This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Argentina Faces Setback in YPF Acquisition Case

January 14, 2024

Argentina has faced a setback in the YPF acquisition case after the US Court allowed the investors of YPF SA to go after its assets. Earlier in September, the US court had ruled in favor of YPF’s investors, i.e., Petersen Energia and Eton Park, to be paid $16.1bn in compensation as they did not receive a tender offer when Argentina acquired YPF in 2012. The ruling came after Argentina missed a January 10 deadline to pledge an equity interest in YPF which would have allowed it to appeal the judgment. According to the judge ruling, Argentina had been trying to dodge its obligations on the final judgment and noted that a reasonable amount of time had passed since the judgment, rejecting the nation’s argument that the investors should not be allowed to start going after assets yet. Burford capital, which is pursuing the claims of shareholders, stands to reap $6.2bn of the judgment, giving it a more than 37,000% return on its initial investment.

In a positive update, Argentina witnessed a turnaround in the sale of its ‘Importer Bonds’ known as ‘Bopreal’ after it sweetened the terms. The Argentinian central bank sold $1.18bn of the bonds in the Thursday’s auction, marking a sharp reversal after the inaugural auction on December 28 which saw the government selling just $68mn of the original $750mn offering. Yesterday, it was reported that Argentina had unlocked $4.7bn funding from the IMF.

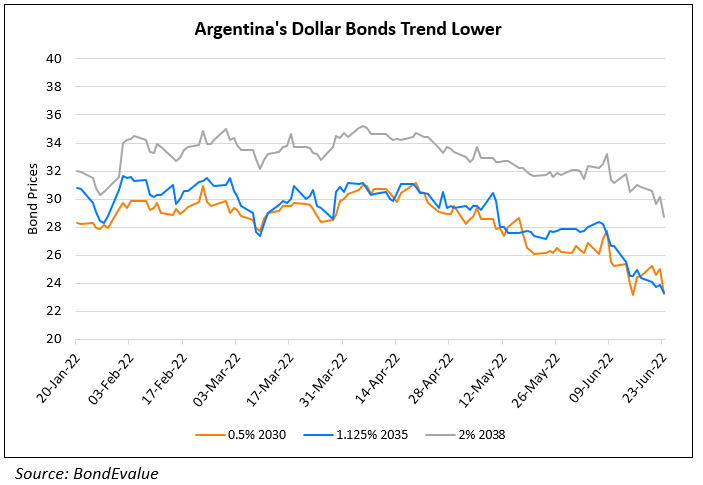

Argentina’s dollar bonds continue to trade at distressed levels of 30-40 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: