This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

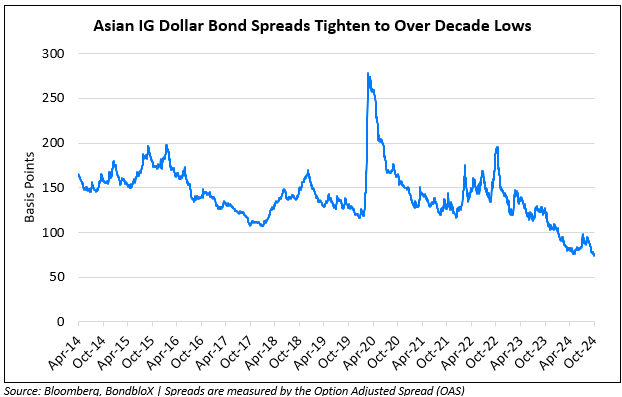

Asian IG Dollar Bond Spreads at Its Tightest Levels in Over a Decade

November 1, 2024

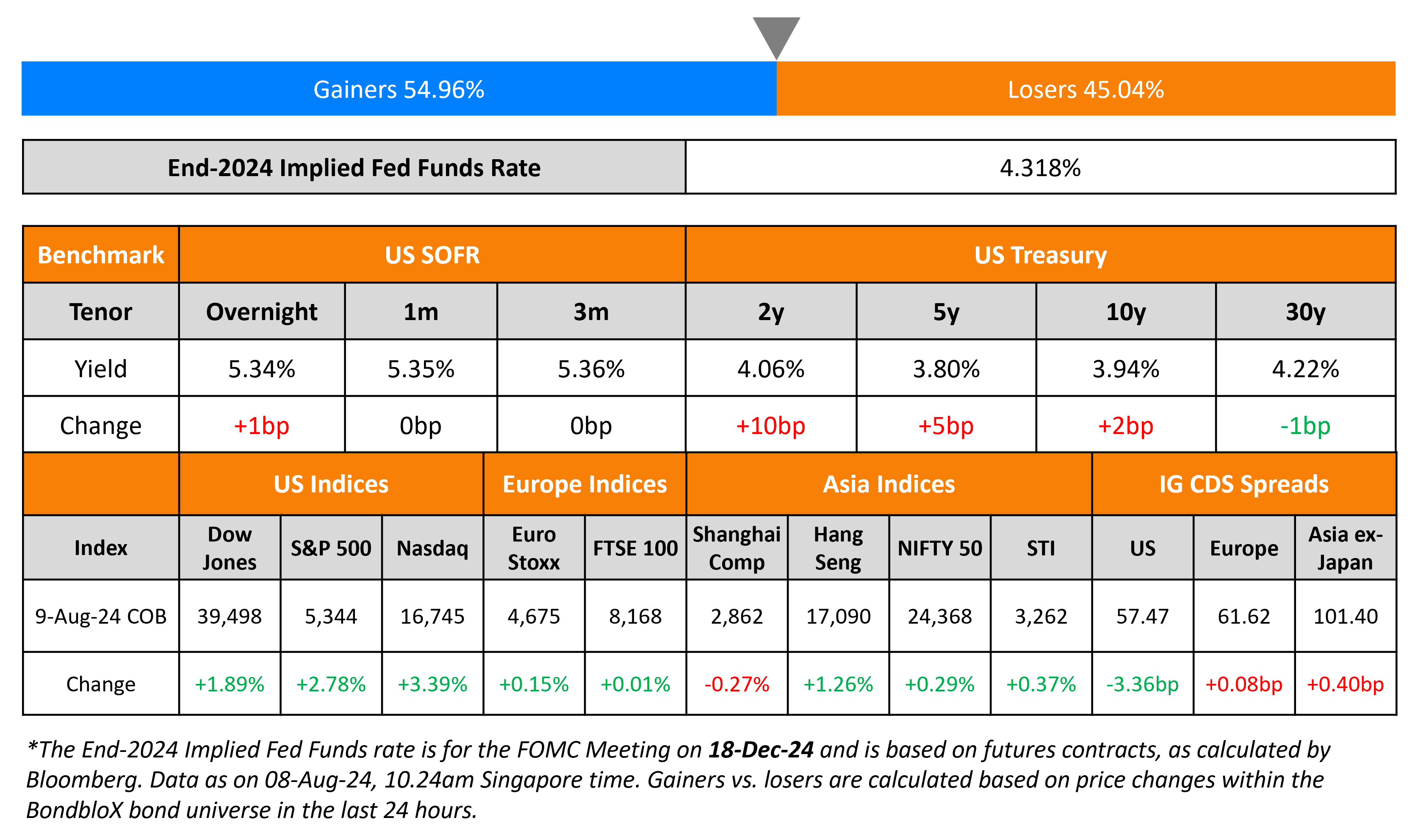

The US Treasury curve flattened as the 2Y and 5Y Treasury yields rose 5bp while the 30Y yield fell 5bp. US Headline PCE for October rose by 2.1% YoY, in-line with expectations and lower than the revised 2.3% September print. The Core PCE Index rose by 2.7% YoY in October, unchanged from September and higher than expectations of 2.6%. Initial jobless claims for the previous week improved, with a rise of 216k vs. expectations of 230k and the prior week’s 228k. Markets now await the NFP print later today with expectations of a 100k rise as compared to September’s 254k print. US IG and HY CDS spreads widened by 1.8bp and 5.8bp respectively. Looking at US equity markets, both S&P and Nasdaq ended in the red, down 1.9% and 2.8% respectively.

European equity markets ended lower too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.9bp and 5.4bp respectively. Asian equity indices have opened broadly mixed this morning. Asia ex-Japan IG CDS spreads saw a 1.4bp tightening. Dollar bond spreads of Asian IG corporates, as measured by the OAS has tightened to its lowest level, at 74bp in over a decade (as seen in the chart above).

New Bond Issues

New Bond Pipeline

- Tata Capital hires for $ bond

-

Islamic Development Bank hires for € 5Y Sukuk bond

Rating Changes

-

Fitch Upgrades UniCredit to ‘BBB+’; Outlook Positive

-

Fitch Downgrades Oriflame ‘s IDR to ‘CCC-‘; Places on Rating Watch Negative\

-

Fitch Downgrades Azul’s Ratings to ‘CC’\

-

Fitch Revises Intesa Sanpaolo’s Outlook to Positive; Affirms at ‘BBB’

Term of the Day

Carry Trade

