This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

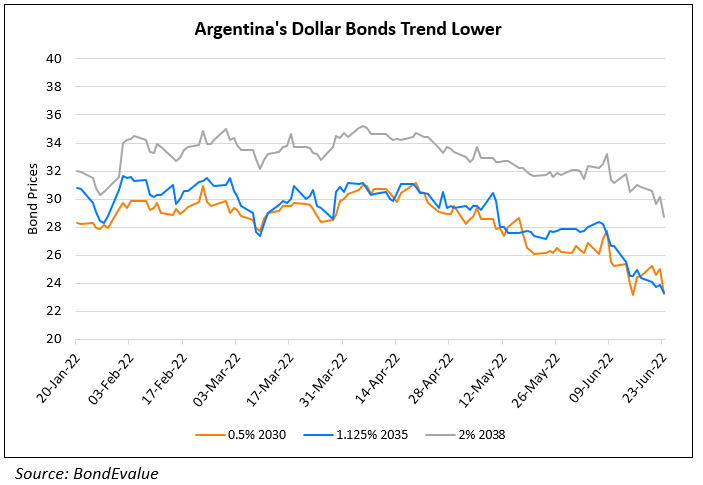

Argentina and IADB Agree to ~$5bn Financing for 2 Years upon Depleting Forex Reserves

September 7, 2022

Argentina has struck an agreement with the Inter-American Development Bank (IADB) where the latter will extend financing to the nation for almost $5bn in 2022 and 2023. The South American nation has been struggling with financial instability with inflation surging over 90%, and with consumption and economic activity going south. The government source said that Argentina urgently needs foreign currency to avoid a depreciation of the peso amid extremely high inflation. In 2022, Argentina will get $3bn and in 2023, another $1.8bn will be given by the IADB. Of the $3bn that it will get this year, $1.2bn would be available in two steps – $500mn will be disbursed by September 30 and $700mn before December 30. The nation’s forex reserves fell to less than $30bn, its lowest levels since late-2016.

Argentina’s dollar bonds were trading slightly higher – its 1.5% 2035s were up 0.47 points to 22.72, yielding 15.62%

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Argentina Due to pay $730mn to the IMF as Uncertainty Looms

January 28, 2022

Argentina Closes $45bn Deal with IMF

March 4, 2022