This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

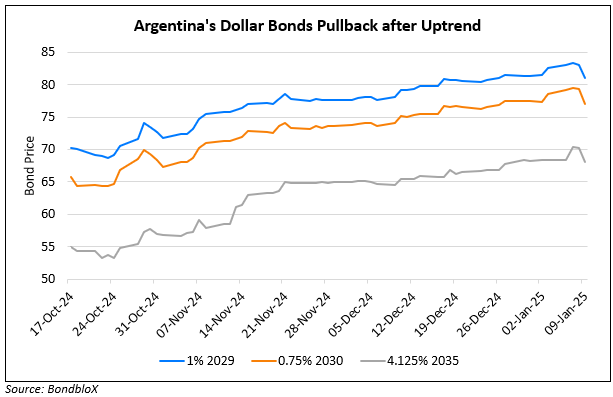

Argentina’s Dollar Bonds Tick Lower

January 9, 2025

Argentina’s dollar bonds were lower across the curve. While the exact reason for the move was not known, reports indicate that the La Nina weather pattern may bring about dry weather and drought to Argentina which is the world’s top provider of processed soy meal. This may further push down profits margins at farms amid an already weak economic backdrop where margins are at decade lows. The sovereign’s notes only recently traded higher after it secured a $1bn two-year repo to bolster its foreign reserves amid austerity measures, high inflation, currency controls and several other challenges. Besides, the nation also indicated that it had sufficient funds to meet its $4.7bn in bond payments due this month. The government is also negotiating with the IMF to replace a $44bn agreement with a new program that may include fresh funding.

Go back to Latest bond Market News

Related Posts:

Argentina Secures $1bn Repo from Banks; Bonds Trade Higher

January 6, 2025

Argentina Downgraded to CCC- by Fitch

October 27, 2022

Argentina and IMF Near Bailout Agreement: Sources

January 3, 2024