Carry trades are a popular trading strategy where an investor borrows money from a country with low interest rates (and a weaker currency) and invests the money in another country’s asset with a higher interest rate. Historically, a famous example has been the Japanese yen-funded carry trade. This was mainly owing to the zero-to-negative interest rates in Japan for the better part of two decades, and bets that rates there would remain at rock bottom levels. In this case, investors globally and even locally would borrow at low interest rates in Japan and invest the money in overseas equities and bonds like the US stock market. Carry trades typically work well when central bank policy certainty is high and expectations are for low market volatility. With the BOJ recently raising rates for the second time in 17 years in July and hinting at more hikes, the famous yen-funded carry-trade has seen an unwinding with more volatility and doubts over the benefits of a yen carry trade.

Talking Heads

On EM Capping Turbulent Month With Losses Before US Vote

Rajeev De Mello, Gama Asset

“We had a confluence of events in October… combination of higher US yields, a stronger dollar, and the risks of a renewed trade war overshadowed the improvement in the growth picture… US growth data surprised positively and the worries around an increase in US tariffs hurt currencies. China also failed to clarify many of its announced policies”

On French Inflation Staying Below ECB’s 2% Goal for Second Month – ECB President, Christine Lagarde

“I am not going to tell you that inflation is under control. We also know that inflation will rise in the coming months, simply because of base effects.”

On Analysts Seeing Yen as Key to BOJ Timing for Next Rate Hike

Chong Hoon Park, economist at StanChart Bank

“Ueda’s comments open a rate hike possibility that will support JPY”

Hari Hariharan, NWI Management

“Ueda-san sounds more hawkish (than markets expected)… dollar-yen cannot go very much lower given you have also to worry about a Donald Trump win next week”

Top Gainers & Losers 01-November-24*

Go back to Latest bond Market News

Related Posts: