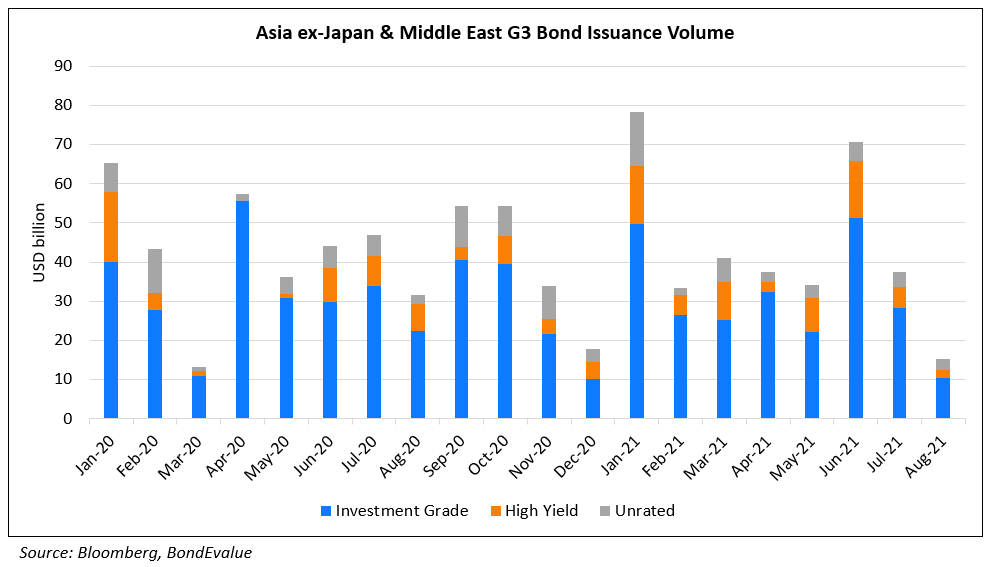

APAC ex-Japan & Middle East G3 issuance stood at $15.2bn, merely half of last August’s issuance of $31.6bn, and 61% lower than July’s issuance of $37.4bn. Issuance in this region was the lowest since the holiday month of December 2020, which saw $17.8bn in deals. The weak issuance was on the back of fewer deals from high yield issuers at just $1.8bn, down 66% MoM and the lowest level in 14 months driven by concerns around China Evergrande’s liquidity position and its ability to repay offshore bonds.

The largest deals last month were led by Intel’s $5bn five-trancher, Charter Communications’ $2bn deal and T-Mobile USA’s $2bn two-trancher, followed by Barclays‘ 4.375% Perp NC7 AT1s and Standard Chartered’s 4.3% Perp NC7 AT1s, both at a size of $1.5bn.

In the APAC & Middle East region, the largest deals were led by India’s largest private bank HDFC Bank’s 3.7% Perp NC5 AT1s and Baidu’s $1bn debut sustainability dual-trancher, followed by ABC International Holdings’ $800mn dual-trancher issued by its wholly owned subsidiary Inventive Global Investments.

.png)

Top Gainers & Losers

The global ex-APAC & Middle East gainers were led by US’ PBF Energy, whose 6% 2028s rose 25.5% to end the month at 66.5 and Zambia, whose bonds rallied after new President Hichilema vouched to fix the country’s finances and try to close a deal with the IMF. Also on the gainers list was Navios Maritime’s 8.125% 2021s, which jumped from 79 cents on the dollar to 101.125 as the company announced that it will be calling the bonds at 100 on September 25.

Among the global losers were Talen Energy, whose 2026s lost 29% of their value during the month. The company was also downgraded on Tuesday to CCC+ from B- by Fitch citing “the company’s preference to capitalize the growth businesses at the asset level rather than at the holding company level, which, in Fitch’s view, has significantly diminished the likelihood of any equity support to right size the highly leverage capital structure.”

.png)

China Huarong led the gainers with its 4.25% perps rising a solid 72% to end the month at 88.6 cents on the dollar as the company announced a state-led bailout. Interestingly, both the gainers and losers list were dominated by Chinese real estate developers. The gainers were led by Kaisa, Zhongliang, Yuzhou, Zhenro, Sunac, Agile and KWG to name a few. Kaisa led with its dollar bonds rising as much as over 20% on the back of strong 1H earnings reported last week. The losers were led by Suning’s Granda Century 7.5% bonds due in two weeks that have lost 46% of their value to now trade at ~31 cents on the dollar as the company seeks a debt extension. The world’s most indebted developer, Evergrande had another dreadful month with its dollar bonds falling a further 10-25% during the month as concerns grow over its liquidity position and extent (or lack of) state support. Another prominent name that traded weaker in August was Future Retail, whose 2025s lost ~15 points during the month to ~58 cents on the dollar after the Indian Supreme Court upheld the Singapore Emergency Arbitrator (EA) award to halt its $4.3bn deal with Reliance Retail.

.png)

Go back to Latest bond Market News

Related Posts: