This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

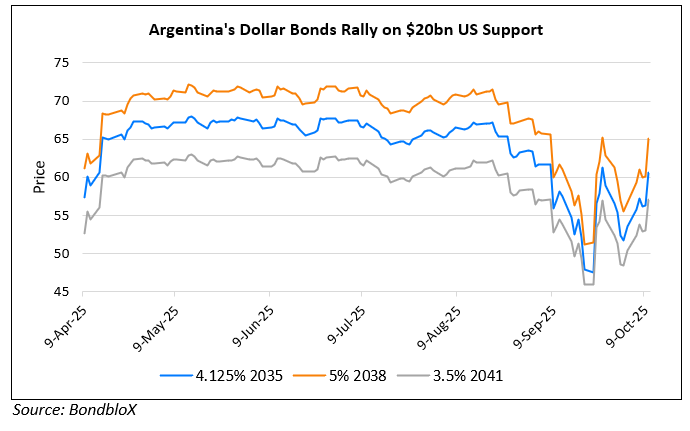

Argentina’s Dollar Bonds Rally on $20bn Currency Swap Support by US

October 10, 2025

Argentina’s dollar bonds rallied by 3-4 points across the curve after the US Treasury finalized a $20bn currency swap framework with Argentina and began buying pesos in the open market, delivering on President Donald Trump’s pledge to support Argentina’s economy. The US action followed four days of meetings between Bessent, Argentine Finance Minister Luis Caputo, and the IMF, which praised the initiative as being aligned with Argentina’s reform agenda focused on fiscal discipline and FX stability. While the Treasury did not disclose details of the swap structure or peso purchases, Bessent emphasized that it was not a bailout, noting that no funds were sent to Buenos Aires. He framed the move as serving US strategic interests, citing President Javier Milei’s alignment with Washington, efforts to curb Chinese influence, and openness to US investment in Argentina’s rare earth and uranium sectors. The intervention also provides a political backstop for Milei ahead of Argentina’s October 26 midterm elections, where his party seeks to strengthen its position amid public discontent with austerity policies. Market analysts said the support could stabilize sentiment and aid Milei politically, though challenges remain. After the move was announced by Treasury Secretary Scott Bessent, the peso strengthened to 1,418 per dollar, local stocks jumped over 5% and dollar bonds jumped.

For more details, click here

Go back to Latest bond Market News

Related Posts: