This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Argentina’s Finance Secretary Indicate Return to Primary Markets If Yields Fall Below 10%

March 21, 2025

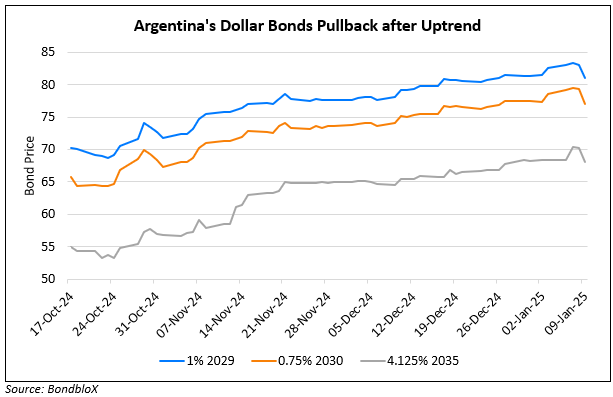

Argentina’s Finance Secretary Pablo Quirno said that the nation is waiting for its sovereign bond yields to drop below 10% before returning to the capital markets. This is said to be a better signal than their earlier expectation of re-entering markets by January 2026. Bloomberg notes that investors have reacted positively to President Javier Milei’s economic reforms, which aim to boost growth, control inflation, and maintain budget surpluses. Since Milei took office in December 2023, the country’s sovereign risk premium has decreased from nearly 1900bp to 764bp as per data from the JPMorgan EMBIG Diversified Argentina Sovereign Spread. Argentina, a known defaulter, has not issued debt since 2018. Its dollar bonds were among the top gainers in 2024, however, the rally has slowed in 2025. The IMF could provide up to $20bn, including $5-10bn in 2025, to boost Argentina’s central bank reserves and support economic reforms. Additionally, Milei’s success in the upcoming mid-term elections is said to be important for securing broader political support.

Argentina’s dollar bonds have trended higher this week, with its 5% 2038s at 68.13, yielding 7.87%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Argentina Secures $1bn Repo from Banks; Bonds Trade Higher

January 6, 2025

Argentina’s Dollar Bonds Tick Lower

January 9, 2025

Argentina’s $44bn Agreement Sees Somber Evaluation by the IMF

January 13, 2025